Question: Hi! Can you please answer this in excel, I cannot solve the IRR. Correct IRR should be 23.01% according to the answer sheet, it just

Hi! Can you please answer this in excel, I cannot solve the IRR. Correct IRR should be 23.01% according to the answer sheet, it just doesn't show how to get to that point. Thanks!

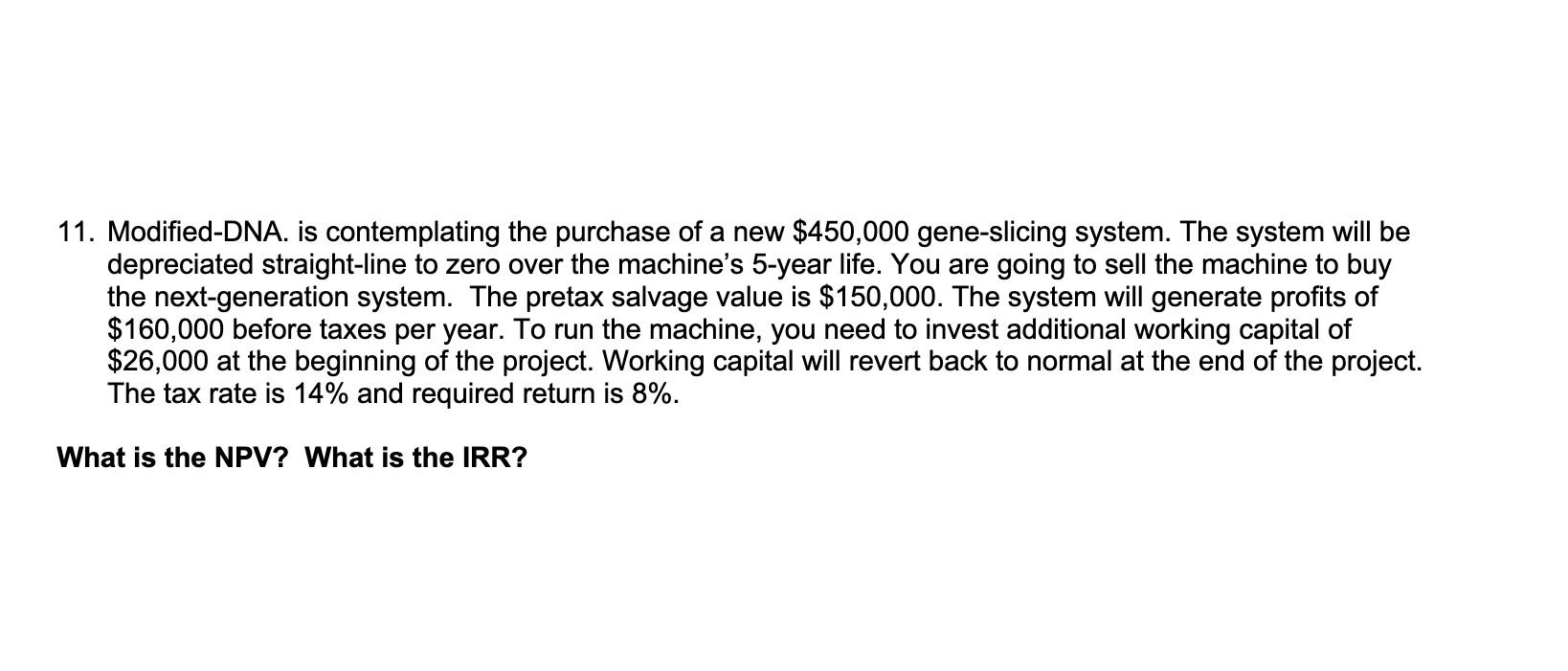

11. Modified-DNA. is contemplating the purchase of a new $450,000 gene-slicing system. The system will be depreciated straight-line to zero over the machine's 5-year life. You are going to sell the machine to buy the next-generation system. The pretax salvage value is $150,000. The system will generate profits of $160,000 before taxes per year. To run the machine, you need to invest additional working capital of $26,000 at the beginning of the project. Working capital will revert back to normal at the end of the project. The tax rate is 14% and required return is 8%. What is the NPV? What is the IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts