Question: Hi, can someone please help me with this question, and if you can please include the formulas. 23. As the lead acquisition consultant at your

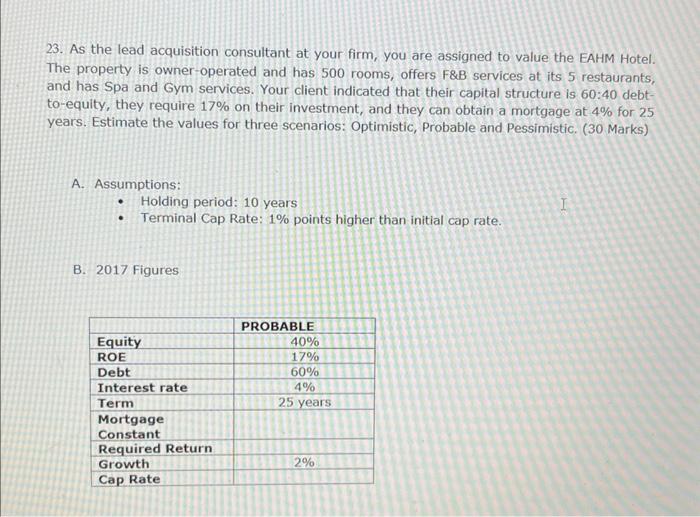

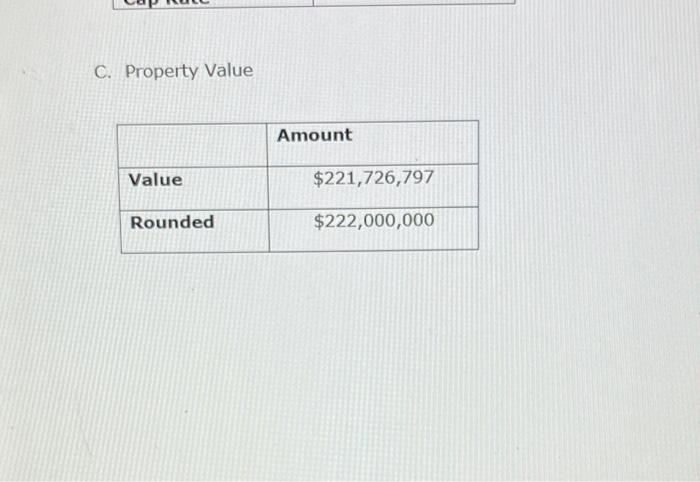

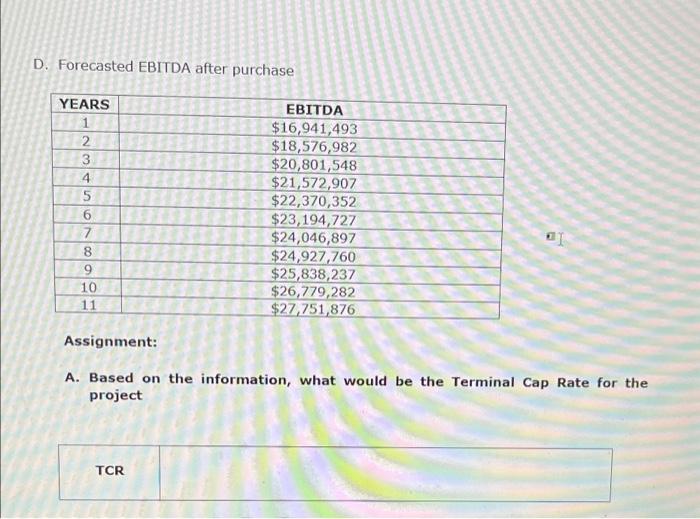

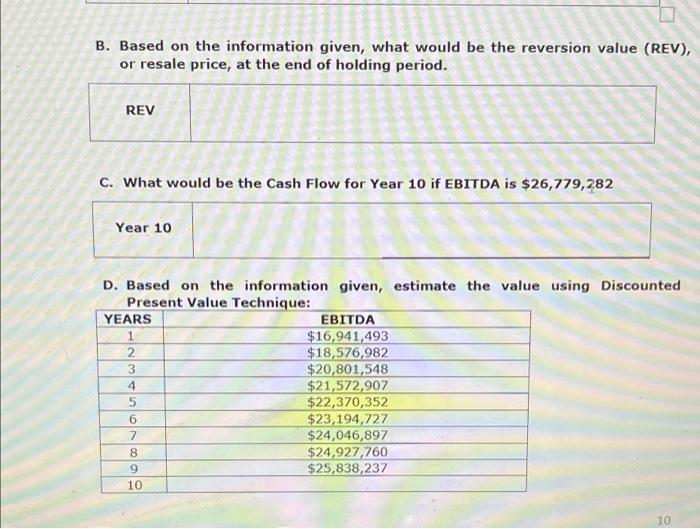

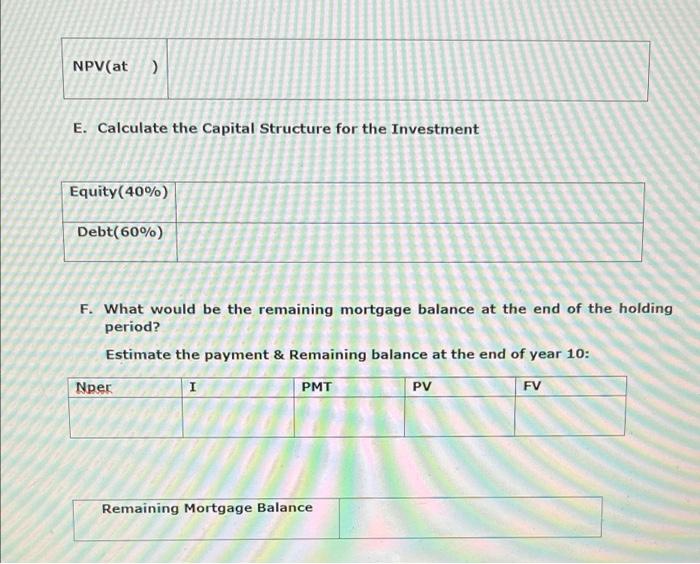

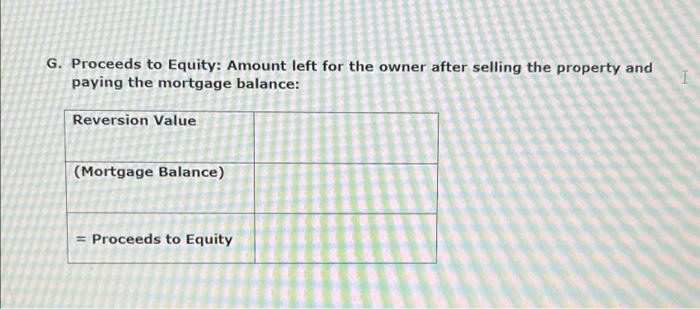

23. As the lead acquisition consultant at your firm, you are assigned to value the EAHM Hotel. The property is owner-operated and has 500 rooms, offers F&B services at its 5 restaurants, and has Spa and Gym services. Your client indicated that their capital structure is 60:40 debt- to-equity, they require 17% on their investment, and they can obtain a mortgage at 4% for 25 years. Estimate the values for three scenarios: Optimistic, Probable and Pessimistic. (30 Marks) A. Assumptions: Holding period: 10 years Terminal Cap Rate: 1% points higher than initial cap rate. I B. 2017 Figures Equity ROE Debt Interest rate Term Mortgage Constant Required Return Growth Cap Rate PROBABLE 40% 17% 60% 4% 25 years 2% C. Property Value Amount Value $221,726,797 Rounded $222,000,000 D. Forecasted EBITDA after purchase YEARS 2 3 4. 5 6 7 8 9 10 11 EBITDA $16,941,493 $18,576,982 $20,801,548 $21,572,907 $22,370,352 $23,194,727 $24,046,897 $24,927,760 $25,838,237 $26,779,282 $27,751,876 Assignment: A. Based on the information, what would be the Terminal Cap Rate for the project TCR B. Based on the information given, what would be the reversion value (REV), or resale price, at the end of holding period. REV C. What would be the Cash Flow for Year 10 if EBITDA is $26,779,282 Year 10 3 D. Based on the information given, estimate the value using Discounted Present Value Technique: YEARS EBITDA 1 $16,941,493 2 $18,576,982 $20,801,548 4 $21,572,907 $22,370,352 $23,194,727 $24,046,897 $24,927,760 $25,838,237 10 is a 10 NPV(at ) E. Calculate the Capital Structure for the Investment Equity(40%) Debt(60%) F. What would be the remaining mortgage balance at the end of the holding period? Estimate the payment & Remaining balance at the end of year 10: Nper 1 PMT PV FV Remaining Mortgage Balance G. Proceeds to Equity: Amount left for the owner after selling the property and paying the mortgage balance: Reversion Value (Mortgage Balance) = Proceeds to Equity 23. As the lead acquisition consultant at your firm, you are assigned to value the EAHM Hotel. The property is owner-operated and has 500 rooms, offers F&B services at its 5 restaurants, and has Spa and Gym services. Your client indicated that their capital structure is 60:40 debt- to-equity, they require 17% on their investment, and they can obtain a mortgage at 4% for 25 years. Estimate the values for three scenarios: Optimistic, Probable and Pessimistic. (30 Marks) A. Assumptions: Holding period: 10 years Terminal Cap Rate: 1% points higher than initial cap rate. I B. 2017 Figures Equity ROE Debt Interest rate Term Mortgage Constant Required Return Growth Cap Rate PROBABLE 40% 17% 60% 4% 25 years 2% C. Property Value Amount Value $221,726,797 Rounded $222,000,000 D. Forecasted EBITDA after purchase YEARS 2 3 4. 5 6 7 8 9 10 11 EBITDA $16,941,493 $18,576,982 $20,801,548 $21,572,907 $22,370,352 $23,194,727 $24,046,897 $24,927,760 $25,838,237 $26,779,282 $27,751,876 Assignment: A. Based on the information, what would be the Terminal Cap Rate for the project TCR B. Based on the information given, what would be the reversion value (REV), or resale price, at the end of holding period. REV C. What would be the Cash Flow for Year 10 if EBITDA is $26,779,282 Year 10 3 D. Based on the information given, estimate the value using Discounted Present Value Technique: YEARS EBITDA 1 $16,941,493 2 $18,576,982 $20,801,548 4 $21,572,907 $22,370,352 $23,194,727 $24,046,897 $24,927,760 $25,838,237 10 is a 10 NPV(at ) E. Calculate the Capital Structure for the Investment Equity(40%) Debt(60%) F. What would be the remaining mortgage balance at the end of the holding period? Estimate the payment & Remaining balance at the end of year 10: Nper 1 PMT PV FV Remaining Mortgage Balance G. Proceeds to Equity: Amount left for the owner after selling the property and paying the mortgage balance: Reversion Value (Mortgage Balance) = Proceeds to Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts