Question: hi can sb help answer this question? Online Tutorial Questions: Investment in Associates and Accounting Policy Exercise 31.9 (adapted) Box Lid is a parent company

hi can sb help answer this question?

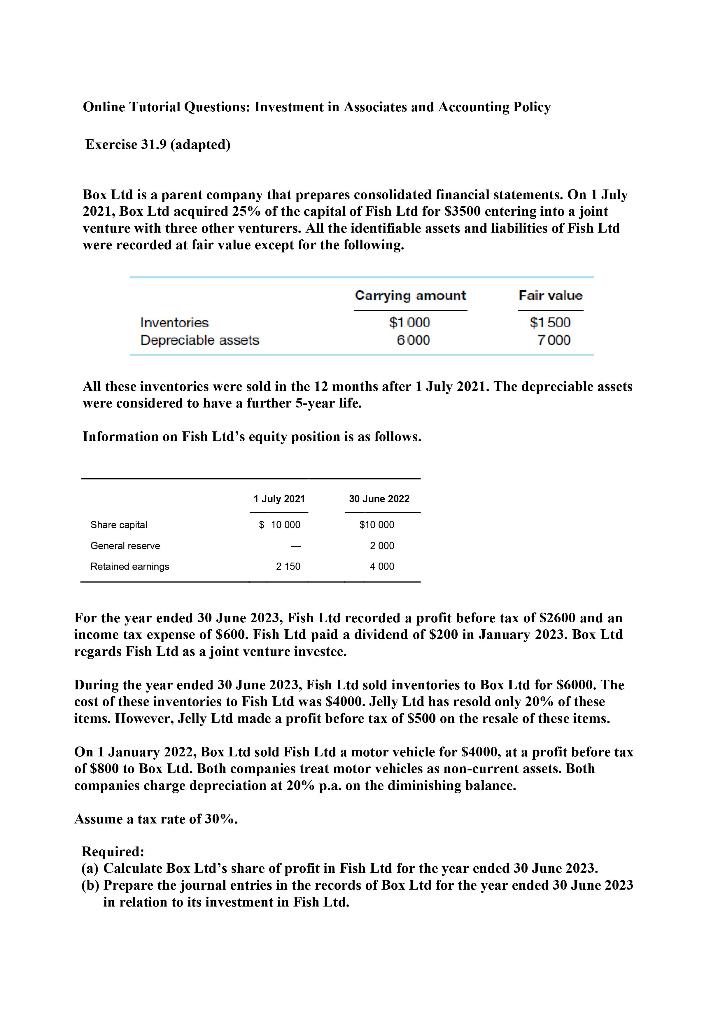

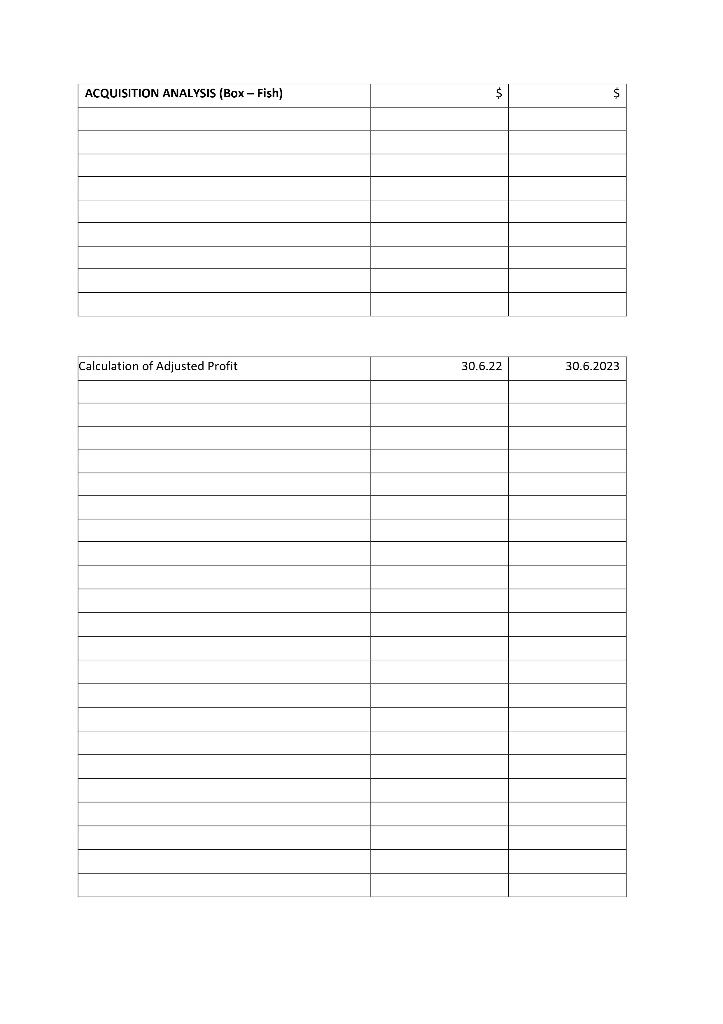

Online Tutorial Questions: Investment in Associates and Accounting Policy Exercise 31.9 (adapted) Box Lid is a parent company that prepares consolidated financial statements. On 1 July 2021, Box Ltd acquired 25\% of the capital of Fish Ltd for $3500 entering into a joint venture with three other venturers. All the identifiable assets and liabilities of Fish Ltd were recorded at fair value except for the following. All these inventories were sold in the 12 months after 1 July 2021. The depreciable assets were considered to have a further 5 -year life. Information on Fish Ltd's equity position is as follows. For the year ended 30 June 2023, Fish L.td recorded a profit before tax of $2600 and an income tax expense of $600. Fish Ltd paid a dividend of $200 in January 2023 . Box Ltd regards Fish Ltd as a joint venture investec. During the year ended 30 June 2023, Fish L.td sold inventories to Box Ltd for $6000. The cost of these inventories to Fish Ltd was $4000. Jelly Ltd has resold only 20% of these items. IIowever, Jelly Ltd made a profit before tax of $500 on the resale of these items. On 1 January 2022 , Box Ltd sold Fish Ltd a motor vehicle for $4000, at a profit before tax of $800 to Box Ltd. Both companies treat motor vehicles as non-current assets. Both companies charge depreciation at 20% p.a. on the diminishing balance. Assume a tax rate of 30%. Required: (a) Calculate Box Ltd's share of profit in Fish Ltd for the year ended 30 June 2023. (b) Prepare the journal entries in the records of Box Ltd for the year ended 30 June 2023 in relation to its investment in Fish Ltd. Online Tutorial Questions: Investment in Associates and Accounting Policy Exercise 31.9 (adapted) Box Lid is a parent company that prepares consolidated financial statements. On 1 July 2021, Box Ltd acquired 25\% of the capital of Fish Ltd for $3500 entering into a joint venture with three other venturers. All the identifiable assets and liabilities of Fish Ltd were recorded at fair value except for the following. All these inventories were sold in the 12 months after 1 July 2021. The depreciable assets were considered to have a further 5 -year life. Information on Fish Ltd's equity position is as follows. For the year ended 30 June 2023, Fish L.td recorded a profit before tax of $2600 and an income tax expense of $600. Fish Ltd paid a dividend of $200 in January 2023 . Box Ltd regards Fish Ltd as a joint venture investec. During the year ended 30 June 2023, Fish L.td sold inventories to Box Ltd for $6000. The cost of these inventories to Fish Ltd was $4000. Jelly Ltd has resold only 20% of these items. IIowever, Jelly Ltd made a profit before tax of $500 on the resale of these items. On 1 January 2022 , Box Ltd sold Fish Ltd a motor vehicle for $4000, at a profit before tax of $800 to Box Ltd. Both companies treat motor vehicles as non-current assets. Both companies charge depreciation at 20% p.a. on the diminishing balance. Assume a tax rate of 30%. Required: (a) Calculate Box Ltd's share of profit in Fish Ltd for the year ended 30 June 2023. (b) Prepare the journal entries in the records of Box Ltd for the year ended 30 June 2023 in relation to its investment in Fish Ltd

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts