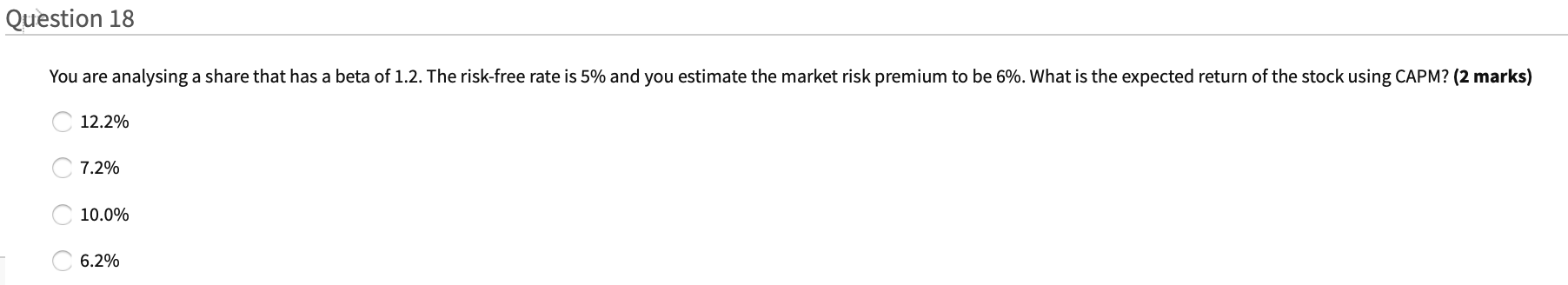

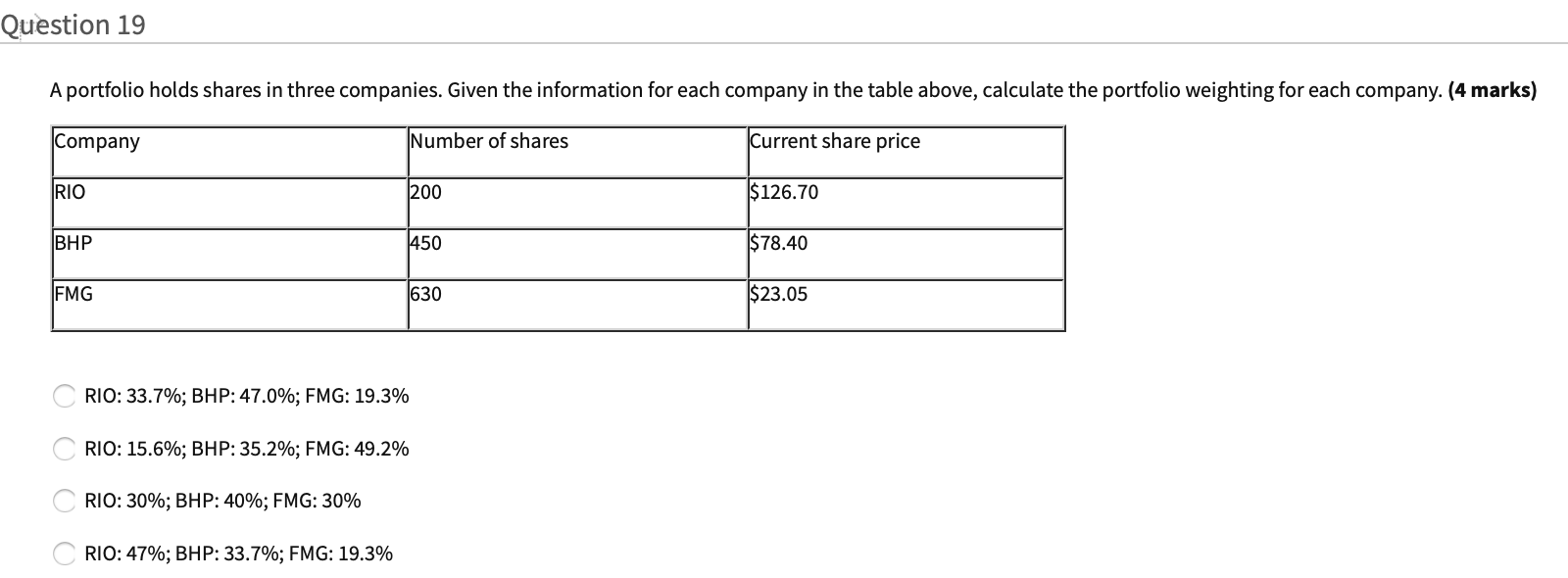

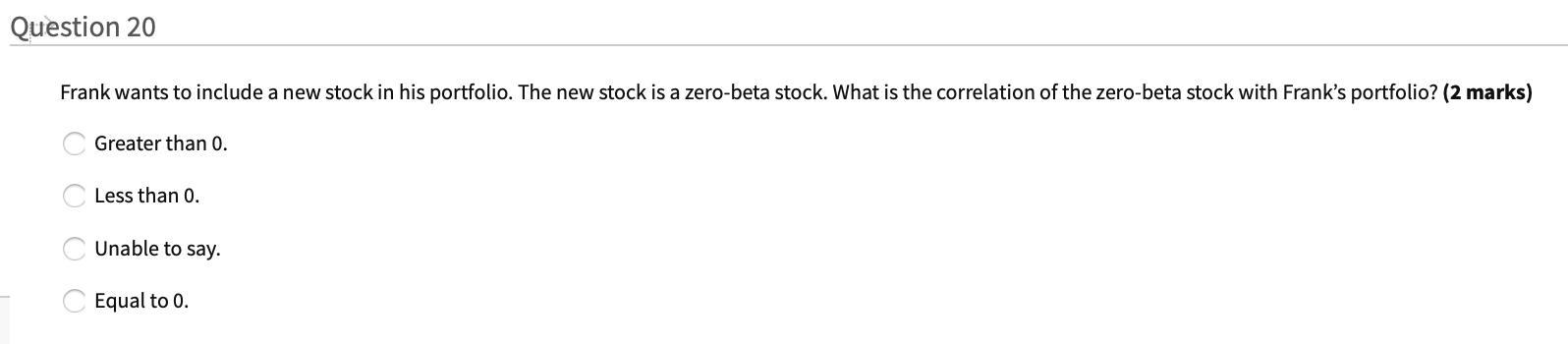

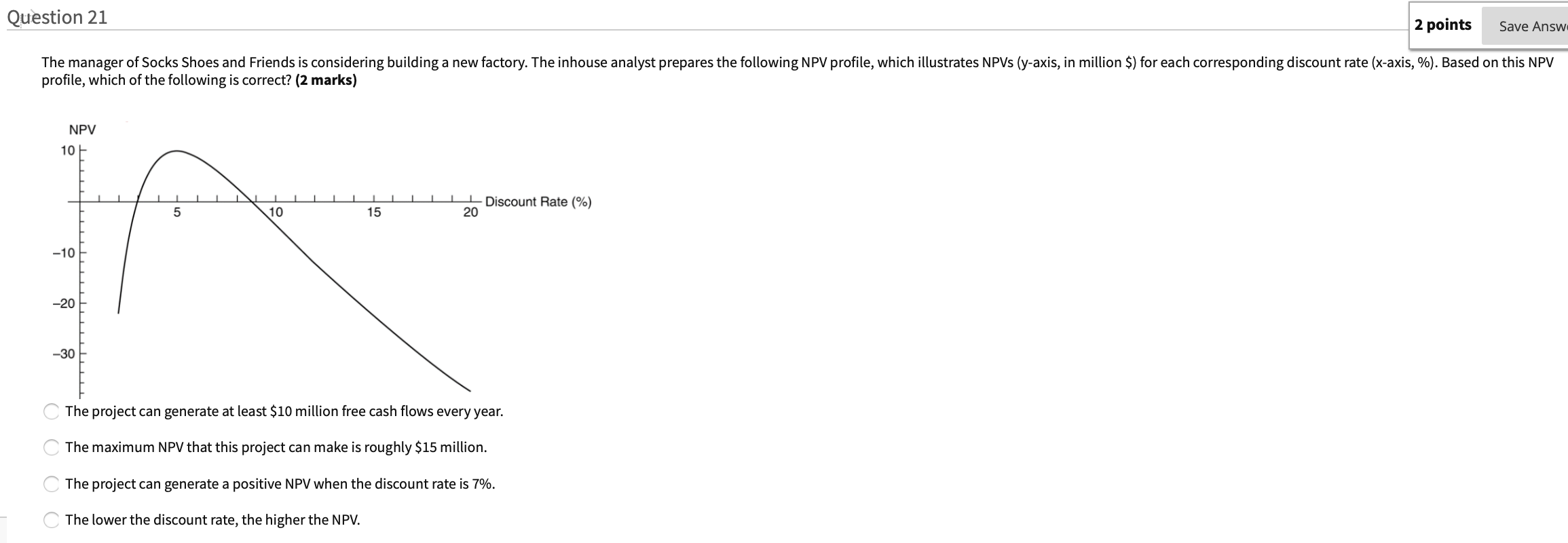

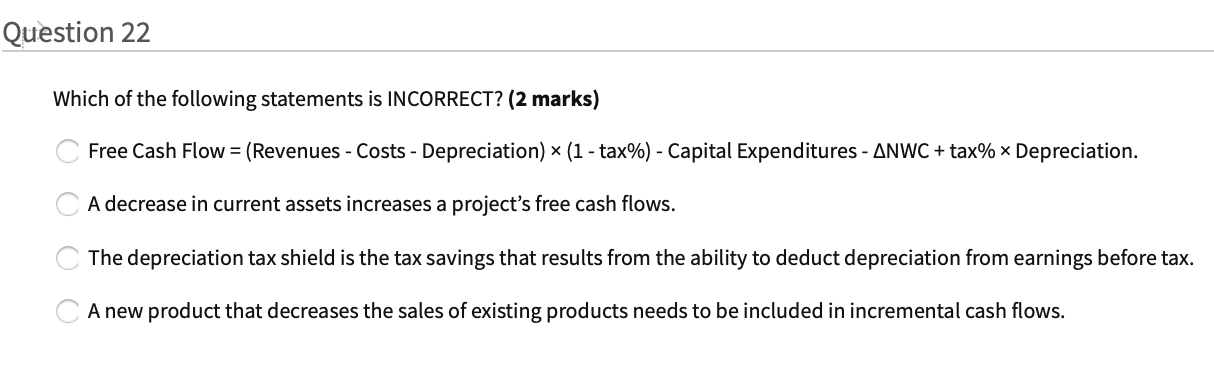

Question: Hi, can you please help answer these multi choice questions. Thanks! (all info provided) Question 18 You are analysing a share that has a beta

Hi, can you please help answer these multi choice questions. Thanks! (all info provided)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts