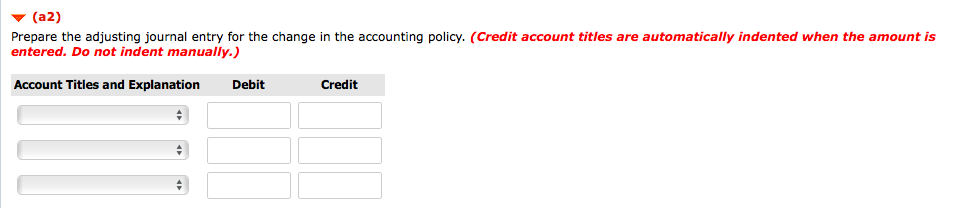

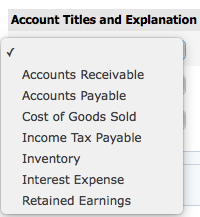

Question: HI. COULD SOMEONE HELP ME SINCE I NEED THE ANSWER TO (a2) BELOW. NOTE THAT LIMITED ACCOUNT TITLES ARE GIVEN FOR EACH ENTRY. Thanks Additional

HI. COULD SOMEONE HELP ME SINCE I NEED THE ANSWER TO (a2) BELOW. NOTE THAT LIMITED ACCOUNT TITLES ARE GIVEN FOR EACH ENTRY. Thanks

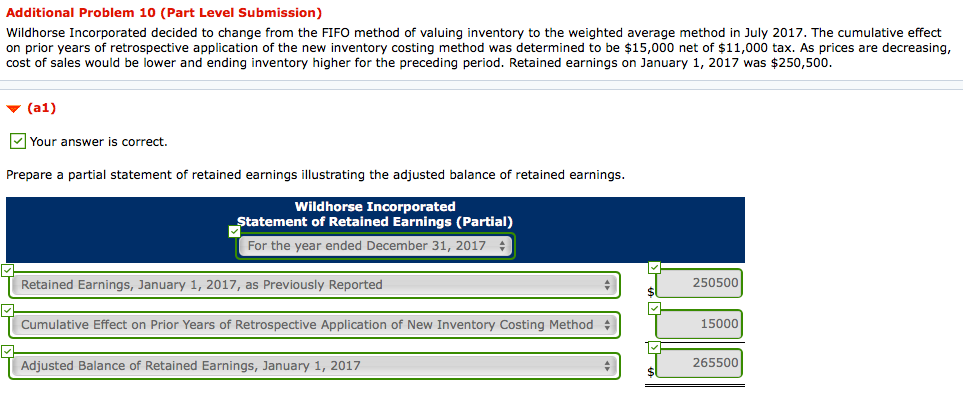

Additional Problem 10 (Part Level Submission) Wildhorse Incorporated decided to change from the FIFO method of valuing inventory to the weighted average method in July 2017. The cumulative effect on prior years of retrospective application of the new inventory costing method was determined to be $15,000 net of $11,000 tax. As prices are decreasing cost of sales would be lower and ending inventory higher for the preceding period. Retained earnings on January 1, 2017 was $250,500 (a1) Your answer is correct. Prepare a partial statement of retained earnings illustrating the adjusted balance of retained earnings. Wildhorse Incorporated Statement of Retained Earnings (Partial) For the year ended December 31, 2017 Retained Earnings, January 1, 2017, as Previously Reported 250500 Cumulative Effect on Prior Years of Retrospective Application of New Inventory Costing Method 15000 265500 Adjusted Balance of Retained Earnings, January 1, 2017

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts