Question: Hi I am needing help solving for 5b as well as 6. Can I get some help please? 2 Case 75 The Western Company Capital

Hi I am needing help solving for 5b as well as 6. Can I get some help please?

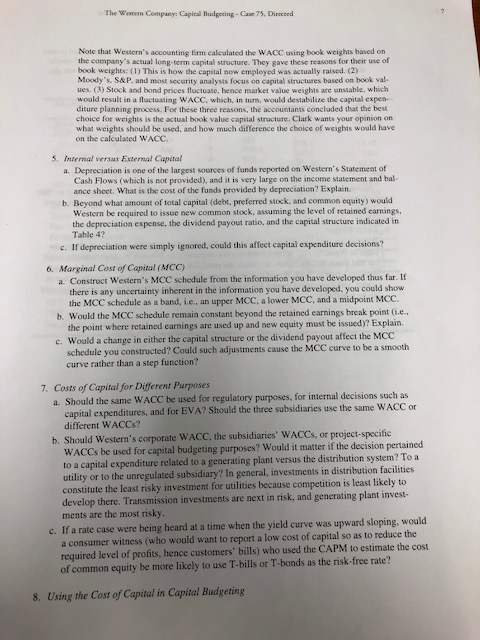

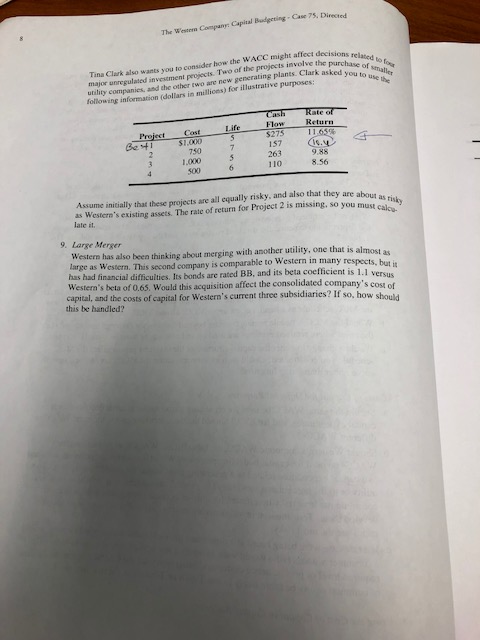

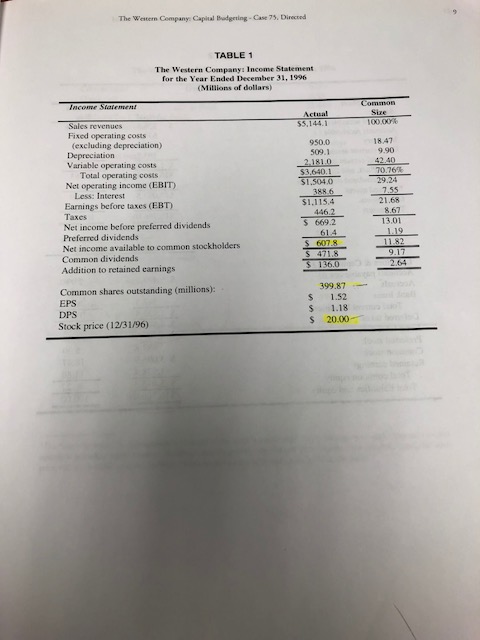

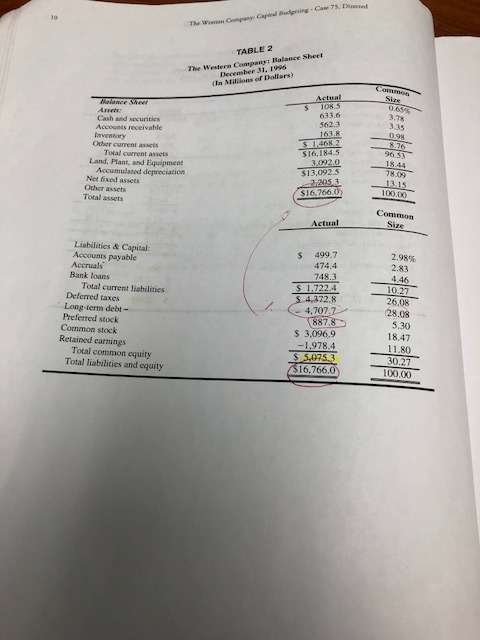

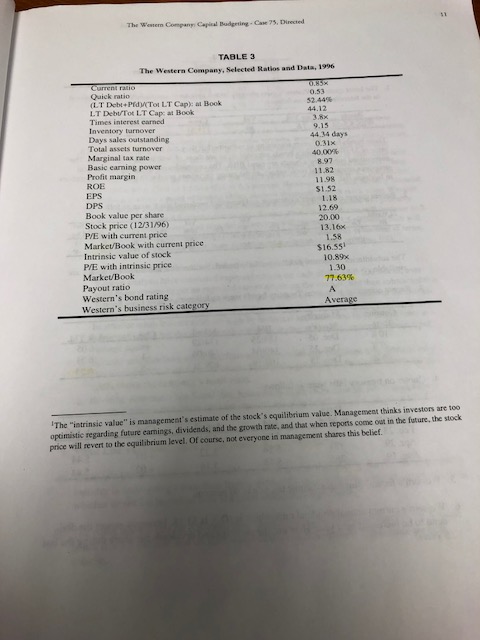

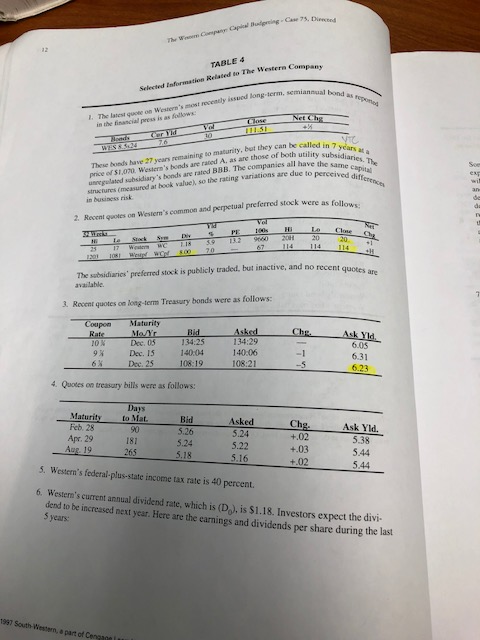

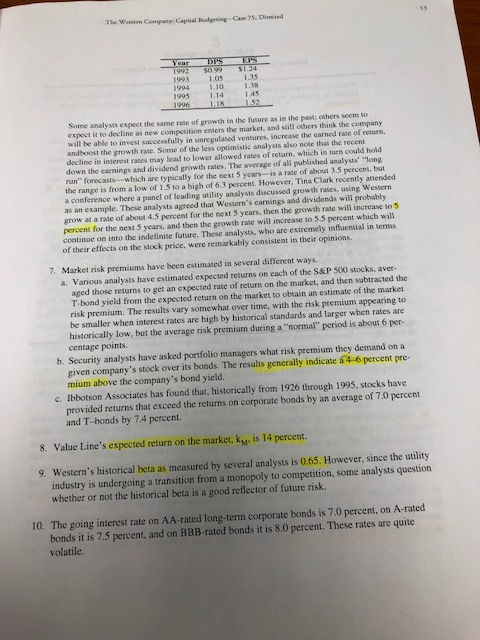

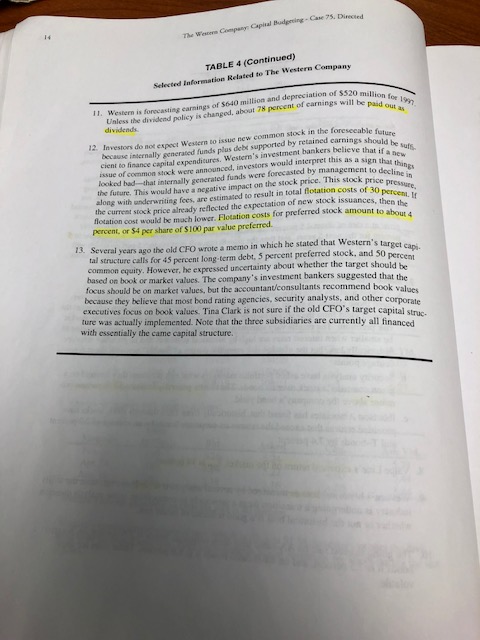

2 Case 75 The Western Company Capital Budgeting Directed Western is a holding company which owns tworegulated utilities plus a third subsidiary which ts in unregulated energy projects. Western's only function is to proxide capital and staff sup to the subsidiaries-it is strictly a holding company. All cash flows generated by the subsidiarie controlled by Western, which uses funds to support its staff, to pay dividends, and to reinvest ts subsidiaries. Funds are allocated back to the subsidiaries depending on their investment oppor in are tunities, not in proportion to the amount of funds sent up to the parent company. The subsidiarie se debt and preferred stock by issuing their own securities, but they need common equity over and above the amount of funds sent back bonds, preferred stock, by the parent company (retained earnings). Western issues and/or common stock and then uses the proceeds t subsidiary. Both the subsidiaries' and Western's bonds and preferred stocks are traded in the put- lic market, but the subsi only for Western's debt and preferred stock. Also, Western's common stock is publicly traded diaries' securities are not actively traded so valid quotations are available Western is contemplating not using preferred stock in the future, but a final decision has not been reached. The company goes through its budget process in the fall. At that time, capital expen- ditures for the coming year are authorized, and plans are made to raise any required external capi- tal. Also, the Board makes a tentative determination of executive bonuses for the year, and it approves the operating targets upon which the following year's compensation will be based. West ern's financial staff also compares the utility subsidiaries' earned rates of return to their authorized rates of return, and their authorized returns to estimates of their costs of capital. If the utilities are projected to earn a lower rate of return on equity than their regulatory commissions have autho- rized, or if the authorized return is less than the cost of equity as estimated by management, then the subsidiaries will seek rate increases Western has been relying on the consulting division of its accounting firm to develop estimates of the cost of capital. When Tina Clark, Western's recently hired CFO, received the accountants cost of capital estimates, she was struck by significant differences between the accountants' calcu lations and the procedures she was used to seeing. She then asked your consulting firm to do an inde pendent cost of capital study, and you were assigned that task Tina explained that she needs the cost of capital for regulatory purposes, for evaluating pro- posed capital expenditures, and for calculating Economic Value Added (EVA). She provided the nancial statements and miscellaneous information contained in Tables 1 through 4 2 Case 75 The Western Company Capital Budgeting Directed Western is a holding company which owns tworegulated utilities plus a third subsidiary which ts in unregulated energy projects. Western's only function is to proxide capital and staff sup to the subsidiaries-it is strictly a holding company. All cash flows generated by the subsidiarie controlled by Western, which uses funds to support its staff, to pay dividends, and to reinvest ts subsidiaries. Funds are allocated back to the subsidiaries depending on their investment oppor in are tunities, not in proportion to the amount of funds sent up to the parent company. The subsidiarie se debt and preferred stock by issuing their own securities, but they need common equity over and above the amount of funds sent back bonds, preferred stock, by the parent company (retained earnings). Western issues and/or common stock and then uses the proceeds t subsidiary. Both the subsidiaries' and Western's bonds and preferred stocks are traded in the put- lic market, but the subsi only for Western's debt and preferred stock. Also, Western's common stock is publicly traded diaries' securities are not actively traded so valid quotations are available Western is contemplating not using preferred stock in the future, but a final decision has not been reached. The company goes through its budget process in the fall. At that time, capital expen- ditures for the coming year are authorized, and plans are made to raise any required external capi- tal. Also, the Board makes a tentative determination of executive bonuses for the year, and it approves the operating targets upon which the following year's compensation will be based. West ern's financial staff also compares the utility subsidiaries' earned rates of return to their authorized rates of return, and their authorized returns to estimates of their costs of capital. If the utilities are projected to earn a lower rate of return on equity than their regulatory commissions have autho- rized, or if the authorized return is less than the cost of equity as estimated by management, then the subsidiaries will seek rate increases Western has been relying on the consulting division of its accounting firm to develop estimates of the cost of capital. When Tina Clark, Western's recently hired CFO, received the accountants cost of capital estimates, she was struck by significant differences between the accountants' calcu lations and the procedures she was used to seeing. She then asked your consulting firm to do an inde pendent cost of capital study, and you were assigned that task Tina explained that she needs the cost of capital for regulatory purposes, for evaluating pro- posed capital expenditures, and for calculating Economic Value Added (EVA). She provided the nancial statements and miscellaneous information contained in Tables 1 through 4

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts