Question: HH tre 70 7 0 Paste & Bi v Brava A24 x v fx 10 Formatting M N O 1 Problem 1: 2 TOTAL Inc.

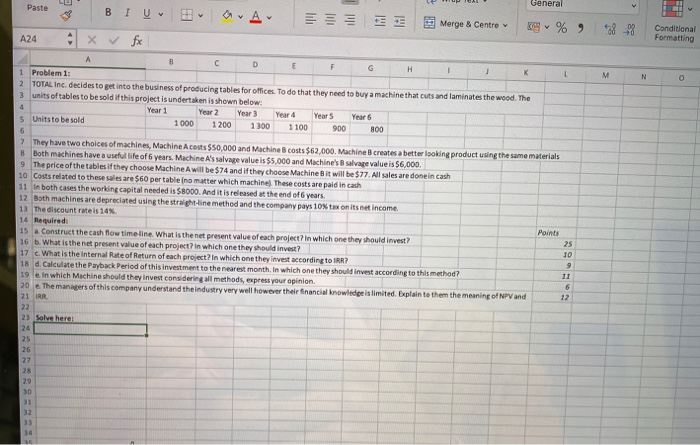

HH tre 70 7 0 Paste & Bi v Brava A24 x v fx 10 Formatting M N O 1 Problem 1: 2 TOTAL Inc. decides to get into the business of producing tables for offices To do that they need to buy a machine that cuts and laminates the wood. The 3 units of tables to be sold of this project is undertaken is shown below Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ Units to be sold 1000 1200 1300 1100 900 900 7 They have two choices of machines, Machine Acosts $50,000 and Machine B costs $62,000. Machine B creates a better looking product using the 8 Both machines have a useful life of 6 years. Machine A's salvage value is $5,000 and Machine's salvage value is 56,000 9 The price of the tables if they choose Machine Awill be $74 and if they choose Machine Bit will be $77. All sales are done in cash 10 Costs related to these sales are $60 per table no matter which machine. These costs are paid in cash 11 in both cases the working capital needed is 58000. And it is released at the end of years. 12 Bath machines are depreciated using the stra n e method and the company pays 10% tons net income 13 The discount rate is 14% 14 Required: 15 a Construct the cash flow timeline. What is then present value of each project in which one they should invest? 16 b. What is the net present value of each project in which one they should invest? 17 c. What is the internal Rate of Return of each project? in which one they invest according to IRR? 18 d. Calculate the Payback period of this investment to the nearest month in which one they should invest according to this method? 19 in which Machine should they invest considering methods, express your opinion. 20 The managers of this company understand the industry very well however their financial Inowledge is limited. Explain to them the meaning of NPV and 23 Solve here: HH tre 70 7 0 Paste & Bi v Brava A24 x v fx 10 Formatting M N O 1 Problem 1: 2 TOTAL Inc. decides to get into the business of producing tables for offices To do that they need to buy a machine that cuts and laminates the wood. The 3 units of tables to be sold of this project is undertaken is shown below Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ Units to be sold 1000 1200 1300 1100 900 900 7 They have two choices of machines, Machine Acosts $50,000 and Machine B costs $62,000. Machine B creates a better looking product using the 8 Both machines have a useful life of 6 years. Machine A's salvage value is $5,000 and Machine's salvage value is 56,000 9 The price of the tables if they choose Machine Awill be $74 and if they choose Machine Bit will be $77. All sales are done in cash 10 Costs related to these sales are $60 per table no matter which machine. These costs are paid in cash 11 in both cases the working capital needed is 58000. And it is released at the end of years. 12 Bath machines are depreciated using the stra n e method and the company pays 10% tons net income 13 The discount rate is 14% 14 Required: 15 a Construct the cash flow timeline. What is then present value of each project in which one they should invest? 16 b. What is the net present value of each project in which one they should invest? 17 c. What is the internal Rate of Return of each project? in which one they invest according to IRR? 18 d. Calculate the Payback period of this investment to the nearest month in which one they should invest according to this method? 19 in which Machine should they invest considering methods, express your opinion. 20 The managers of this company understand the industry very well however their financial Inowledge is limited. Explain to them the meaning of NPV and 23 Solve here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts