Question: Hi can i get help with this please? displayed below.] This year, Amy purchased $2,100 of equipment for use in her business. However, the machine

![Hi can i get help with this please? displayed below.] This year,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716a5986aae6_4316716a597a0918.jpg)

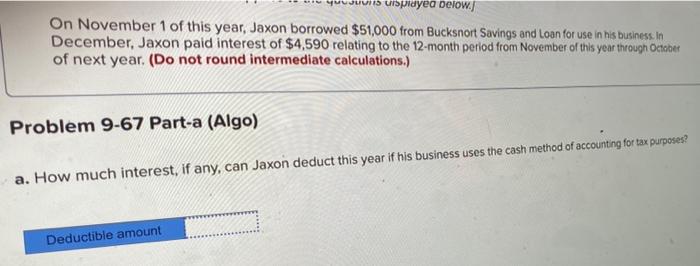

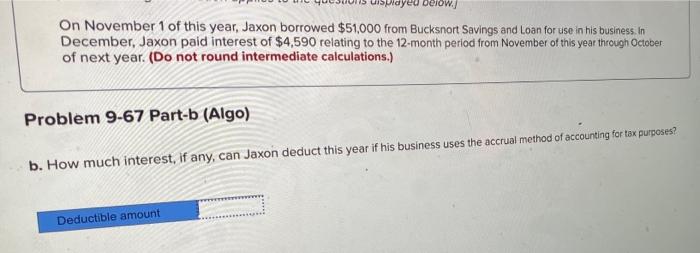

displayed below.] This year, Amy purchased $2,100 of equipment for use in her business. However, the machine was damaged in a traffic accident while Amy was transporting the equipment to her business. Note that because Amy did not place the equipment into service during the year, she does not claim any depreciation or cost recovery expense for the equipment. Problem 9-57 Part-c (Algo) c. Suppose that after the accident, Amy could not replace the equipment so she had the equipment repaired for $4,800. What amount can Amy deduct for the loss of the equipment? Deductible amount is displayed below. On November 1 of this year, Jaxon borrowed $51,000 from Bucksnort Savings and Loan for use in his business. In December, Jaxon paid interest of $4,590 relating to the 12-month period from November of this year through October of next year. (Do not round intermediate calculations.) Problem 9-67 Part-a (Algo) a. How much interest, if any, can Jaxon deduct this year if his business uses the cash method of accounting for tax purposes? Deductible amount played below.] On November 1 of this year, Jaxon borrowed $51,000 from Bucksnort Savings and Loan for use in his business. In December, Jaxon paid interest of $4,590 relating to the 12-month period from November of this year through October of next year. (Do not round intermediate calculations.) Problem 9-67 Part-b (Algo) b. How much interest, if any, can Jaxon deduct this year if his business uses the accrual method of accounting for tax purposes? Deductible amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts