Question: hh 2. Q13: Suppose C = 40 + 0.8Y D. T = 50, 1 = 60, G = 40, X = 90, M = 50+

hh

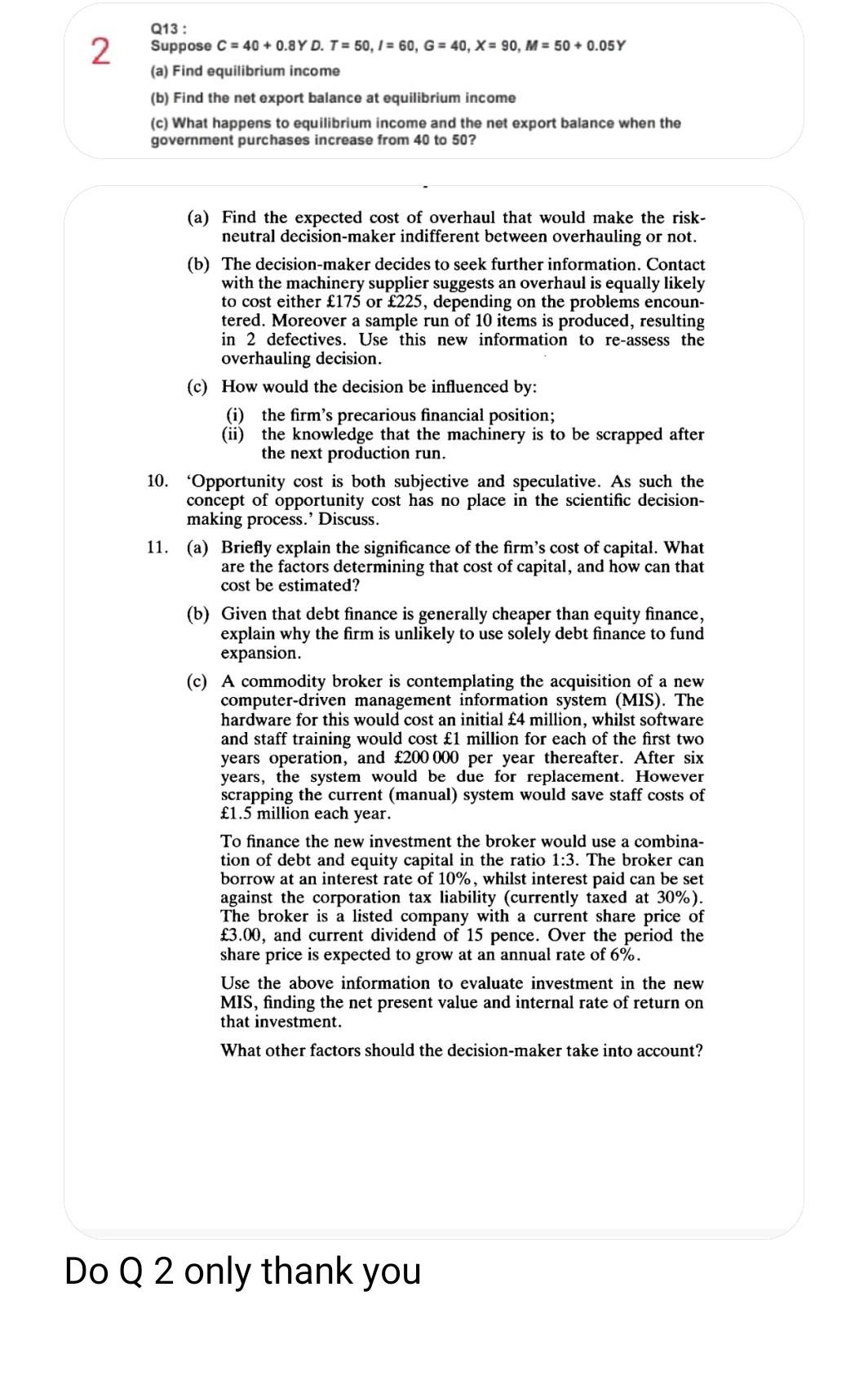

2. Q13: Suppose C = 40 + 0.8Y D. T = 50, 1 = 60, G = 40, X = 90, M = 50+ 0.05Y (a) Find equilibrium income (b) Find the net export balance at equilibrium income (c) What happens to equilibrium income and the net export balance when the government purchases increase from 40 to 50? (a) Find the expected cost of overhaul that would make the risk- neutral decision-maker indifferent between overhauling or not. (b) The decision-maker decides to seek further information. Contact with the machinery supplier suggests an overhaul is equally likely to cost either 175 or 225, depending on the problems encoun- tered. Moreover a sample run of 10 items is produced, resulting in 2 defectives. Use this new information to re-assess the overhauling decision. (c) How would the decision be influenced by: (i) the firm's precarious financial position; (ii) the knowledge that the machinery is to be scrapped after the next production run. 10. 'Opportunity cost is both subjective and speculative. As such the concept of opportunity cost has no place in the scientific decision- making process.' Discuss. 11. (a) Briefly explain the significance of the firm's cost of capital. What are the factors determining that cost of capital, and how can that cost be estimated? (b) Given that debt finance is generally cheaper than equity finance, explain why the firm is unlikely to use solely debt finance to fund expansion. (c) A commodity broker is contemplating the acquisition of a new computer-driven management information system (MIS). The hardware for this would cost an initial 4 million, whilst software and staff training would cost 1 million for each of the first two years operation, and 200 000 per year thereafter. After six years, the system would be due for replacement. However scrapping the current (manual) system would save staff costs of 1.5 million each year. To finance the new investment the broker would use a combina- tion of debt and equity capital in the ratio 1:3. The broker can borrow at an interest rate of 10%, whilst interest paid can be set against the corporation tax liability (currently taxed at 30%). The broker is a listed company with a current share price of 3.00, and current dividend of 15 pence. Over the period the share price is expected to grow at an annual rate of 6%. Use the above information to evaluate investment in the new MIS, finding the net present value and internal rate of return on that investment. What oti factors should the decision ker take acco t? Do Q 2 only thank youStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock