Question: Hi, Could you please show step by step solution to this problem? Bert and Catherine Longfelter Bert and Catherine are married and file a joint

Hi, Could you please show step by step solution to this problem?

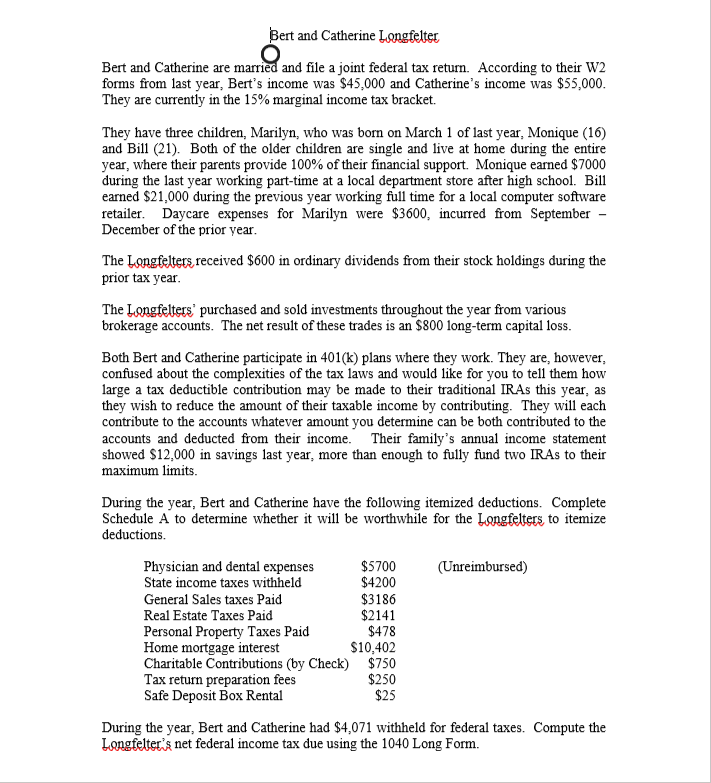

Bert and Catherine Longfelter Bert and Catherine are married and file a joint federal tax return. According to their W2 forms from last year, Bert's income was $45,000 and Catherine's income was $55,000. They are currently in the 15% marginal income tax bracket. They have three children, Marilyn, who was born on March 1 of last year, Monique (16) and Bill (21). Both of the older children are single and live at home during the entire year, where their parents provide 100% of their financial support. Monique earned $7000 during the last year working part-time at a local department store after high school. Bill earned $21,000 during the previous year working full time for a local computer software retailer. Daycare expenses for Marilyn were $3600, incurred from September December of the prior year. The Longfelters received $600 in ordinary dividends from their stock holdings during the prior tax year. The Longfelters' purchased and sold investments throughout the year from various brokerage accounts. The net result of these trades is an $800 long-term capital loss. Both Bert and Catherine participate in 401(k) plans where they work. They are, however, confused about the complexities of the tax laws and would like for you to tell them how large a tax deductible contribution may be made to their traditional IRAs this year, as they wish to reduce the amount of their taxable income by contributing. They will each contribute to the accounts whatever amount you determine can be both contributed to the accounts and deducted from their income. Their family's annual income statement showed $12,000 in savings last year, more than enough to fully fund two IRAs to their maximum limits. During the year, Bert and Catherine have the following itemized deductions. Complete Schedule A to determine whether it will be worthwhile for the Longfelters to itemize deductions (Unreimbursed) Physician and dental expenses $5700 State income taxes withheld $4200 General Sales taxes Paid $3186 Real Estate Taxes Paid $2141 Personal Property Taxes Paid $478 Home mortgage interest $10,402 Charitable Contributions (by Check) $750 Tax return preparation fees $250 Safe Deposit Box Rental $25 During the year, Bert and Catherine had $4,071 withheld for federal taxes. Compute the Langfelter is net federal income tax due using the 1040 Long Form. Bert and Catherine Longfelter Bert and Catherine are married and file a joint federal tax return. According to their W2 forms from last year, Bert's income was $45,000 and Catherine's income was $55,000. They are currently in the 15% marginal income tax bracket. They have three children, Marilyn, who was born on March 1 of last year, Monique (16) and Bill (21). Both of the older children are single and live at home during the entire year, where their parents provide 100% of their financial support. Monique earned $7000 during the last year working part-time at a local department store after high school. Bill earned $21,000 during the previous year working full time for a local computer software retailer. Daycare expenses for Marilyn were $3600, incurred from September December of the prior year. The Longfelters received $600 in ordinary dividends from their stock holdings during the prior tax year. The Longfelters' purchased and sold investments throughout the year from various brokerage accounts. The net result of these trades is an $800 long-term capital loss. Both Bert and Catherine participate in 401(k) plans where they work. They are, however, confused about the complexities of the tax laws and would like for you to tell them how large a tax deductible contribution may be made to their traditional IRAs this year, as they wish to reduce the amount of their taxable income by contributing. They will each contribute to the accounts whatever amount you determine can be both contributed to the accounts and deducted from their income. Their family's annual income statement showed $12,000 in savings last year, more than enough to fully fund two IRAs to their maximum limits. During the year, Bert and Catherine have the following itemized deductions. Complete Schedule A to determine whether it will be worthwhile for the Longfelters to itemize deductions (Unreimbursed) Physician and dental expenses $5700 State income taxes withheld $4200 General Sales taxes Paid $3186 Real Estate Taxes Paid $2141 Personal Property Taxes Paid $478 Home mortgage interest $10,402 Charitable Contributions (by Check) $750 Tax return preparation fees $250 Safe Deposit Box Rental $25 During the year, Bert and Catherine had $4,071 withheld for federal taxes. Compute the Langfelter is net federal income tax due using the 1040 Long Form

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts