Question: Hi can i get help from this please? Under current GAAP, intangible assets are classified as a Amortizable or unamortizable. b. Limited-life or indefinite-life c.

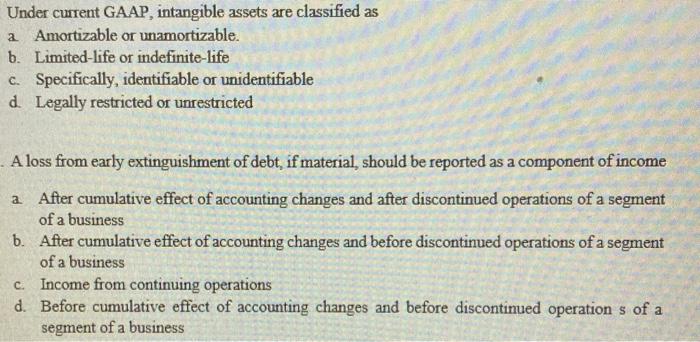

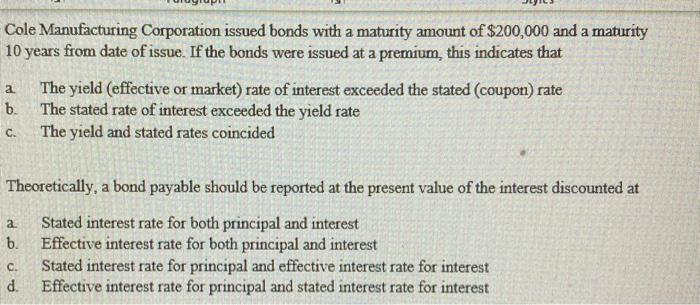

Under current GAAP, intangible assets are classified as a Amortizable or unamortizable. b. Limited-life or indefinite-life c. Specifically, identifiable or unidentifiable d. Legally restricted or unrestricted A loss from early extinguishment of debt, if material, should be reported as a component of income a. After cumulative effect of accounting changes and after discontinued operations of a segment of a business b. After cumulative effect of accounting changes and before discontinued operations of a segment of a business c. Income from continuing operations d. Before cumulative effect of accounting changes and before discontinued operation s of a segment of a business Cole Manufacturing Corporation issued bonds with a maturity amount of $200,000 and a maturity 10 years from date of issue. If the bonds were issued at a premium, this indicates that a. The yield (effective or market) rate of interest exceeded the stated (coupon) rate b. The stated rate of interest exceeded the yield rate c. The yield and stated rates coincided Theoretically, a bond payable should be reported at the present value of the interest discounted at a. Stated interest rate for both principal and interest b. Effective interest rate for both principal and interest c. Stated interest rate for principal and effective interest rate for interest d. Effective interest rate for principal and stated interest rate for interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts