Question: Hi - Could you please help with the following assignment: Matt Glennon (SSN 123-45-5555), lives at 211 W Wisconsin Ave, Apt 4, Chicago, IL 60657.

Hi -

Could you please help with the following assignment:

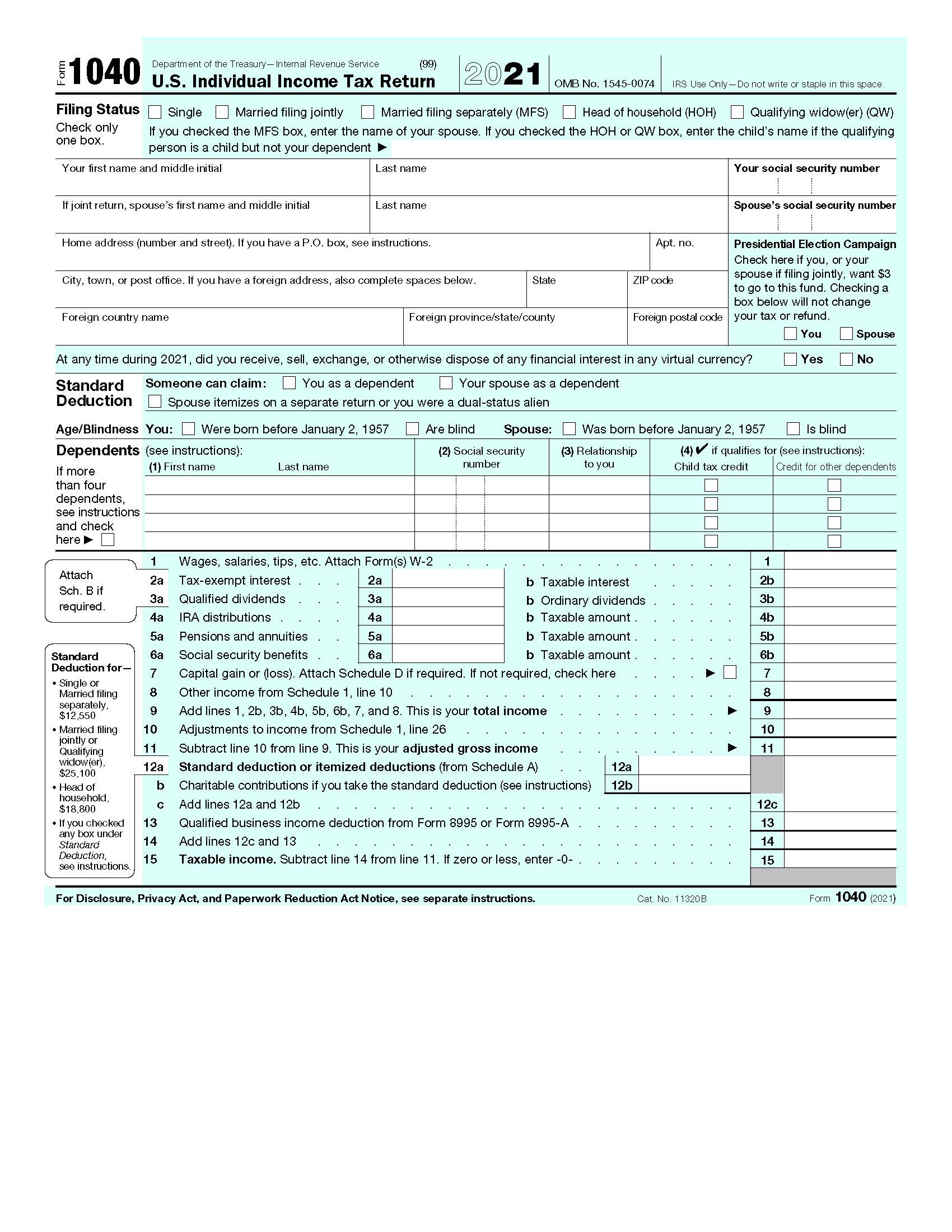

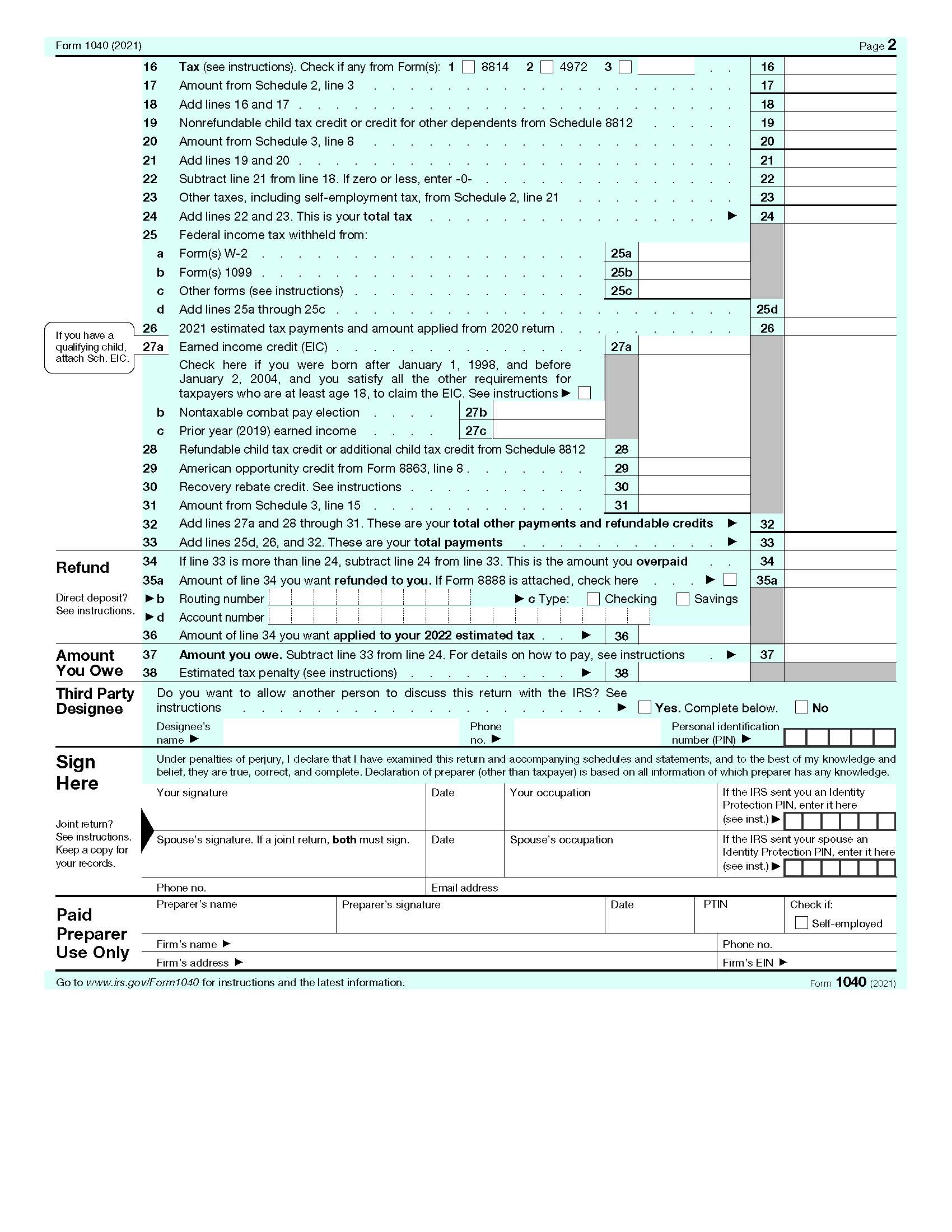

Matt Glennon (SSN 123-45-5555), lives at 211 W Wisconsin Ave, Apt 4, Chicago, IL 60657. He played quarterback for a football team and earned $30,000. He then developed an interest in photography. He took photography classes and decided to run his legitimate photography business as a sole proprietorship and sold a few of his photos. During the year, he had gross receipts of $1,000. However, due to a lawsuit regarding one of the pictures he sold, he paid attorney fees of $4,000. These legal fees were legitimate business expenses. He does not have any dependents but is married to Lisa Glennon (SSN 123-45-7777) and wants to file separate from his spouse. Lisa takes the standard deduction. Matt had no involvement with crypto currencies. A detail of other 2021 transactions are as follows:

Federal Income Tax Wage Withholding: $8,000

Interest from Chase savings account: $1,500

Interest from municipal bonds: $2,000

A gift from his dad: $2,500

A transfer from his savings to checking: $10,000

A trip he won from a contest: $5,000

Alimony paid to a prior wife: $2,000 (Barbara Smith SSN 123-45-9999; divorce agreement executed in 2016)

Child support paid to prior wife $3,000

Itemized deductions of: $6,100

Fully complete a 2021 Form 1040 and Form 1040 Schedule 1.

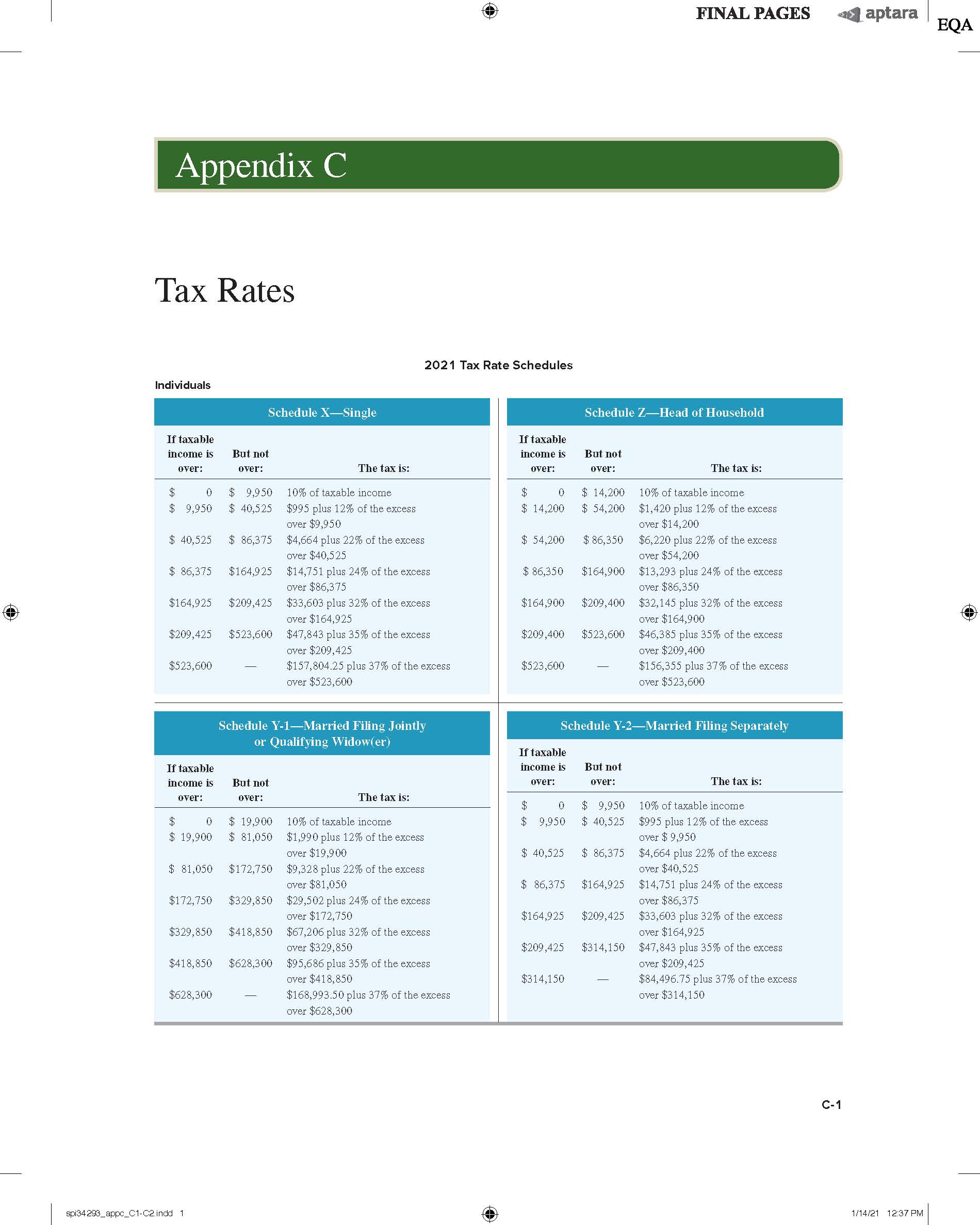

Use the 2021 federal tax rate schedule.

Thank you very much!

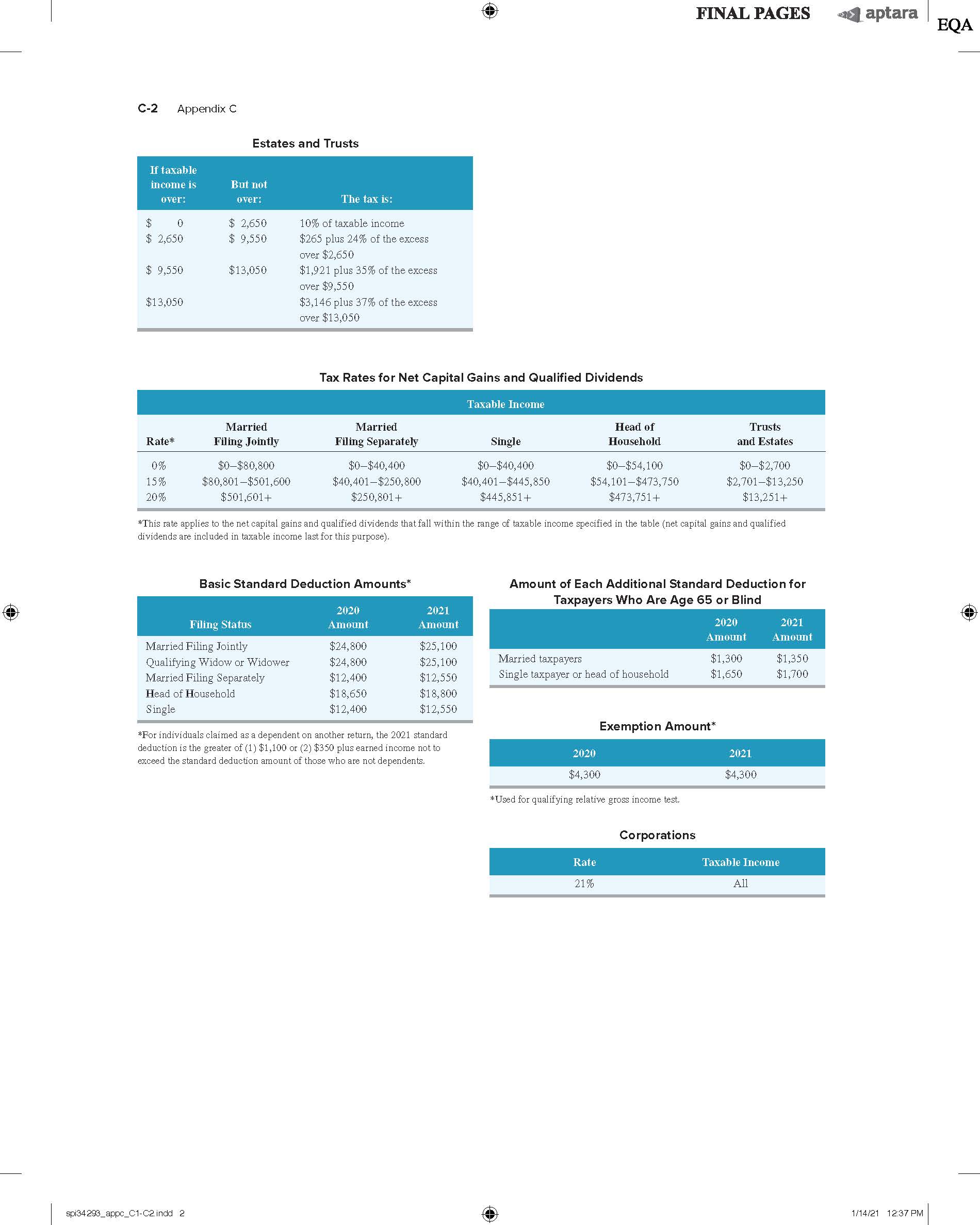

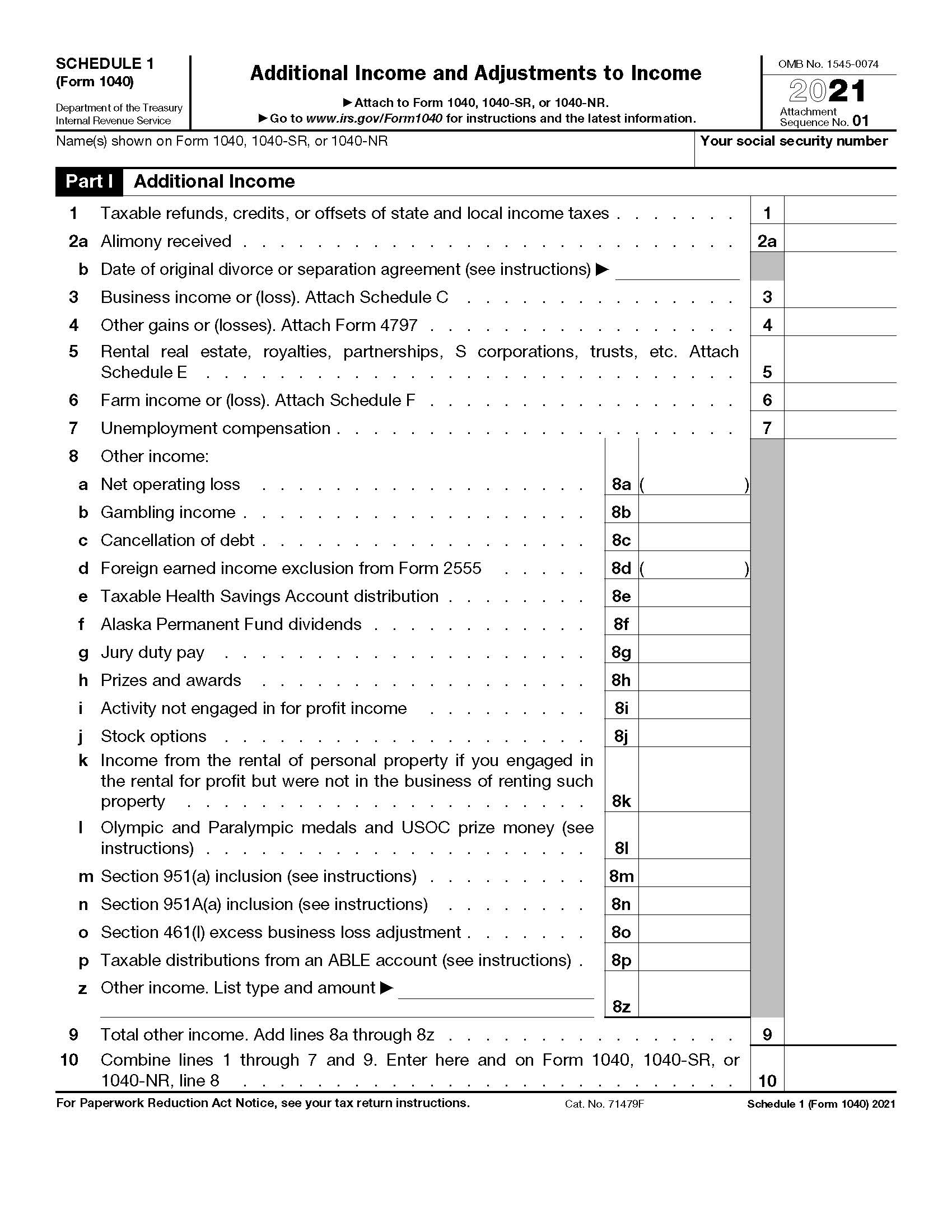

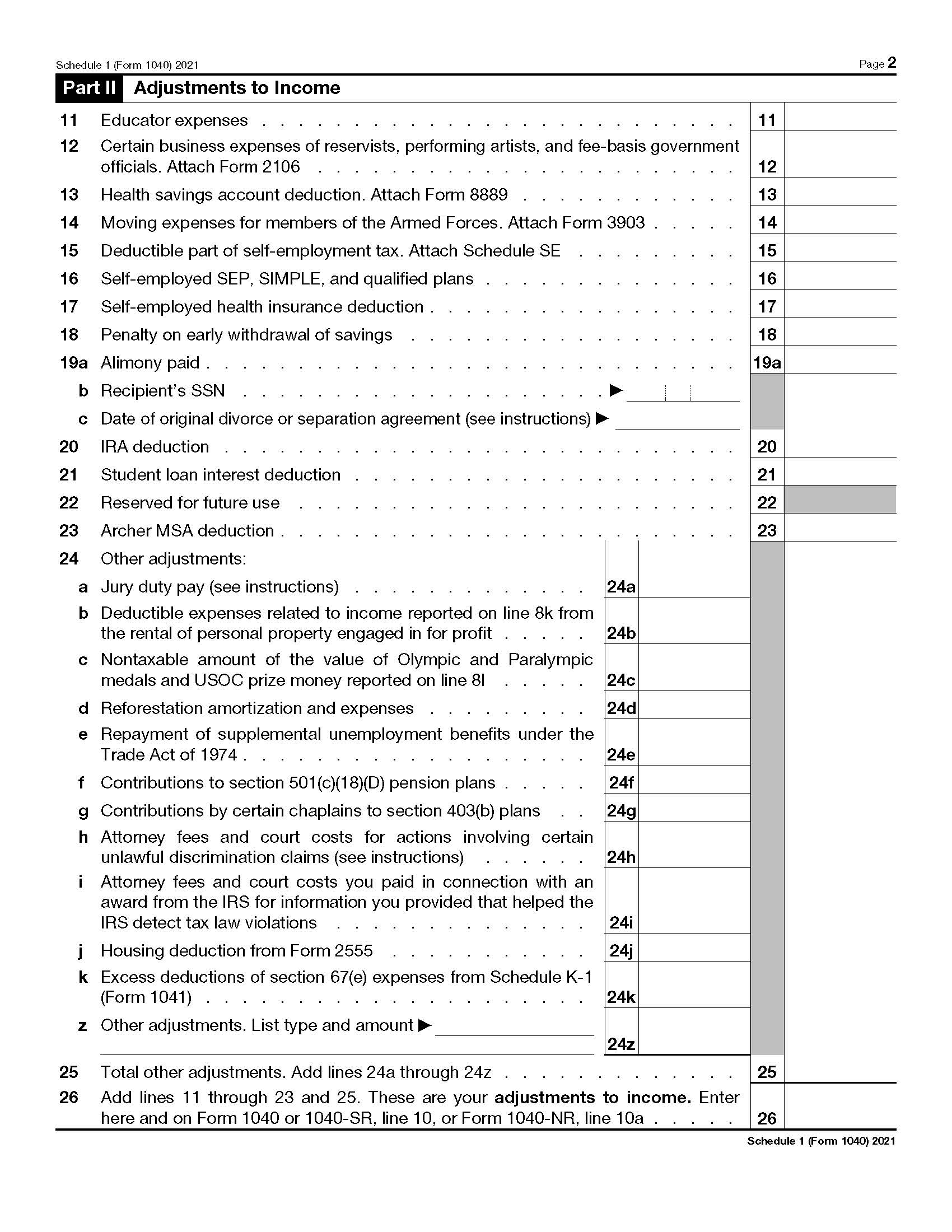

FINAL PAGES aaptara l E Appendix C Tax Rates 2021 Tax Rate Schedules Individuals If taxable If taxable income is But not income is But not over: over: The tax is: over: over: The tax is: $ 0 $ 9,950 10% of taxable income $ 0 $ 14,200 10% of taxable income $ 9,950 $ 40,525 $995 plus 12% of the excess $ 14,200 $ 54,200 $1,420 plus 12% of the excess over $9,950 over $14,200 $ 40,525 $ 86,375 $4,664 plus 22% of the excess $ 54,200 $86,350 $6,220 plus 22% of the excess over $40,5 25 over $54,200 $ 86,375 $164,925 $14,751 plus 24% ofthe excess $ 86,350 $164,900 $13,293 plus 24% of the excess over $86,375 over $86,350 $164,925 $209,425 $33,603 plus 32% of the excess $164,900 $209,400 $32,145 plus 32% of the excess over $164,925 over $164,900 $209,425 $523,600 $47,843 plus 35% of the excess $209,400 $523,600 $46,385 plus 35% of the excess over $209,425 over $209,400 $523,600 7 $157,804.25 plus 37% of the excess $523,600 7 $156,355 plus 37% of the excess over $5 23,600 over $523,600 Schedule YlMarried Filing Jointly or Qualifying Widowl er! Iftaxable income is But not over: over: The taxis: $ 0 $ 19,900 10% of taxable income $ 19,900 $ 81,050 $1,990 plus 12% of the excess over $19,900 $ 81,050 $172,750 $9,328 plus 22% of the excess over $81,050 $172,750 $329,850 $29,502 plus 24% of the excess over $172,750 $329,850 $418,850 $67,206 plus 32% of the excess over $329,850 $418,850 $628,300 $95,686 plus 35% of the excess over $418,850 $628,300 7 $168,993.50 plus 37% of the excess over $628,300 Schedule Y Married F 0 Separate Iftaxable income is But not oVBr: over: The tax is: $ 0 $ 9,950 10% of tsxahleincome $ 9,950 $ 40,525 $995 plus 12% of the excess over $ 9,950 $ 40,525 $ 86,375 $4,664 plus 22% of the excess over $40,525 $ 86,375 $164,925 $14,751 plus 24% of the excess over $86,375 $164,925 $209,425 $33,603 plus 32% of the excess over $164,925 $209,425 $314,150 $47,843 plus 35% of the excess over $209,425 $314,150 7 $84,496.75 plus 37% ofthe excess over $314,150 Sp134 298_appc_01702 mod 1 1714/21 1237 PM QA FINAL PAGES aptara EQA C-2 Appendix C Estates and Trusts If taxable income is But not over: over: The tax is: 0 $ 2,650 10% of taxable income $ 2,650 $ 9,550 $265 plus 24% of the excess over $2,650 $ 9,350 $13,050 $1,921 plus 35% of the excess over $9,550 $13,050 $3,146 plus 37% of the excess over $13,050 Tax Rates for Net Capital Gains and Qualified Dividends Taxable Income Married Married Head of Trusts Rate* Filing Jointly Filing Separately Single Household and Estates 0% $0-$80,800 $0-$40,400 $0-$40,400 $0-$54,100 $0-$2,700 15% $80,801-$501,600 $40,401-$250,800 $40,401-$445,850 $54,101-$473,750 $2,701-$13,250 20% $501,601+ $250,801 + $445,851+ $473,751+ $13,251+ *This rate applies to the net capital gains and qualified dividends that fall within the range of taxable income specified in the table (net capital gains and qualified lividends are included in taxable income last for this purpose). Basic Standard Deduction Amounts* Amount of Each Additional Standard Deduction for Taxpayers Who Are Age 65 or Bling 2020 2021 Filing Status mount Amount 2020 2021 Amount Amount Married Filing Jointly $24,800 $25,100 Qualifying Widow or Widower $24,80 $25, 100 Married taxpayers $1,300 $1,35 Married Filing Separately $12, 40 $12,550 Single taxpayer or head of household $1,650 $1,700 Head of Household $18,650 $18,800 Single $12,400 $12,550 *For individuals claimed as a dependent on another return, the 2021 standard Exemption Amount* deduction is the greater of (1) $1,100 or (2) $350 plus earned income not to 2020 2021 exceed the standard deduction amount of those who are not dependents. $4,300 $4,300 *Used for qualifying relative gross income test. Corporations Rate Taxable Income 21% Al spi34 293_appc_C1-C2. indd 2 1/14/21 12:37 PM$ 1040 Department of the Treasury - Internal Revenue Service (99) U.S. Individual Income Tax Return 2021 OMB No. 1545-0074 |IRS Use Only - Do not write or staple in this space. Filing Status | Single Married filing jointly Married filing separately (MFS) | Head of household (HOH) Qualifying widow(er) (QW) Check only If you checked the MFS box, enter the name of your spouse. If you checked the HOH or QW box, enter the child's name if the qualifying one box. person is a child but not your dependent Your first name and middle initial Last name Your social security number If joint return, spouse's first name and middle initial Last name Spouse's social security number Home address (number and street). If you have a P.O. box, see instructions. Apt. no. Presidential Election Campaign Check here if you, or your City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code spouse if filing jointly, want $3 to go to this fund. Checking a box below will not change Foreign country name Foreign province/state/county Foreign postal code| your tax or refund. You Spouse At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No Standard Someone can claim: You as a dependent Your spouse as a dependent Deduction Spouse itemizes on a separate return or you were a dual-status alien Age/Blindness You: Were born before January 2, 1957 | Are blind Spouse: | Was born before January 2, 1957 Is blind Dependents (see instructions) 2) Social security (3) Relationship (4) if qualifies for (see instructions): If more (1) First name Last name number to you Child tax credit Credit for other dependents than four dependents, see instructions and check here 1 Wages, salaries, tips, etc. Attach Form(s) W-2 1 Attach 2a Sch. B if 2a Tax-exempt interest . b Taxable interest 2b required 3a Qualified dividends 3a b Ordinary dividends 3b 4a IRA distributions 4a b Taxable amount 4b 5a Pensions and annuities . 5a b Taxable amount . 5b Standard 6a Social security benefits . 6a b Taxable amount . 6b Deduction for- Capital gain or (loss). Attach Schedule D if required. If not required, check here 7 Single or Married filing Other income from Schedule 1, line 10 8 separately $12,550 Add lines 1, 2b, 3b, 4b, 5b, 6b, 7, and 8. This is your total income 9 Married filing 10 Adjustments to income from Schedule 1, line 26 10 jointly or Qualifying 11 Subtract line 10 from line 9. This is your adjusted gross income 11 widow (er) $25,100 12a Standard deduction or itemized deductions (from Schedule A) 12a Head of b Charitable contributions if you take the standard deduction (see instructions) 12b household, $18,800 C Add lines 12a and 12b 12c If you checked 13 Qualified business income deduction from Form 8995 or Form 8995-A 13 any box under Standard 14 Add lines 12c and 13 14 Deduction, 15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- 15 see instructions. For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11320B Form 1040 (2021)Form 1040 (2021) Page 2 16 Tax (see instructions). Check if any from Form(s): 1 D 8814 2 |:| 4972 3 D . . 16 17 Amount from Schedule 2, line 3 . . . . . . . . . . . . . . . . . . . . 17 18 Add lines 16and 17 . . . . . . . . . . . . . . . . . . . . . . . . 18 19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 . . . . . 19 20 Amount from Schedule 3, line 8 . . . . . . . . . . . . . . . . . . . . 20 21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . 21 22 Subtract line 21 from line 18. If zero or less, enter -0- . . . . . . . . . . . . . . 22 23 Other taxes, including self-employment tax, from Schedule 2, line 21 . . . . . . . . . 23 24 Add lines 22 and 23. This is your total tax . . . . . . . . . . . . . . . . P 24 25 Federal income tax withheld from: a Form(s) W-2 . . . . . . . . . . . . . . . . . . 25a b Form(s) 1099 . . . . . . . . . . . . . . . . . . 25b c Other forms (see instructions) . . . . . . . . . . . . . 25c d Add lines 25a through 25c . . . . . . . . . . . . . . . . . . . . . . 25d \"you have a 26 2021 estimated tax payments and amount applied from 2020 return . . . . . . . . . . 26 qualifying child, 27a Earned Income credit (EIC). . . . . . . . . . . . 27a mam SC\" 30' Check here if you were born after January 1, 1998, and before January 2, 2004 and you satisfy all the other requirements for taxpayers who are at least age 18, to claim the EIC. See instructions > b Nontaxable combat pay election . . . . 27b c Prior year (2019) earned income . . . . 27c 28 Refundable child tax credit or additional child tax credit from Schedule 8812 28 29 American opportunity credit from Form 8863, line 8 . . . . . . . 29 30 Recovery rebate credit. See instructions . . . . . . . . . . 30 31 Amount from Schedule 3 line 15 . . . 31 32 Add lines 27a and 28 through 31. These are your total other payments and refundable credits b 32 33 Add lines 25d, 26, and 32. These are your total payments . . . . . . . . . . . P 33 Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid . . 34 35a Amount of line 34 you want refunded to you. If Form 8888' Is attached check here . . . b 35a Direet deposit? h b Routing number. ' ' ' I ' I ' ' b 0 Type. Checking Savings See Instructions. k (1 Account numberI . . I I I I I I I I I I I I 36 Amount of line 34 you want applied to your 2022 estimated tax . . V 36 Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instrLctions . b 37 YOU Owe 38 Estimated tax penalty (see instructions) . . . . . . . . . b 38 Third Party Do you want to allow another person to discuss this return with the IRS? See Designee instructions . . . . . . . . . . . . . . . . . . . . D Yes. Complete below. No DeSIgnee's Phone Personal Identification name F no. V number IPINI F I I I I I I Sign Under penalties of perjury, I declare that l have examined this return and accompanyingrschedules and statements, and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) Is based on all Information of which preparer as any knowledge. Here Your signature Date Your occupation If the IRS sent you an Identity Protection PIN, enter it here Joint return? (see inst.) b EEEEED See instructions. Spouse's signature. If a joint return, both must sign. Date Spouse's occupation If the IRS sent your spouse an KEEP a COW k" Identity Protection PIN, enter it here Phone no. Email address _ Preparer's name Preparer's signature Date PT N Check if: Paid Selfsemployed Preparer , Firm '3 name > Phone no. Use Only . , Firm's address > Firm's EIN i Go to WWW. Irs.gov/Form1040 for instructions and the latest information. Form 1040 (2021) SCHEDULE 1 (Form 1040) Department of the Treasury Internal Revenue SerVIce Name(s) shown on Form 1040, 1040-SR, or 1040-NR 1 Sta-\"$0.079! N603; 10 For Paperwork Reduction Act Notice, see your tax return instructions. PAttach to Form 1040, 1040-SR, or 1040-NR. Additional Income Additional Income and Adjustments to Income >Go to www.irs.gov/Form1040 for instructions and the latest information. Your social security number OMB No. 1545-0074 221 Attachment Sequence No.01 Taxable refunds, credits, or offsets of state and local income taxes . Alimony received . Date of original divorce or separation agreement (see instructions) > Business income or (loss). Attach Schedule C Other gains or (losses). Attach Form 4797 . Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E Farm income or (loss). Attach Schedule F Unemployment compensation . Other income: Net operating loss Gambling income . Cancellation of debt . Foreign earned income exclusion from Form 2555 Taxable Health Savings Account distribution . Alaska Permanent Fund dividends . Jury duty pay Prizes and awards Activity not engaged in for profit income Stock options Income from the rental of personal property if you engaged in the rental for profit but were not in the business of renting such property Olympic and Paralympic medals and USOC prize money (see instructions) . Section 951(a) inclusion (see instructions) Section 951A(a) inclusion (see instructions) Section 4610) excess business loss adjustment . Taxable distributions from an ABLE account (see instructions) . Other income. List type and amount > Total other' Income. Add lines 8a through 82 Combine lines 1 through 7 and 9. Enter here and on Form 1040 1040 SR, or 1040- NR, line 8 1 2a A 4 5 6 7 8a ) 8b 8c 8d ) 8e 8f 89 8h 8i 8] 8k 8| 8m 8n 80 8p 82 9 10 Cat. No. 71479F Schedule 1 (Form 1040) 2021 Schedule 1 (Form 1040) 2021 Ialll Adjustments to Income 11 12 13 14 15 16 17 18 19a 20 21 22 23 24 d Reforestation amortization and expenses . . . . . . . . . 24d 25 26 Page 2 Educator expenses Certain business expenses of reservists, performing artists, and feebasis government officials. Attach Form 2106 Health savings account deduction. Attach Form 8889 Moving expenses for members of the Armed Forces. Attach Form 3903 . Deductible part of self-employment tax. Attach Schedule SE Selfemployed SEP, SIMPLE, and qualified plans . Selfemployed health insurance deduction . Penalty on early withdrawal of savings Alimony paid . . . Recipient'sSSN....................> Date of original divorce or separation agreement (see instructions) > IRA deduction Student loan interest deduction Reserved for future use Archer MSA deduction . Other adjustments: Jury duty pay (see instructions) . . . . . . . . . . . . . 24a 11 12 13 14 15 16 17 18 19a 20 21 22 23 Deductible expenses related to income reported on line 8k from the rental of personal property engaged in for profit . . . . . 24b Nontaxable amount of the value of Olympic and Paralympic medals and USOC prize money reported on line 8| . . . . . 24c Repayment of supplemental unemployment benefits under the TradeActof1974................... 24e Contributions to section 501(c)(18)(D) pension plans. . . . . 24f Contributions by certain chaplains to section 403(b) plans . . 24g Attorney fees and court costs for actions involving certain unlawful discrimination claims (see instructions) . . . . . . 24h Attorney fees and court costs you paid in connection with an award from the IRS for information you provided that helped the IRS detect tax law violations . . . . . . . . . . . . . . 24i Housing deductionfrom Form2555 . . . . . . . . . . . 24j Excess deductions of section 67(e) expenses from Schedule K1 (Form1041)..................... 24k Other adjustments. List type and amount b 24z Total other adjustments. Add lines 24a through 242 . Add lines 11 through 23 and 25. These are your adjustments to income. Enter here and on Form 1040 or 1040SR, line 10, or Form 1040NR, line 10a . 25 26 Schedule 1 (Form 1040) 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts