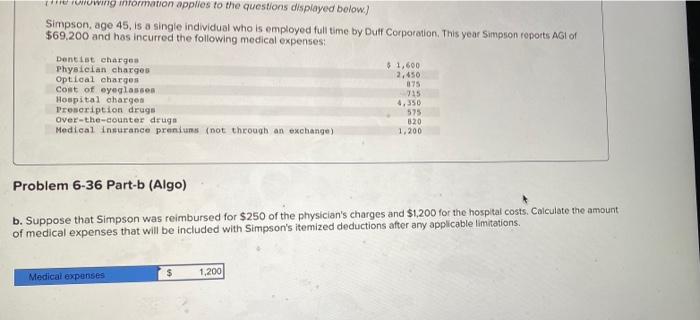

Question: Hi can I get help with this please? howing information applies to the questions displayed below.) Simpson, age 45, is a single individual who is

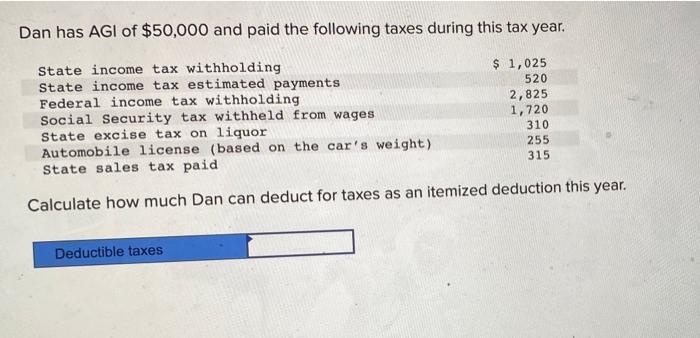

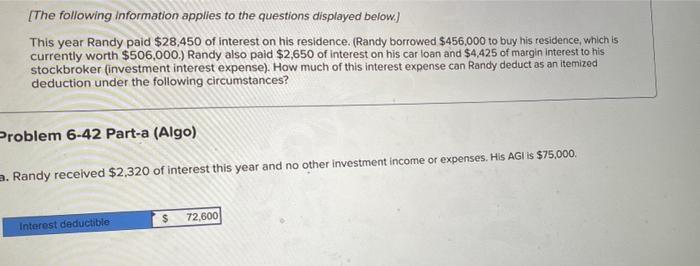

howing information applies to the questions displayed below.) Simpson, age 45, is a single individual who is employed full time by Duff Corporation. This year Simpson reports AGI of $69,200 and has incurred the following medical expenses: $1,600 2,450 875 Dentist charges Physician charges Optical charges Cost of eyeglasses Hospital charges Prescription drugs Over-the-counter drugs 715 4,350 575 820 Medical insurance preniums (not through an exchange) 1,200 Problem 6-36 Part-b (Algo) b. Suppose that Simpson was reimbursed for $250 of the physician's charges and $1,200 for the hospital costs. Calculate the amount of medical expenses that will be included with Simpson's itemized deductions after any applicable limitations. $ 1,200 Medical expenses Dan has AGI of $50,000 and paid the following taxes during this tax year. State income tax withholding $ 1,025 520 State income tax estimated payments Federal income tax withholding 2,825 1,720 Social Security tax withheld from wages. State excise tax on liquor 310 255 Automobile license (based on the car's weight) State sales tax paid 315 Calculate how much Dan can deduct for taxes as an itemized deduction this year. Deductible taxes [The following information applies to the questions displayed below.) This year Randy paid $28,450 of interest on his residence. (Randy borrowed $456,000 to buy his residence, which is currently worth $506,000.) Randy also paid $2,650 of interest on his car loan and $4,425 of margin interest to his stockbroker (investment interest expense). How much of this interest expense can Randy deduct as an itemized deduction under the following circumstances? Problem 6-42 Part-a (Algo) a. Randy received $2,320 of interest this year and no other investment income or expenses. His AGI is $75,000. Interest deductible $ 72,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts