Question: Hi, could you try to solve this problem? I give excellent ratings. Thank you very much. A large nation-wide e-tailer operates five fulfillment centers spread

Hi, could you try to solve this problem? I give excellent ratings. Thank you very much.

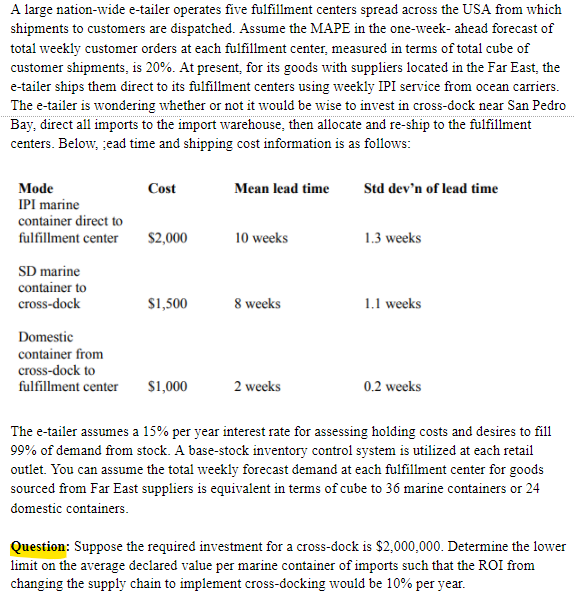

A large nation-wide e-tailer operates five fulfillment centers spread across the USA from which shipments to customers are dispatched. Assume the MAPE in the one-week-ahead forecast of total weekly customer orders at each fulfillment center, measured in terms of total cube of customer shipments, is 20%. At present, for its goods with suppliers located in the Far East, the e-tailer ships them direct to its fulfillment centers using weekly IPI service from ocean carriers. The e-tailer is wondering whether or not it would be wise to invest in cross-dock near San Pedro Bay, direct all imports to the import warehouse, then allocate and re-ship to the fulfillment centers. Below, read time and shipping cost information is as follows: Cost Mean lead time Std devn of lead time Mode IPI marine container direct to fulfillment center SD marine container to cross-dock $2,000 10 weeks 1.3 weeks $1,500 8 weeks 1.1 weeks Domestic container from cross-dock to fulfillment center $1,000 2 weeks 0.2 weeks The e-tailer assumes a 15% per year interest rate for assessing holding costs and desires to fill 99% of demand from stock. A base-stock inventory control system is utilized at each retail outlet. You can assume the total weekly forecast demand at each fulfillment center for goods sourced from Far East suppliers is equivalent in terms of cube to 36 marine containers or 24 domestic containers. Question: Suppose the required investment for a cross-dock is $2,000,000. Determine the lower limit on the average declared value per marine container of imports such that the ROI from changing the supply chain to implement cross-docking would be 10% per year. A large nation-wide e-tailer operates five fulfillment centers spread across the USA from which shipments to customers are dispatched. Assume the MAPE in the one-week-ahead forecast of total weekly customer orders at each fulfillment center, measured in terms of total cube of customer shipments, is 20%. At present, for its goods with suppliers located in the Far East, the e-tailer ships them direct to its fulfillment centers using weekly IPI service from ocean carriers. The e-tailer is wondering whether or not it would be wise to invest in cross-dock near San Pedro Bay, direct all imports to the import warehouse, then allocate and re-ship to the fulfillment centers. Below, read time and shipping cost information is as follows: Cost Mean lead time Std devn of lead time Mode IPI marine container direct to fulfillment center SD marine container to cross-dock $2,000 10 weeks 1.3 weeks $1,500 8 weeks 1.1 weeks Domestic container from cross-dock to fulfillment center $1,000 2 weeks 0.2 weeks The e-tailer assumes a 15% per year interest rate for assessing holding costs and desires to fill 99% of demand from stock. A base-stock inventory control system is utilized at each retail outlet. You can assume the total weekly forecast demand at each fulfillment center for goods sourced from Far East suppliers is equivalent in terms of cube to 36 marine containers or 24 domestic containers. Question: Suppose the required investment for a cross-dock is $2,000,000. Determine the lower limit on the average declared value per marine container of imports such that the ROI from changing the supply chain to implement cross-docking would be 10% per year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts