Question: HI guys i need help with this problem. Accounting is not my strongs suits, any help would be much appreciated. Thank You Colonial Company Colonial

HI guys i need help with this problem. Accounting is not my strongs suits, any help would be much appreciated. Thank You

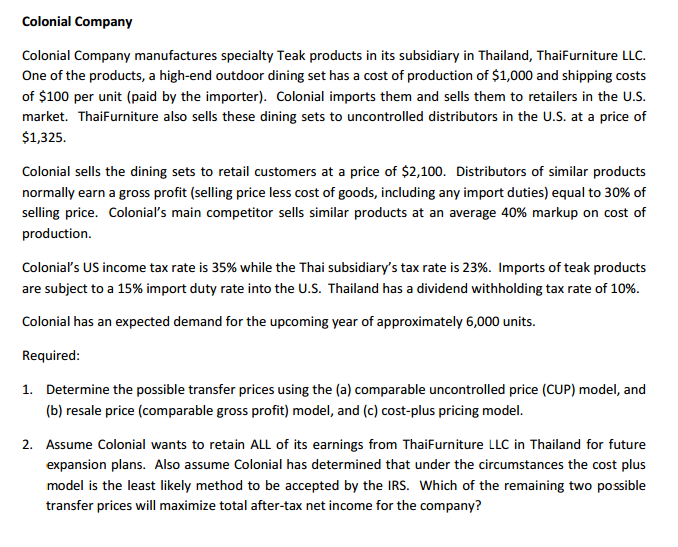

Colonial Company Colonial Company manufactures specialty Teak products in its subsidiary in Thailand, ThaiFurniture LLC. One of the products, a high-end outdoor dining set has a cost of production of $1,000 and shipping costs of $100 per unit (paid by the importer). Colonial imports them and sells them to retailers in the U.S. market. ThaiFurniture also sells these dining sets to uncontrolled distributors in the U.S. at a price of $1,325. Colonial sells the dining sets to retail customers at a price of $2,100. Distributors of similar products normally earn a gross profit (selling price less cost of goods, including any import duties) equal to 30% of selling price. Colonial's main competitor sells similar products at an average 40% markup on cost of production Coloniars US income tax rate is 35% while the Thai subsidiary's tax rate is 23%. Imports of teak products are subject to a 15% import duty rate into the US. Thailand has a dividend withholding tax rate of 10%. Colonial has an expected demand for the upcoming year of approximately 6,000 units. Required 1. Determine the possible transfer prices using the (a) comparable uncontrolled price (CUP) model, and (b) resale price (comparable gross profit) model, and (c) cost-plus pricing model 2. Assume Colonial wants to retain ALL of its earnings from ThaiFurniture LLC in Thailand for future expansion plans. Also assume Colonial has determined that under the circumstances the cost plus model is the least likely method to be accepted by the IRS. Which of the remaining two possible transfer prices will maximize total after-tax net income for the company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts