Question: Hi could you answer each question with steps showing how to solve please? 8. Mecole discovered a year ago some interesting patterns on the stock

Hi could you answer each question with steps showing how to solve please?

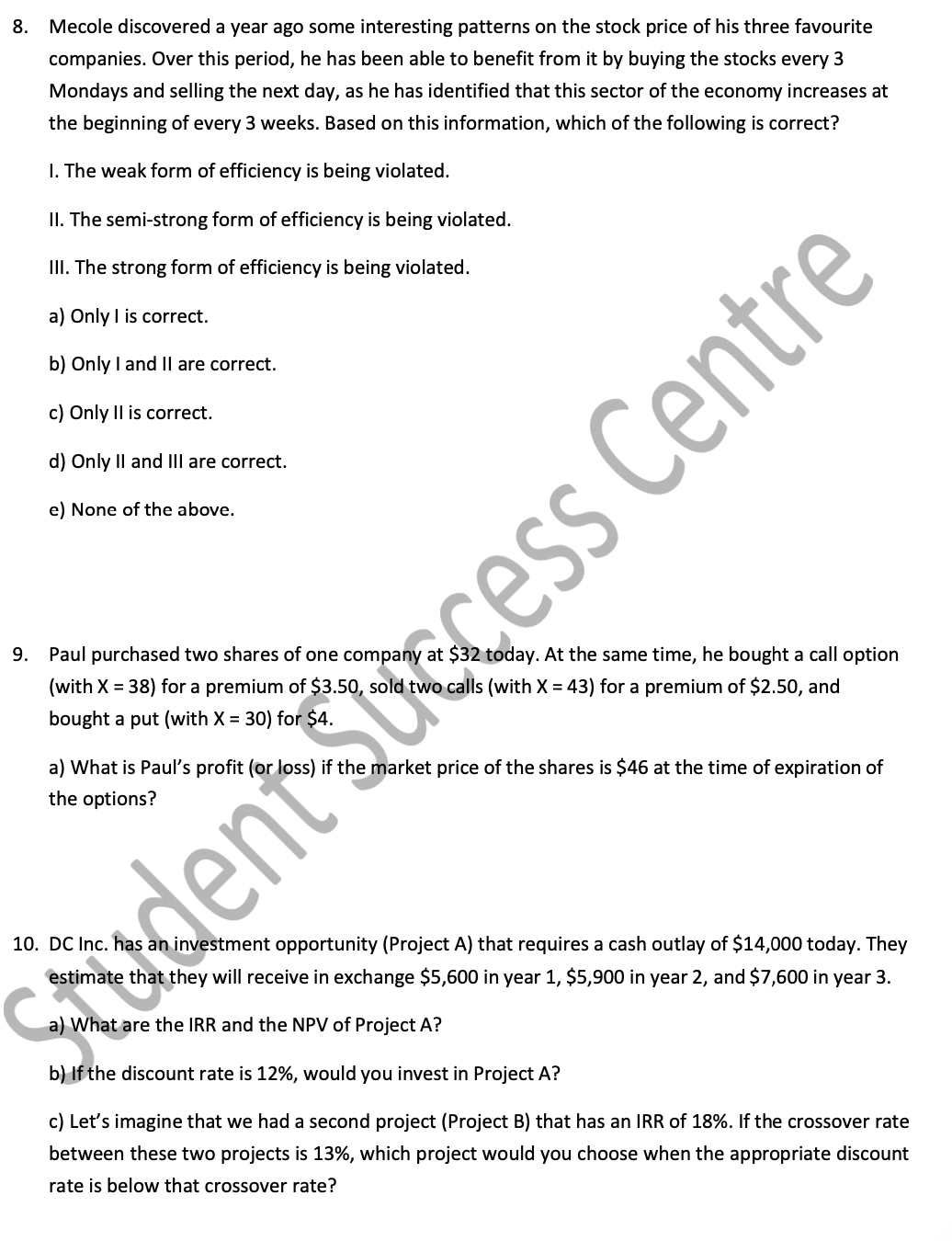

8. Mecole discovered a year ago some interesting patterns on the stock price of his three favourite companies. Over this period, he has been able to benefit from it by buying the stocks every 3 Mondays and selling the next day, as he has identified that this sector of the economy increases at the beginning of every 3 weeks. Based on this information, which of the following is correct? I. The weak form of efficiency is being violated. II. The semi-strong form of efficiency is being violated. III. The strong form of efficiency is being violated. a) Only I is correct. b) Only I and II are correct. c) Only II is correct. d) Only II and III are correct. e) None of the above. 9. Paul purchased two shares of one company at $32 today. At the same time, he bought a call option (with X=38 ) for a premium of $3.50, sold two calls (with X=43 ) for a premium of $2.50, and bought a put (with X=30 ) for $4. a) What is Paul's profit (or loss) if the market price of the shares is $46 at the time of expiration of the options? 10. DC Inc. has an investment opportunity (Project A) that requires a cash outlay of $14,000 today. They estimate that they will receive in exchange $5,600 in year 1,$5,900 in year 2 , and $7,600 in year 3 . a) What are the IRR and the NPV of Project A? b) If the discount rate is 12%, would you invest in Project A? c) Let's imagine that we had a second project (Project B) that has an IRR of 18%. If the crossover rate between these two projects is 13%, which project would you choose when the appropriate discount rate is below that crossover rate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts