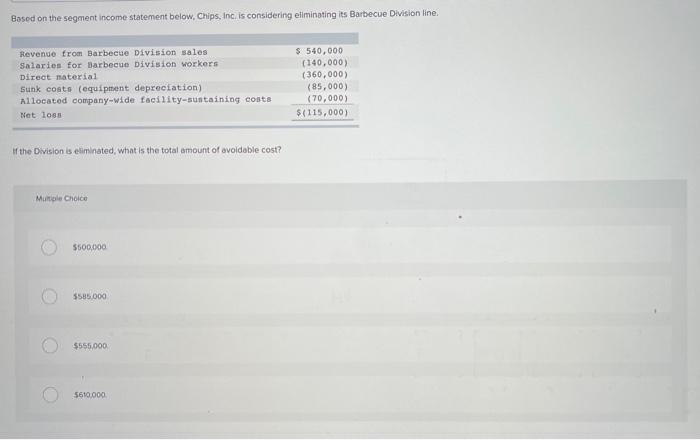

Question: Hi, can you answer all three please. thank you Based on the segment income statement below. Chips, Inc. is considering eliminating its Barbecue Division line,

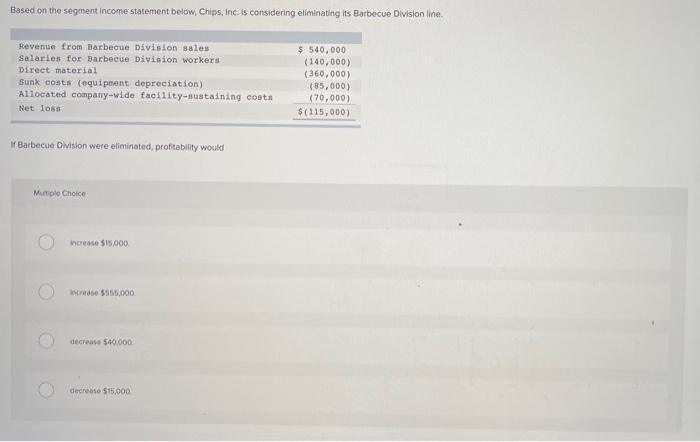

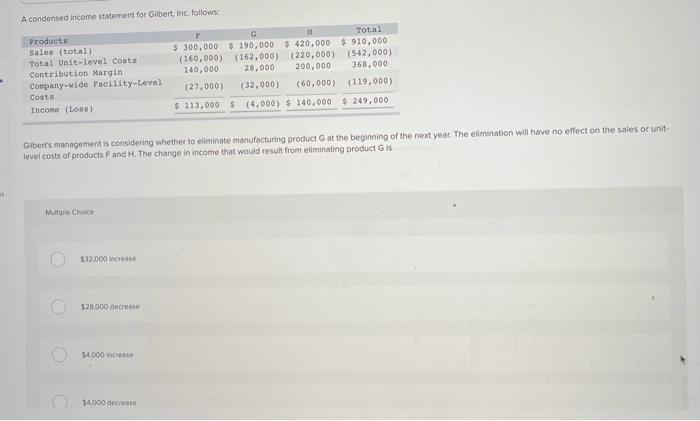

Based on the segment income statement below. Chips, Inc. is considering eliminating its Barbecue Division line, Revenue from Barbecue Division sales Salaries for Barbecue Division workers Direct material Sunk costs (equipment depreciation) Allocated company-wide facility-sustaining costs Net loss $ 540,000 (140,000) (360,000) (85,000) (70,000) $(115,000) If the Division is eliminated, whint is the total amount of avoidable cost? Multiple Choice 5500,000 $585.000 $555,000 5610,000 Based on the segment income statement below, Chips, Inc. is considering eliminating its Barbecue Division line Revenue from Barbecue Division sales Salarios for Barbecue Division workers Direct material Sunk costs (equipment depreciation) Allocated company-wide facility-sustaining costa Net loss $ 540,000 (140,000) (360,000) (85,000) (70,000) $(115,000) Barbecue Division were eliminated, profitability would Multiple Choice Increase $15.000 increase $150.000 decrease $40.000 decrease $15.000 A condensed income statement for Gilbert Inc. follows: G HI Total $ 300,000 $ 190,000 $420,000 $910,000 (160,000) (162,000) (220,000) (542,000) 140,000 28,000 200,000 368,000 127,000) 132,000) (60,000) (119,000) $ 113,000 S (4,000) $ 140,000 $ 249,000 Products Sales (total) Total Unit-level Costs Contribution Margin company-wide Facility-Level Coats Income (Loss) . Glibert's management is considering whether to eliminate manufacturing product G at the beginning of the next year. The elimination will have no effect on the sales or unit level costs of products F and H. The change in income that would result from eliminating product is Multiple Choice . 132,000 was 520.000 decrease 54.000 cres C 54.000 decrease

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts