Question: Hi could you answer each question with steps showing how to solve please? 11. Suzuki wants to know the WACC of the company where he

Hi could you answer each question with steps showing how to solve please?

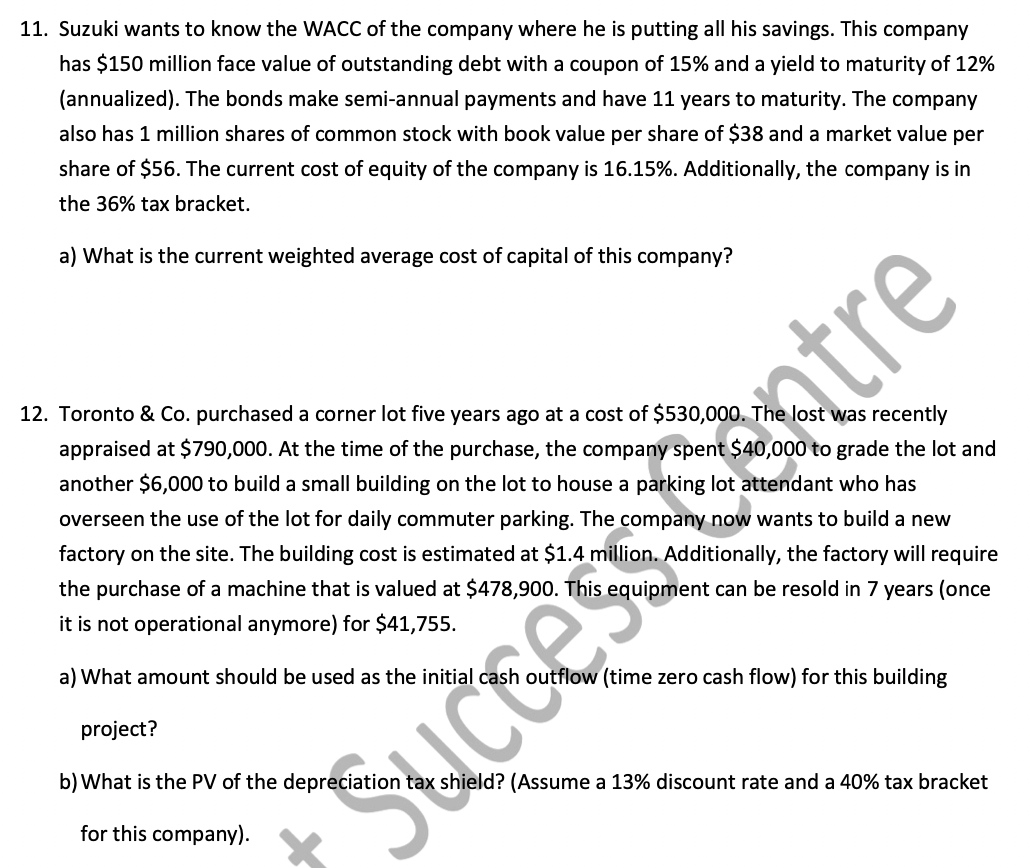

11. Suzuki wants to know the WACC of the company where he is putting all his savings. This company has $150 milion face value of outstanding debt with a coupon of 15% and a yield to maturity of 12% (annualized). The bonds make semi-annual payments and have 11 years to maturity. The company also has 1 million shares of common stock with book value per share of $38 and a market value per share of $56. The current cost of equity of the company is 16.15%. Additionally, the company is in the 36% tax bracket. a) What is the current weighted average cost of capital of this company? 12. Toronto \& Co. purchased a corner lot five years ago at a cost of $530,000. The lost was recently appraised at $790,000. At the time of the purchase, the company spent $40,000 to grade the lot and another $6,000 to build a small building on the lot to house a parking lot attendant who has overseen the use of the lot for daily commuter parking. The company now wants to build a new factory on the site. The building cost is estimated at $1.4 million. Additionally, the factory will require the purchase of a machine that is valued at $478,900. This equipment can be resold in 7 years (once it is not operational anymore) for $41,755. a) What amount should be used as the initial cash outflow (time zero cash flow) for this building project? b) What is the PV of the depreciation tax shield? (Assume a 13% discount rate and a 40% tax bracket for this company). 11. Suzuki wants to know the WACC of the company where he is putting all his savings. This company has $150 milion face value of outstanding debt with a coupon of 15% and a yield to maturity of 12% (annualized). The bonds make semi-annual payments and have 11 years to maturity. The company also has 1 million shares of common stock with book value per share of $38 and a market value per share of $56. The current cost of equity of the company is 16.15%. Additionally, the company is in the 36% tax bracket. a) What is the current weighted average cost of capital of this company? 12. Toronto \& Co. purchased a corner lot five years ago at a cost of $530,000. The lost was recently appraised at $790,000. At the time of the purchase, the company spent $40,000 to grade the lot and another $6,000 to build a small building on the lot to house a parking lot attendant who has overseen the use of the lot for daily commuter parking. The company now wants to build a new factory on the site. The building cost is estimated at $1.4 million. Additionally, the factory will require the purchase of a machine that is valued at $478,900. This equipment can be resold in 7 years (once it is not operational anymore) for $41,755. a) What amount should be used as the initial cash outflow (time zero cash flow) for this building project? b) What is the PV of the depreciation tax shield? (Assume a 13% discount rate and a 40% tax bracket for this company)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts