Question: Hi can I get with this please? Required information Problem 6-42 (LO 6-2) (Algo) [The following information applies to the questions displayed below.] This year

![(LO 6-2) (Algo) [The following information applies to the questions displayed below.]](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb324587e46_43766fb324523471.jpg)

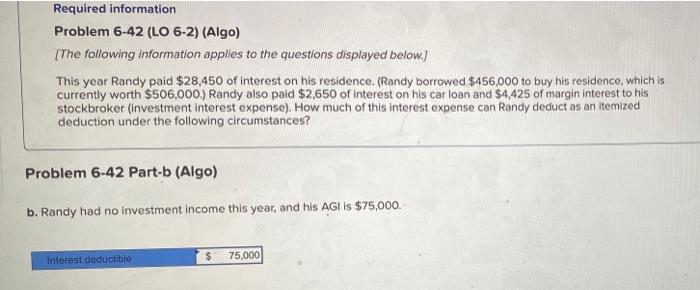

Required information Problem 6-42 (LO 6-2) (Algo) [The following information applies to the questions displayed below.] This year Randy paid $28,450 of interest on his residence. (Randy borrowed $456,000 to buy his residence, which is currently worth $506,000.) Randy also paid $2,650 of interest on his car loan and $4,425 of margin interest to his stockbroker (investment interest expense). How much of this interest expense can Randy deduct as an itemized deduction under the following circumstances? Problem 6-42 Part-b (Algo) b. Randy had no investment income this year, and his AGI is $75,000. Interest deductible $ 75,000 Ray Ray made the following contributions in 2021. Charity Property Cost FMV Athens Academy School Cash $ 8,250 $ 8,250 United Way Cash 4,200 4,200 American Heart Association First Methodist Church Antique painting Coca-Cola stock 15,550 77,750 15,650 23,475 Determine the maximum amount of charitable deduction for each of these contributions ignoring the AGI ceiling on charitable contributions and assuming that the American Heart Association plans to sell the antique painting to fund its operations. Ray Ray has owned the painting and Coca-Cola stock since 1990. Maximum Amount Cash contributions $ 16,500 8,400 Property donations $

Step by Step Solution

There are 3 Steps involved in it

Randys Interest Deduction 1 Residence Interest Randy paid 28450 in mortgage interest Mortgage intere... View full answer

Get step-by-step solutions from verified subject matter experts