Question: Hi can you please answer it on Microsoft Excel thank you Instructions Corporate Valuation Translation Effects Exchange Rates on Valu Corporate Valuation Lincoln Corp has

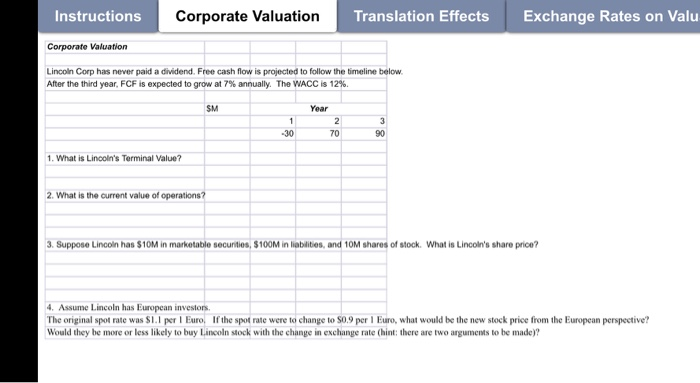

Instructions Corporate Valuation Translation Effects Exchange Rates on Valu Corporate Valuation Lincoln Corp has never paid a dividend. Free cash flow is projected to follow the timeline below. After the third year, FCF is expected to grow at 7% annually. The WACC is 12% 1 -30 Year 2 70 3 90 1. What is Lincoln's Terminal Value? 2. What is the current value of operations? 3. Suppose Lincoln has $10M in marketable securities, $100M in liabilities, and 10M shares of stock. What is Lincoln's share price? 4. Assume Lincoln has European investors The original spot rate was $1.I per i Euro. If the spot rate were to change to $0.9 per 1 Euro, what would be the new stock price from the European perspective? Would they be more or less likely to buy Lincoln stock with the change in exchange rate (hint: there are two arguments to be made)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts