Question: Hi, can someone please help me answer these last two questions? thanks 4. What is the amount of net cash flows (not discounted) for an

Hi, can someone please help me answer these last two questions? thanks

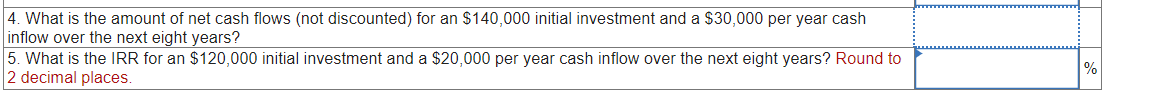

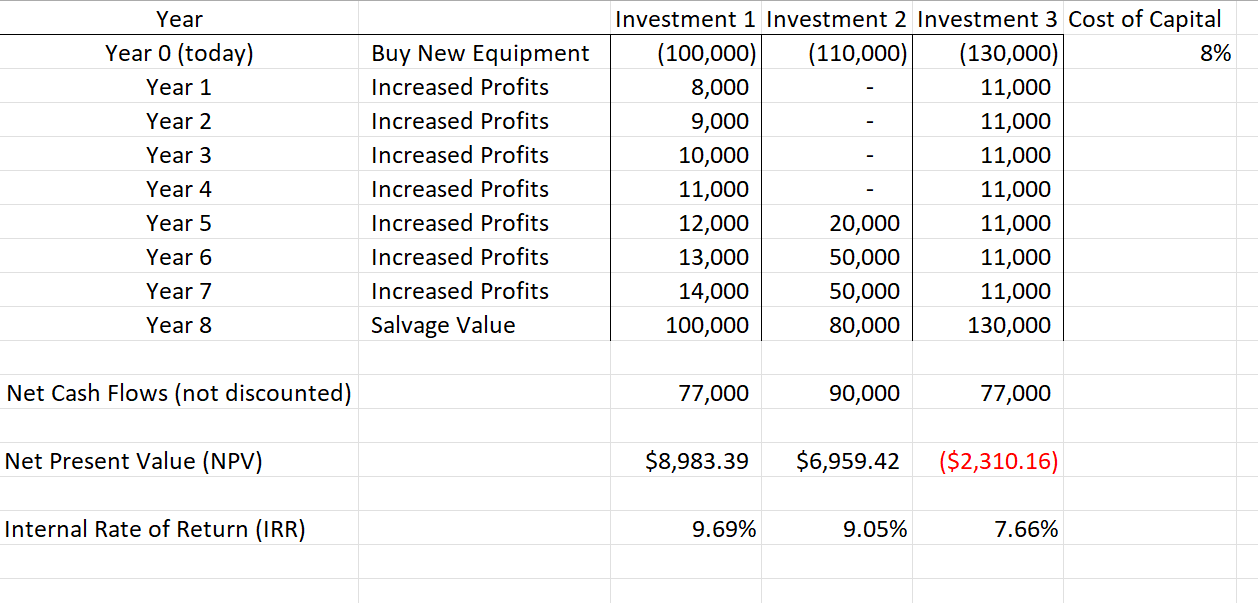

4. What is the amount of net cash flows (not discounted) for an $140,000 initial investment and a $30,000 per year cash inflow over the next eight years? 5. What is the IRR for an $120,000 initial investment and a $20,000 per year cash inflow over the next eight years? Round to 2 decimal places. \begin{tabular}{|c|c|c|c|c|c|} \hline Year & & Investment 1 & Investment 2 & Investment 3 & Cost of Capital \\ \hline Year 0 (today) & Buy New Equipment & (100,000) & (110,000) & (130,000) & 8% \\ \hline Year 1 & Increased Profits & 8,000 & - & 11,000 & \\ \hline Year 2 & Increased Profits & 9,000 & - & 11,000 & \\ \hline Year 3 & Increased Profits & 10,000 & - & 11,000 & \\ \hline Year 4 & Increased Profits & 11,000 & - & 11,000 & \\ \hline Year 5 & Increased Profits & 12,000 & 20,000 & 11,000 & \\ \hline Year 6 & Increased Profits & 13,000 & 50,000 & 11,000 & \\ \hline Year 7 & Increased Profits & 14,000 & 50,000 & 11,000 & \\ \hline Year 8 & Salvage Value & 100,000 & 80,000 & 130,000 & \\ \hline Net Cash Flows (not discounted) & & 77,000 & 90,000 & 77,000 & \\ \hline Net Present Value (NPV) & & $8,983.39 & $6,959.42 & ($2,310.16) & \\ \hline Internal Rate of Return (IRR) & & 9.69% & 9.05% & 7.66% & \\ \hline & & & & & \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts