Question: hi, can anyone solve the problem for this? detailed solution is required. 2. Consider a market with only two risky stocks. A and B. and

hi, can anyone solve the problem for this? detailed solution is required.

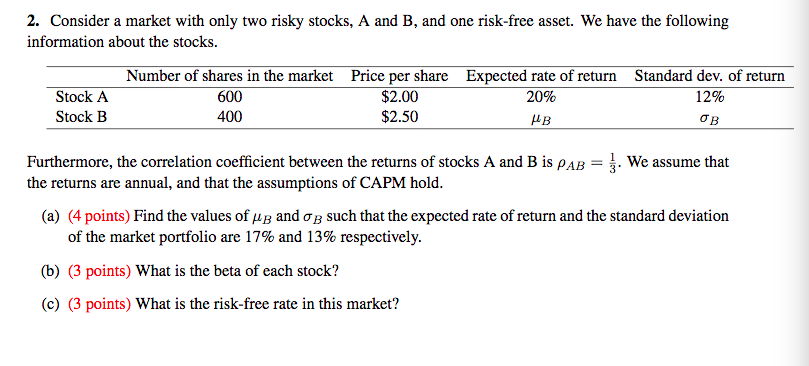

2. Consider a market with only two risky stocks. A and B. and one risk-free asset. We have the following information about the stocks. Number of shares in the market Price per share Expected rate of return Standard dev. of return Stockr sou $2.00 20% 12% StoekB 400 $2.50 a3 53 Furthermore, the correlation coefficient between the returns of stocks A and E is pAB = i We assume that the returns are annual, and that the assumptions of CAPM hold. (a) (4 points) Find the values of it}; and {75- such that the expected rate of return and the standard deviation of the market portfolio are THE: and 13% respectively. (b) (3 points) What is the beta of each stock? (c) (3 points) What is the risk-free rate in this market

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts