Question: Hi, can I get help with these two please Tax Drill - Corporate NCG or NCL Complete the following statements regarding the treatment of a

Hi, can I get help with these two please

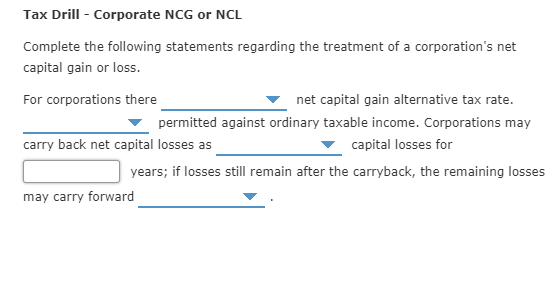

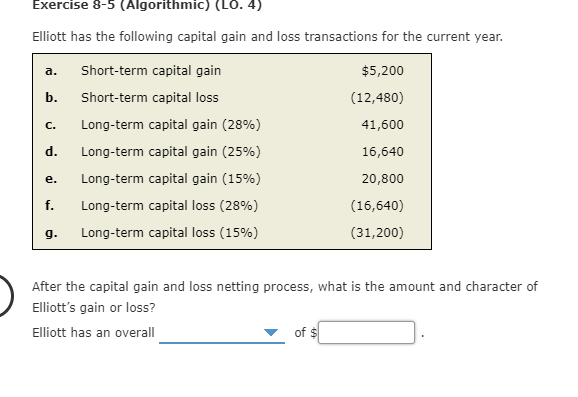

Tax Drill - Corporate NCG or NCL Complete the following statements regarding the treatment of a corporation's net capital gain or loss. For corporations there net capital gain alternative tax rate. permitted against ordinary taxable income. Corporations may carry back net capital losses as capital losses for years; if losses still remain after the carryback, the remaining losses may carry forward Exercise 8-5 (Algorithmic) (LO. 4) Elliott has the following capital gain and loss transactions for the current year. b. C. d. e. f. g. Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (25%) Long-term capital gain (15%) Long-term capital loss (28%) Long-term capital loss (15%) $5,200 (12,480) 41,600 16,640 20,800 (16,640) (31,200) After the capital gain and loss netting process, what is the amount and character of Elliott's gain or loss? Elliott has an overall of $ . Tax Drill - Corporate NCG or NCL Complete the following statements regarding the treatment of a corporation's net capital gain or loss. For corporations there net capital gain alternative tax rate. permitted against ordinary taxable income. Corporations may carry back net capital losses as capital losses for years; if losses still remain after the carryback, the remaining losses may carry forward Exercise 8-5 (Algorithmic) (LO. 4) Elliott has the following capital gain and loss transactions for the current year. b. C. d. e. f. g. Short-term capital gain Short-term capital loss Long-term capital gain (28%) Long-term capital gain (25%) Long-term capital gain (15%) Long-term capital loss (28%) Long-term capital loss (15%) $5,200 (12,480) 41,600 16,640 20,800 (16,640) (31,200) After the capital gain and loss netting process, what is the amount and character of Elliott's gain or loss? Elliott has an overall of $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts