Question: Hi, can you explain this please. Question 1. A portfolio manager asks you to help analyse two stocks. It is known that the mean or

Hi, can you explain this please.

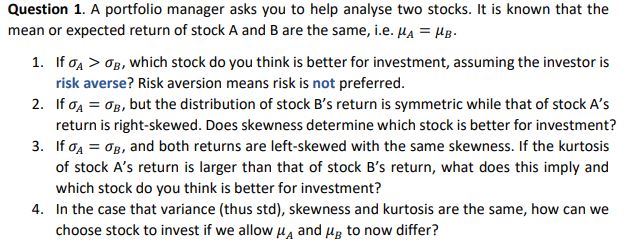

Question 1. A portfolio manager asks you to help analyse two stocks. It is known that the mean or expected return of stock A and B are the same, i.e. MA = /g- 1. If Of > of, which stock do you think is better for investment, assuming the investor is risk averse? Risk aversion means risk is not preferred. 2. If OA = 09, but the distribution of stock B's return is symmetric while that of stock A's return is right-skewed. Does skewness determine which stock is better for investment? 3. If Of = op, and both returns are left-skewed with the same skewness. If the kurtosis of stock A's return is larger than that of stock B's return, what does this imply and which stock do you think is better for investment? 4. In the case that variance (thus std), skewness and kurtosis are the same, how can we choose stock to invest if we allow w and , to now differ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts