Question: Hi, all these question fo with each other so please refer to the first one. Thanks! D Question 26 1 pts Please use the information

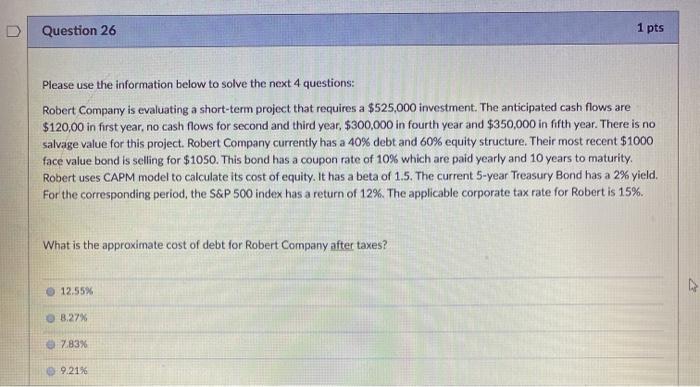

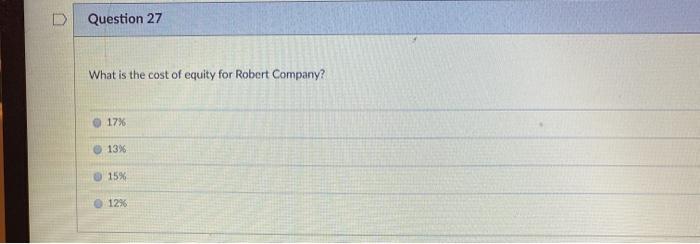

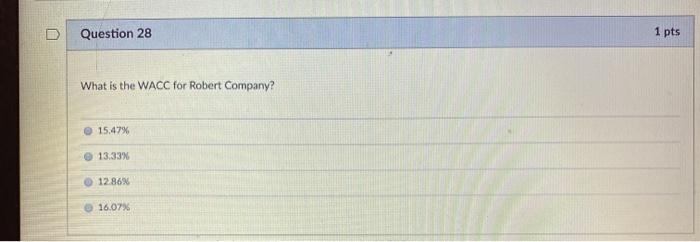

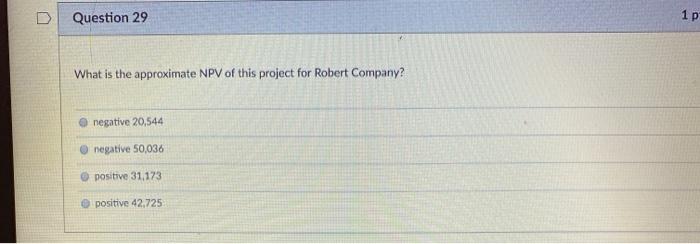

D Question 26 1 pts Please use the information below to solve the next 4 questions: Robert Company is evaluating a short-term project that requires a $525,000 investment. The anticipated cash flows are $120,00 in first year, no cash flows for second and third year, $300,000 in fourth year and $350,000 in fifth year. There is no salvage value for this project. Robert Company currently has a 40% debt and 60% equity structure. Their most recent $1000 face value bond is selling for $1050. This bond has a coupon rate of 10% which are paid yearly and 10 years to maturity. Robert uses CAPM model to calculate its cost of equity. It has a beta of 1.5. The current 5-year Treasury Bond has a 2% yield. For the corresponding period, the S&P 500 index has a return of 12%. The applicable corporate tax rate for Robert is 15%. What is the approximate cost of debt for Robert Company after taxes? 12.55% B.27% 7.83% 9.21% Question 27 What is the cost of equity for Robert Company? 17% 13% 15% 12% Question 28 1 pts What is the WACC for Robert Company? 15.47% 13.33% 12.86% 16.07% Question 29 1 1 p What is the approximate NPV of this project for Robert Company? negative 20,544 negative 50,036 positive 31,173 positive 42,725

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts