Question: HI can i get help from this please? use table please? 2. (20 pts.) Polyester Company purchased a machine in 2018 for $1,000,000. The machine

HI can i get help from this please? use table please?

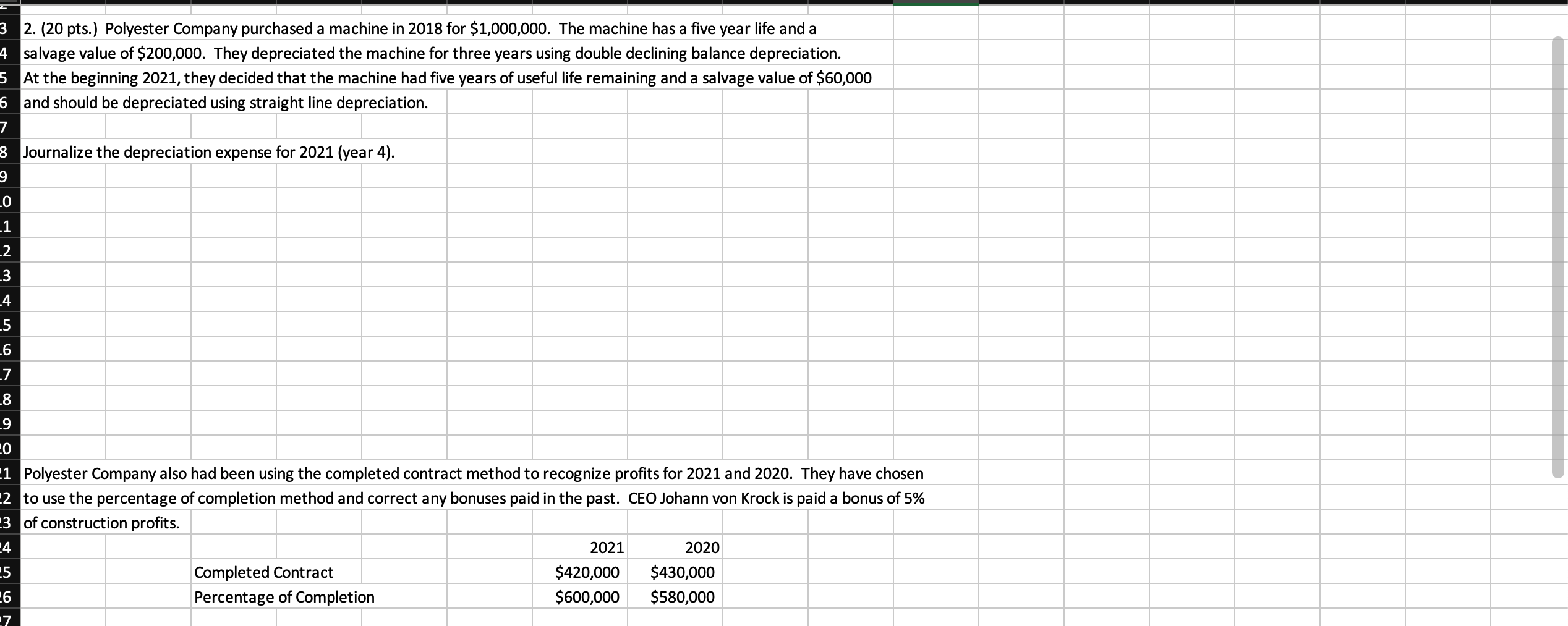

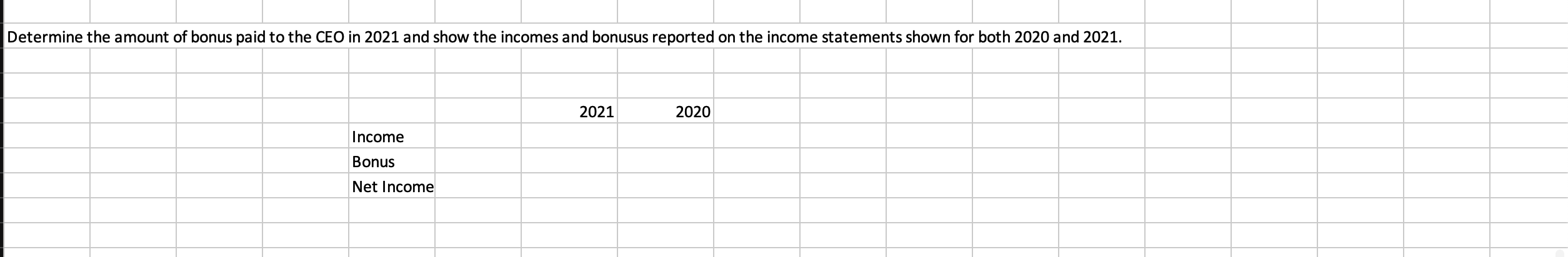

2. (20 pts.) Polyester Company purchased a machine in 2018 for $1,000,000. The machine has a five year life and a salvage value of $200,000. They depreciated the machine for three years using double declining balance depreciation. At the beginning 2021, they decided that the machine had five years of useful life remaining and a salvage value of $60,000 and should be depreciated using straight line depreciation. Journalize the depreciation expense for 2021 (year 4). Polyester Company also had been using the completed contract method to recognize profits for 2021 and 2020 . They have chosen to use the percentage of completion method and correct any bonuses paid in the past. CEO Johann von Krock is paid a bonus of 5% of construction profits. \begin{tabular}{|l|r|r|} \hline & 2021 & 2020 \\ \hline Completed Contract & $420,000 & $430,000 \\ \hline Percentage of Completion & $600,000 & $580,000 \\ \hline \end{tabular} Determine the amount of bonus paid to the CEO in 2021 and show the incomes and bonusus reported on the income statements shown for both 2020 and 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts