Question: Hi Everyone! I would really like some help on this problem and if you can show your work that would be fantastic. Thank you in

Hi Everyone! I would really like some help on this problem and if you can show your work that would be fantastic. Thank you in advance!

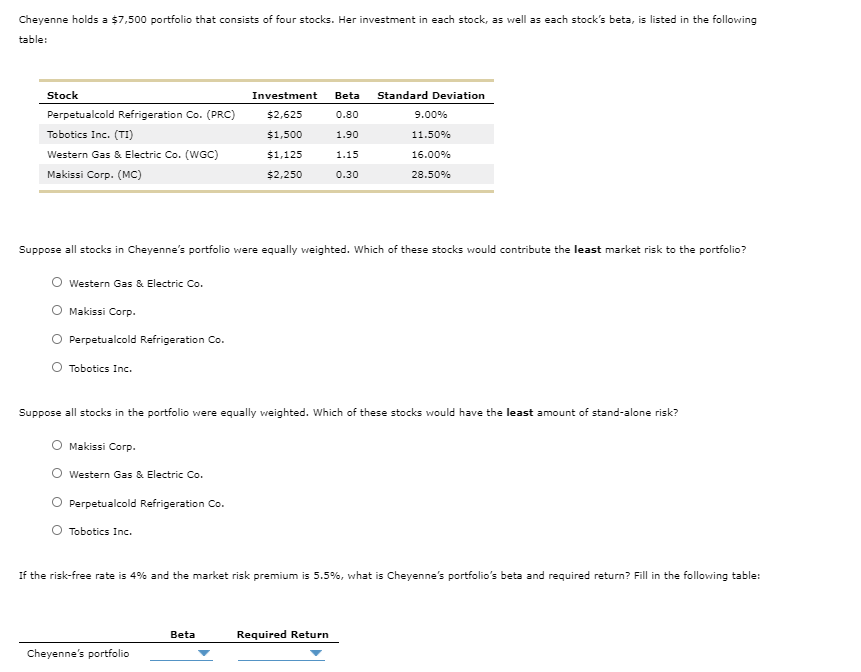

Cheyenne holds a $7,500 portfolio that consists of four stocks. Her investment in each stock, as well as each stock's beta, is listed in the following table: Beta Investment $2,625 0.80 Stock Perpetualcold Refrigeration Co. (PRC) Tobotics Inc. (TI) Western Gas & Electric Co. (WGC) Makissi Corp. (MC) Standard Deviation 9.00% 11.50% 16.00% $1,500 1.90 $1,125 1.15 $2,250 0.30 28.50% Suppose all stocks in Cheyenne's portfolio were equally weighted. Which of these stocks would contribute the least market risk to the portfolio? Western Gas & Electric Co. Makissi Corp. Perpetualcold Refrigeration Co. Tobotics Inc. Suppose all stocks in the portfolio were equally weighted. Which of these stocks would have the least amount of stand-alone risk? Makissi Corp. Western Gas & Electric Co. Perpetualcold Refrigeration Co. Tobotics Inc. If the risk-free rate is 4% and the market risk premium is 5.5%, what is Cheyenne's portfolio's beta and required return? Fill in the following table: Beta Required Return Cheyenne's portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts