Question: Hi, can I please get some help with the 3 multiple choice homework questions below. Please provide explanation if possible. Thanks Q1) In each of

Hi, can I please get some help with the 3 multiple choice homework questions below. Please provide explanation if possible. Thanks

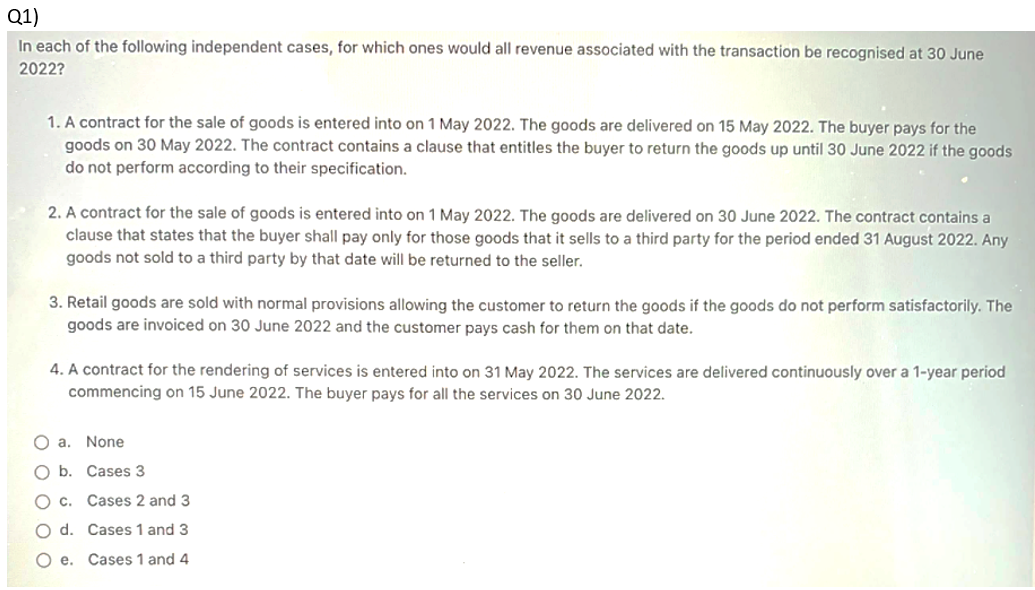

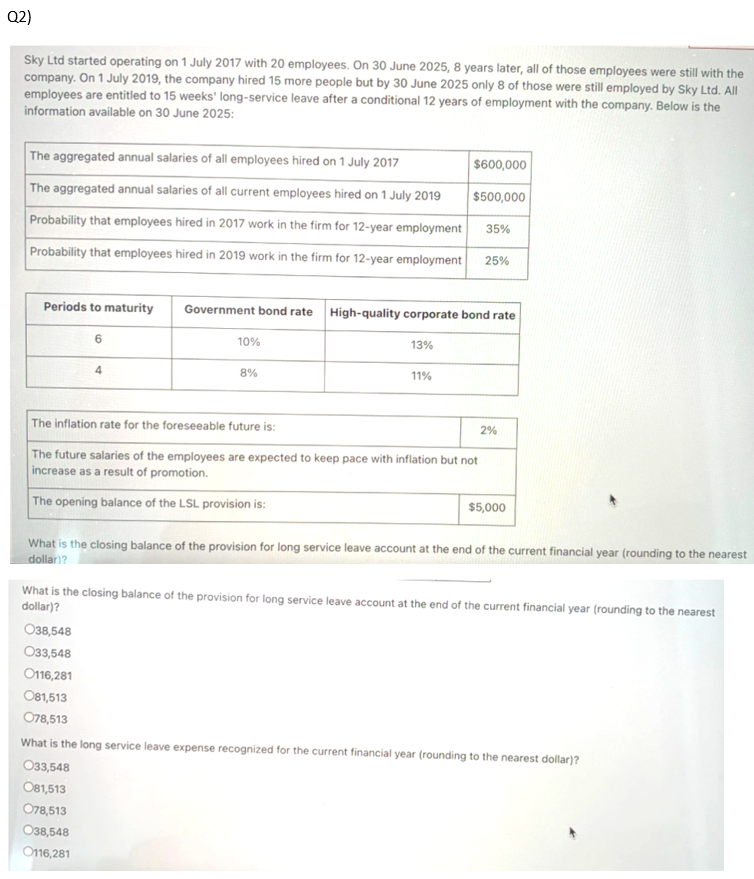

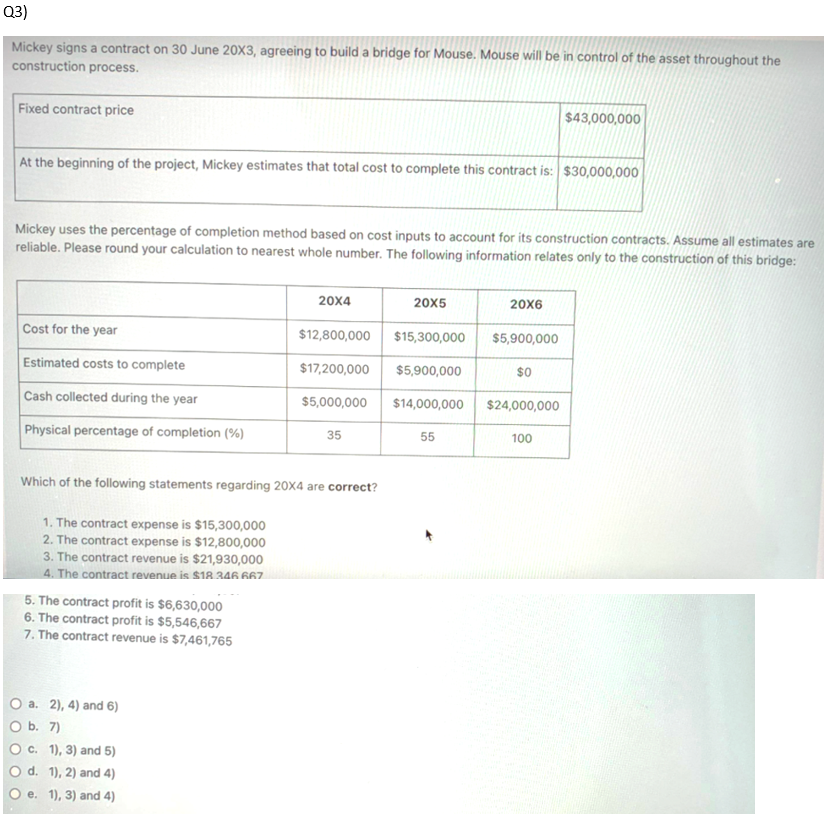

Q1) In each of the following independent cases, for which ones would all revenue associated with the transaction be recognised at 30 June 2022? 1. A contract for the sale of goods is entered into on 1 May 2022. The goods are delivered on 15 May 2022. The buyer pays for the goods on 30 May 2022. The contract contains a clause that entitles the buyer to return the goods up until 30 June 2022 if the goods do not perform according to their specification. 2. A contract for the sale of goods is entered into on 1 May 2022. The goods are delivered on 30 June 2022. The contract contains a clause that states that the buyer shall pay only for those goods that it sells to a third party for the period ended 31 August 2022. Any goods not sold to a third party by that date will be returned to the seller. 3. Retail goods are sold with normal provisions allowing the customer to return the goods if the goods do not perform satisfactorily. The goods are invoiced on 30 June 2022 and the customer pays cash for them on that date. 4. A contract for the rendering of services is entered into on 31 May 2022. The services are delivered continuously over a 1-year period commencing on 15 June 2022. The buyer pays for all the services on 30 June 2022. O a None O b. Cases 3 O c. Cases 2 and 3 O d. Cases 1 and 3 O e. Cases 1 and 4 Q2) Sky Ltd started operating on 1 July 2017 with 20 employees. On 30 June 2025, 8 years later, all of those employees were still with the company. On 1 July 2019, the company hired 15 more people but by 30 June 2025 only 8 of those were still employed by Sky Ltd. All employees are entitled to 15 weeks' long-service leave after a conditional 12 years of employment with the company. Below is the information available on 30 June 2025: The aggregated annual salaries of all employees hired on 1 July 2017 $600,000 The aggregated annual salaries of all current employees hired on 1 July 2019 $500,000 Probability that employees hired in 2017 work in the firm for 12-year employment 35% Probability that employees hired in 2019 work in the firm for 12-year employment 25% Periods to maturity Government bond rate High-quality corporate bond rate 6 10% 13% 8% 11% 2% The inflation rate for the foreseeable future is: The future salaries of the employees are expected to keep pace with inflation but not increase as a result of promotion The opening balance of the LSL provision is: $5,000 What is the closing balance of the provision for long service leave account at the end of the current financial year (rounding to the nearest dollar? What is the closing balance of the provision for long service leave account at the end of the current financial year (rounding to the nearest dollar)? 38,548 033,548 0116,281 081,513 078,513 What is the long service leave expense recognized for the current financial year (rounding to the nearest dollar)? 033,548 081,513 078,513 38,548 0116,281 Q3) Mickey signs a contract on 30 June 20x3, agreeing to build a bridge for Mouse. Mouse will be in control of the asset throughout the construction process. Fixed contract price $43,000,000 At the beginning of the project, Mickey estimates that total cost to complete this contract is: $30,000,000 Mickey uses the percentage of completion method based on cost inputs to account for its construction contracts. Assume all estimates are reliable. Please round your calculation to nearest whole number. The following information relates only to the construction of this bridge: 20x4 20x5 20X6 Cost for the year $12,800,000 $15,300,000 $5,900,000 Estimated costs to complete $17,200,000 $5,900,000 $0 Cash collected during the year $5,000,000 $14,000,000 $24,000,000 Physical percentage of completion (%) 35 55 100 Which of the following statements regarding 20x4 are correct? 1. The contract expense is $15,300,000 2. The contract expense is $12,800,000 3. The contract revenue is $21,930,000 4. The contract revenue is $18.246 667 5. The contract profit is $6,630,000 6. The contract profit is $5,546,667 7. The contract revenue is $7,461,765 O a. 2), 4) and 6) O b. 7) O c. 1), 3) and 5) O d. 1), 2) and 4) O e. 1), 3) and 4)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts