Question: Hi Could someone please help my understand this question with working Thanks Question 4: Process Costing The following data relate to Summer Manufacturing Ltd: Work

Hi Could someone please help my understand this question with working Thanks

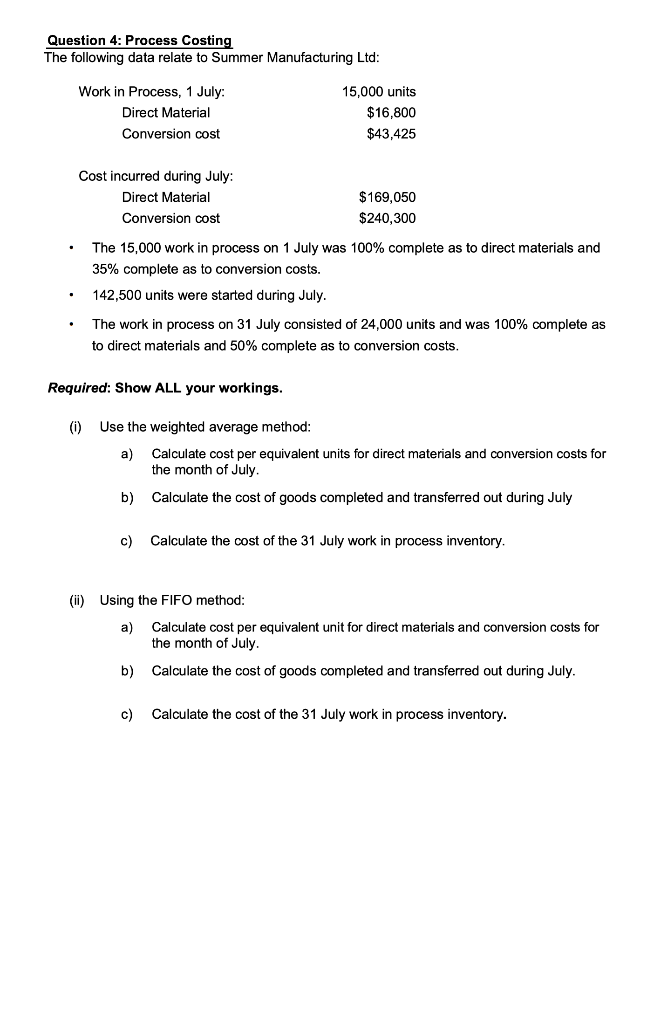

Question 4: Process Costing The following data relate to Summer Manufacturing Ltd: Work in Process, 1 July: Direct Material Conversion cost 15,000 units $16,800 $43,425 Cost incurred during July: Direct Material Conversion cost $169,050 $240,300 The 15,000 work in process on 1 July was 100% complete as to direct materials and 35% complete as to conversion costs. 142,500 units were started during July. The work in process on 31 July consisted of 24,000 units and was 100% complete as to direct materials and 50% complete as to conversion costs. Required: Show ALL your workings. (0) Use the weighted average method: Calculate cost per equivalent units for direct materials and conversion costs for the month of July b) Calculate the cost of goods completed and transferred out during July c) Calculate the cost of the 31 July work in process inventory. (i) Using the FIFO method: a) Calculate cost per equivalent unit for direct materials and conversion costs for the month of July b) Calculate the cost of goods completed and transferred out during July. c) Calculate the cost of the 31 July work in process inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts