Question: HGR BLOCK Module 04 Post Workshop Activity - Joseph Portlanda You are required to create a tax return for the following Taxpayer which includes completing

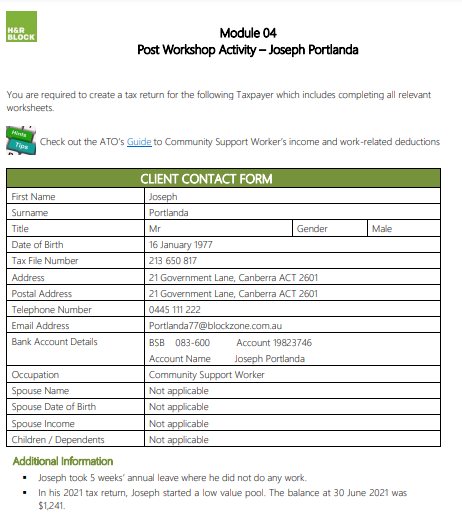

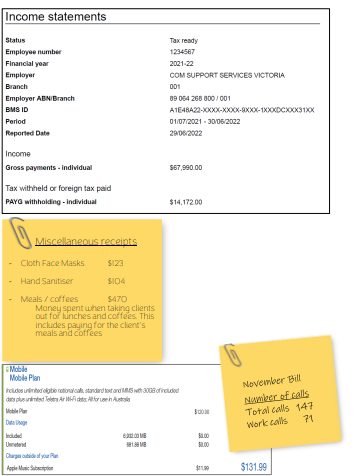

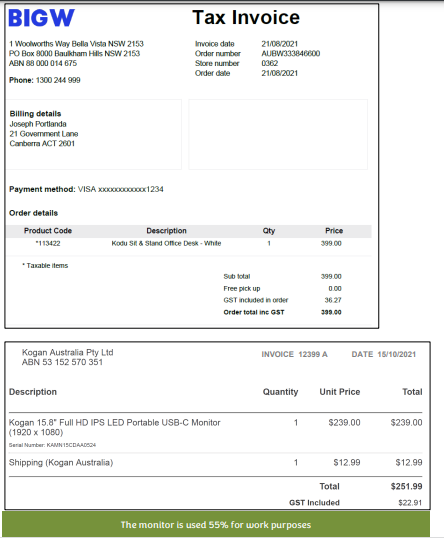

HGR BLOCK Module 04 Post Workshop Activity - Joseph Portlanda You are required to create a tax return for the following Taxpayer which includes completing all relevant worksheets. Check out the ATO's Guide to Community Support Worker's income and work-related deductions CLIENT CONTACT FORM First Name Joseph Surname Portlanda Title Mr Gender Male Date of Birth 16 January 1977 Tax File Number 213 650 817 Address 21 Government Lane, Canberra ACT 2601 Postal Address 21 Government Lane, Canberra ACT 2601 Telephone Number 0445 111 222 Email Address Portlanda77@blockzone.com.au Bank Account Details B58 083-600 Account 19823746 Account Name Joseph Portlanda Occupation Community Support Worker Spouse Name Not applicable Spouse Date of Birth Not applicable Spouse Income Not applicable Children / Dependents Not applicable Additional Information Joseph took 5 weeks' annual leave where he did not do any work. In his 2021 tax return, Joseph started a low value pool. The balance at 30 June 2021 was $1,241.Income statements Status Tax ready Employee number 1234587 Financial your 2021-22 Employer COM SUPPORT SERVICES VICTORIA Branch Employer ABN Branch 09 084 260 000 / 001 BM& ID Forlod 01/07/2021 - 30/06/2022 Reported Date Income Gross payments - Individual 567 ,890 00 Tax withheld or foreign tax paid PAYG withholding - Individual $14.172 00 Miscellaneous receipts Cloth Face Masks $123 Hand Sanitizer $104 Meals / coffees $470 Money spent when taking clients out for lunches and coffees. This includes paying for the client's meals and coffees Mobile Mobile Plan November Bill Nowniger of calls Total calls 147 Work calls 71 Chirpa subia d your Pin $131.99BIGW Tax Invoice 1 Woolworths Way Bella Vista NSW 2153 Invoice date 21/08/2021 PO Box 8000 Baulkham Hills NSW 2153 Order number ABN 80 000 014 675 Store number Order date 21/08/2021 Phone: 1300 244 999 Billing details Joseph Portlanda 21 Goverment Lane Canberra ACT 2601 Payment method: VISA xxxxxxxxxx1234 Order details Product Code Description aty Price #1 13422 Kodu 50 & Stand Office Desk - While 1 DO BBC " Taxable items Sub total 398100 Free pick up 0100 GST inchated in order 18 27 Order total inc GST 195.00 Kogan Australia Pty Lid INVOICE 12399 A DATE 15/10/2021 ABN 53 152 570 351 Description Quantity Unit Price Total Kogan 15.8" Full HD IPS LED Portable USB-C Monitor 1 $239.00 $239.00 (1820 x 1080) Sarial Number: KAMNISCOA40834 Shipping (Kogan Australia) 1 $12.99 $12.99 Total $251.99 OST Included $22.91 The monitor is used 55% for work purposesMessages. 1:08 am 424 0 1 of 1 JB HI-FI DIGITAL RECEIPT JB HIFI = Melton SHOP MMOS Woodgrove Shopping Centre Melton West, VIC, 3337 Phone - 93 9971 1300 TAX INVOICE - ADN 37 093 114 206 Tax Invoice RETRIEVE PARKED BALE Number of Items APPLE - ATAPODS FRO W/ MAGSAFE CHARGING 552131 329.00 APPLE - PENCIL 2ND GENERATION 348343 199.00 APPLE - IPAD AIR 5 MM9L3X/A 256 8PG WF 579769 1159.00 You can now recycle electronics, collected straight from your home! Go to www.emeals. is BUHTOTAL 1687.00 TOTAL PRICE 1687.00 02 EFTPOS-VISA-HC = ONLI 1687.00 CHANGE 0 .00 GST Included 153.36 * Indicates Taxable Items jbhifi.com.au The Air Pods are used 70% for work purposes The Apple Pencil is used 100% for work purposes The iPad is used 80% for work purposes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts