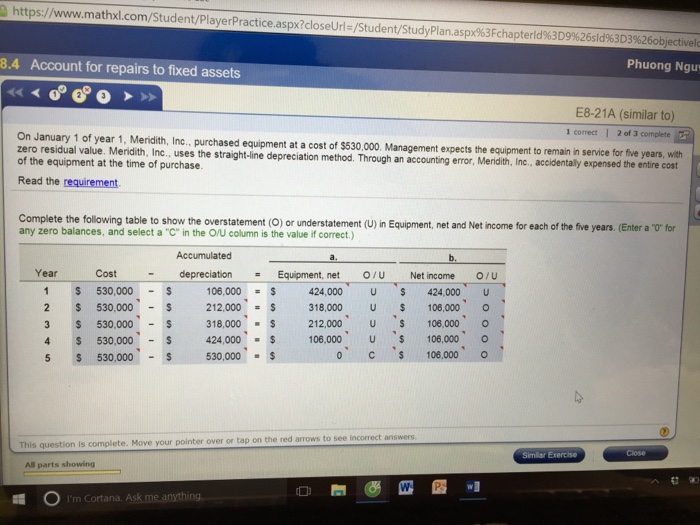

Question: Hi, can you help me annswer this question below. exercise's answer included in the picture. Please explain for me why understatement(u) overstatement(0). Thank you so

https://ww w math l com/Student/playerPractice.aspx?closeUrls/Student/StudyPlanaspx%3Fchapterld%3D992 sld%3D3%26objectivel 8.4 Account for repairs to fixed assets Phuong Ngu E8-21A (similar to) 1 correct 1 2 of 3 complete On January 1 of year 1, Meridith, Inc., purchased equipment at a cost of $530,000. Management expects the equipment to remain in service for five years, wih zero residual value. Meridith, Inc, uses the straight-line depreciation method. Through an accounting error, Meridith, Inc, accidentaly of the equipment at the time of purchase expensed the entire cost Read the requirement. Complete the following table to show the overstatement (O) or understatement (U) in Equipment, net and Net income for each of the five years. (Enter a "o for any zero balances, and select a "C" in the O/U column is the value if correct.) Accumulated Year Cost - depreciation = Equipment, net O/U Net income O/U 2 $ 530,000 3 S 530,000S 4 S 530,000S 5 S 530,000 106,000 = $ 212.000 $ 318,000 424,000 $ 30,000 424,000 U 424,000 U 318,000 u 10000 o 212,000 U S 106,000 O 106,000U106,000 O 530,000,-S 424,000.$ 108,000: u:$ 106,000. 0 C S 106,000 O the red arrows to see incorrect answers This question is complete. Move your pointer over or tap on Similar Exercise All parts showing I'm Cortana. Ask me anything

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts