Question: Hi, I am having problems with this Excel questions, could anyone help me get the solutions for this? Thanks for any help! 4. We need

Hi, I am having problems with this Excel questions, could anyone help me get the solutions for this?

Thanks for any help!

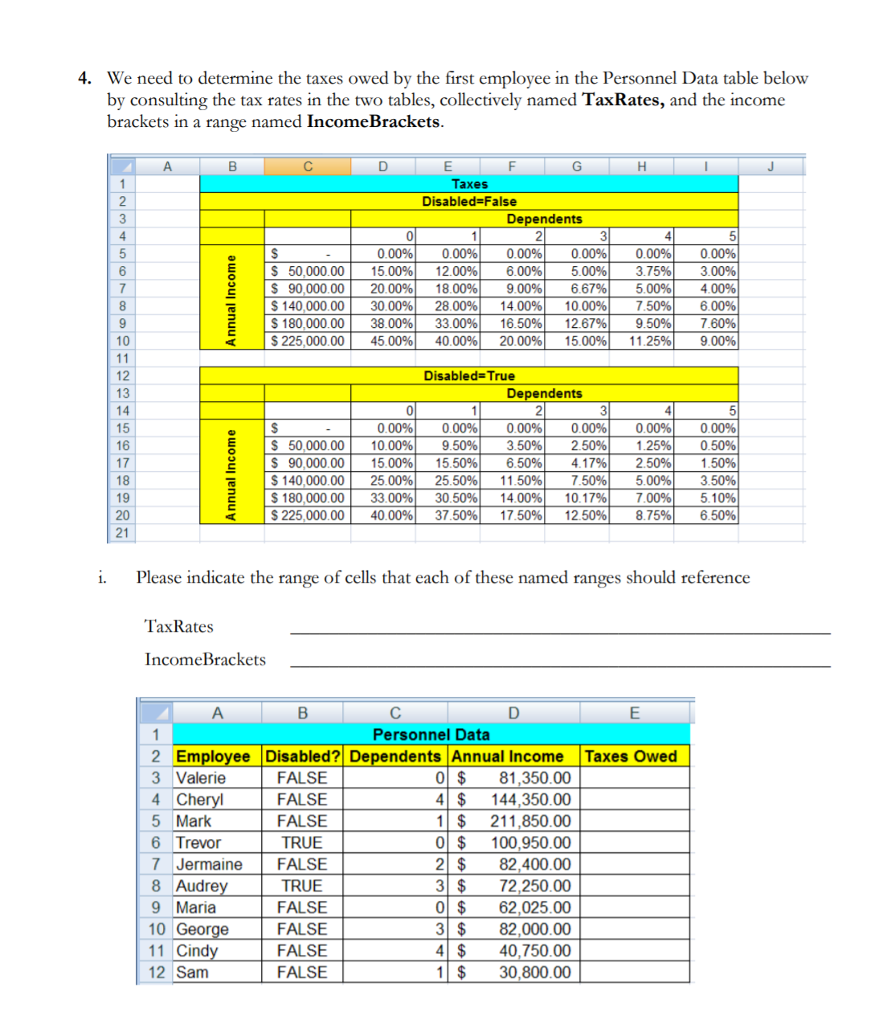

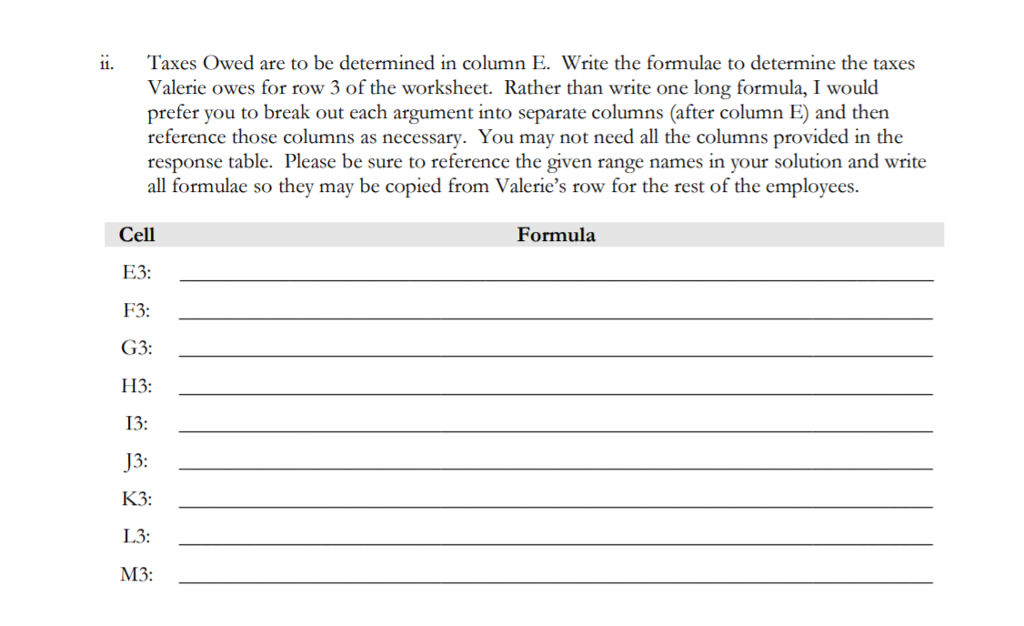

4. We need to determine the taxes owed by the first employee in the Personnel Data table below by consulting the tax rates in the two tables, collectively named TaxRates, and the income brackets in a range named IncomeBrackets Taxes Disabled-False Dependents |$50,000.00 | $90,000 00 | $140,000 001 $180,000.00 | $225,000 001 000% 15.00% 2000% 3000%) 38.00%) 45 00% 0.00% 12.00%) 1800% 28 00%) 33.00%) 4000% 0.00% 6.00% 900% 1400% 16.50% 0.00%) 5.00%) 6679 1000%) 12.67% 1500%) 0.00% 3.75%) 5.00% 7.50% 9.50%) 11.25%) 000% 3.00% 400% 600% 7.60% 900% 2000% Disabled- True 13 Dependents 15 000%) $50.000.00 | 1000%) $90,000.00 | 1500%) $140,000.00 | 25 00% $180,000 00133 0096| $225,000.00! 4000%) 0.00%) 9.50%) 15.50%) 25 50% 3050%) 37.50%) 000% 3.50%) 650% 1150% 14 00% 17.50%) 000%) 2.50%) 4.17%) 7.50%) 0.00%) 1.25%) 2.50%) 5.00%) 7.00%) 8.75%) 000% 050% 150% 350% 510% 650% 10179 19 20 21 12.50%) i. Please indicate the range of cells that each of these named ranges should reference TaxRates IncomeBrackets Personnel Data 2 Employee Disabled? Dependents Annual Income Taxes Owed 3 Valerie 4 Che 5 Mark 6 Trevor 7 JermaineFALSE 8 Audre 9 Maria 10 Geor 11 Cin 12 Samm FALSE FALSE FALSE TRUE 0$ 81,350.00 4$144,350.00 1 $ 211,850.00 $ 100,950.00 $ 82,400.00 3 $ 72,250.00 0$ 62,025.00 3 $ 82,000.00 4$ 40,750.00 1$ 30,800.00 TRUE FALSE FALSE FALSE FALSE 4. We need to determine the taxes owed by the first employee in the Personnel Data table below by consulting the tax rates in the two tables, collectively named TaxRates, and the income brackets in a range named IncomeBrackets Taxes Disabled-False Dependents |$50,000.00 | $90,000 00 | $140,000 001 $180,000.00 | $225,000 001 000% 15.00% 2000% 3000%) 38.00%) 45 00% 0.00% 12.00%) 1800% 28 00%) 33.00%) 4000% 0.00% 6.00% 900% 1400% 16.50% 0.00%) 5.00%) 6679 1000%) 12.67% 1500%) 0.00% 3.75%) 5.00% 7.50% 9.50%) 11.25%) 000% 3.00% 400% 600% 7.60% 900% 2000% Disabled- True 13 Dependents 15 000%) $50.000.00 | 1000%) $90,000.00 | 1500%) $140,000.00 | 25 00% $180,000 00133 0096| $225,000.00! 4000%) 0.00%) 9.50%) 15.50%) 25 50% 3050%) 37.50%) 000% 3.50%) 650% 1150% 14 00% 17.50%) 000%) 2.50%) 4.17%) 7.50%) 0.00%) 1.25%) 2.50%) 5.00%) 7.00%) 8.75%) 000% 050% 150% 350% 510% 650% 10179 19 20 21 12.50%) i. Please indicate the range of cells that each of these named ranges should reference TaxRates IncomeBrackets Personnel Data 2 Employee Disabled? Dependents Annual Income Taxes Owed 3 Valerie 4 Che 5 Mark 6 Trevor 7 JermaineFALSE 8 Audre 9 Maria 10 Geor 11 Cin 12 Samm FALSE FALSE FALSE TRUE 0$ 81,350.00 4$144,350.00 1 $ 211,850.00 $ 100,950.00 $ 82,400.00 3 $ 72,250.00 0$ 62,025.00 3 $ 82,000.00 4$ 40,750.00 1$ 30,800.00 TRUE FALSE FALSE FALSE FALSE

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts