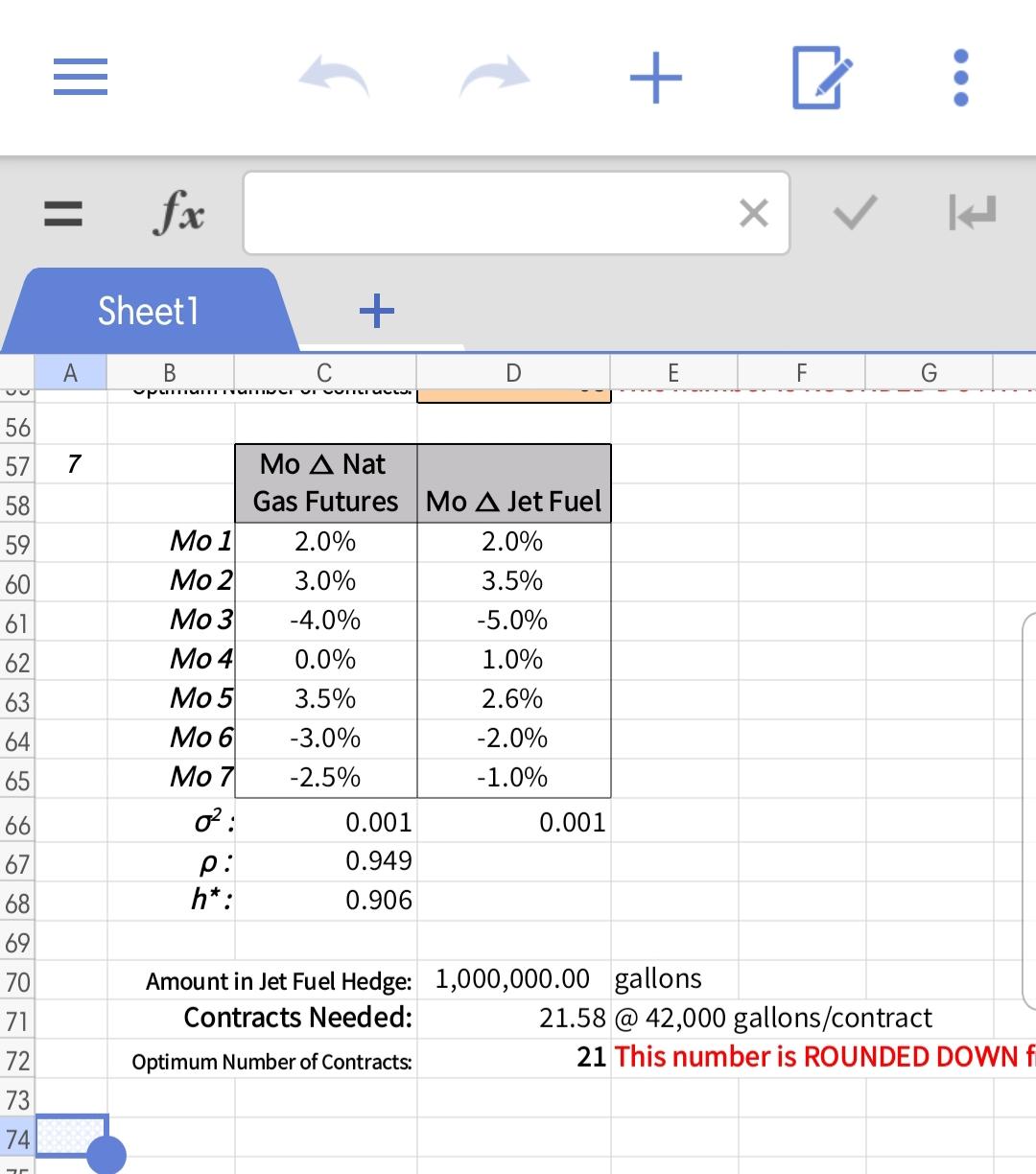

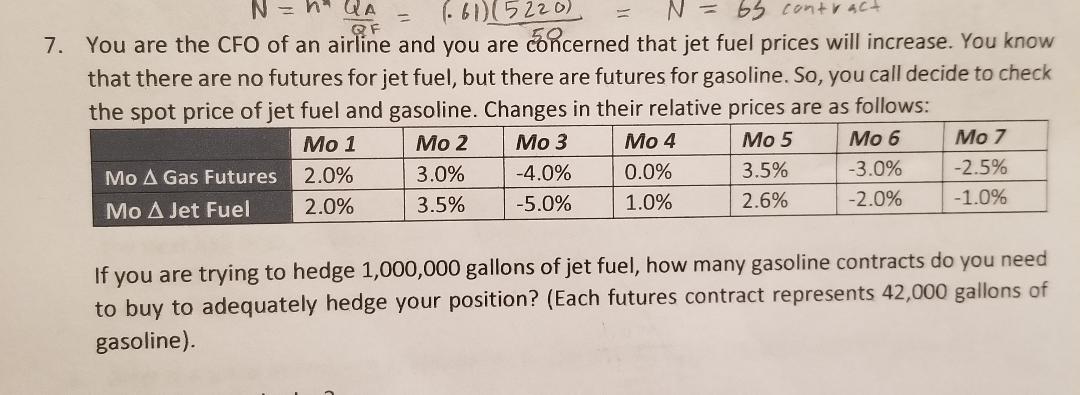

Question: Hi I am stuck with this problems 7... I have the answer in EXCEL it's in RED but I have no idea on how to

Hi I am stuck with this problems 7...

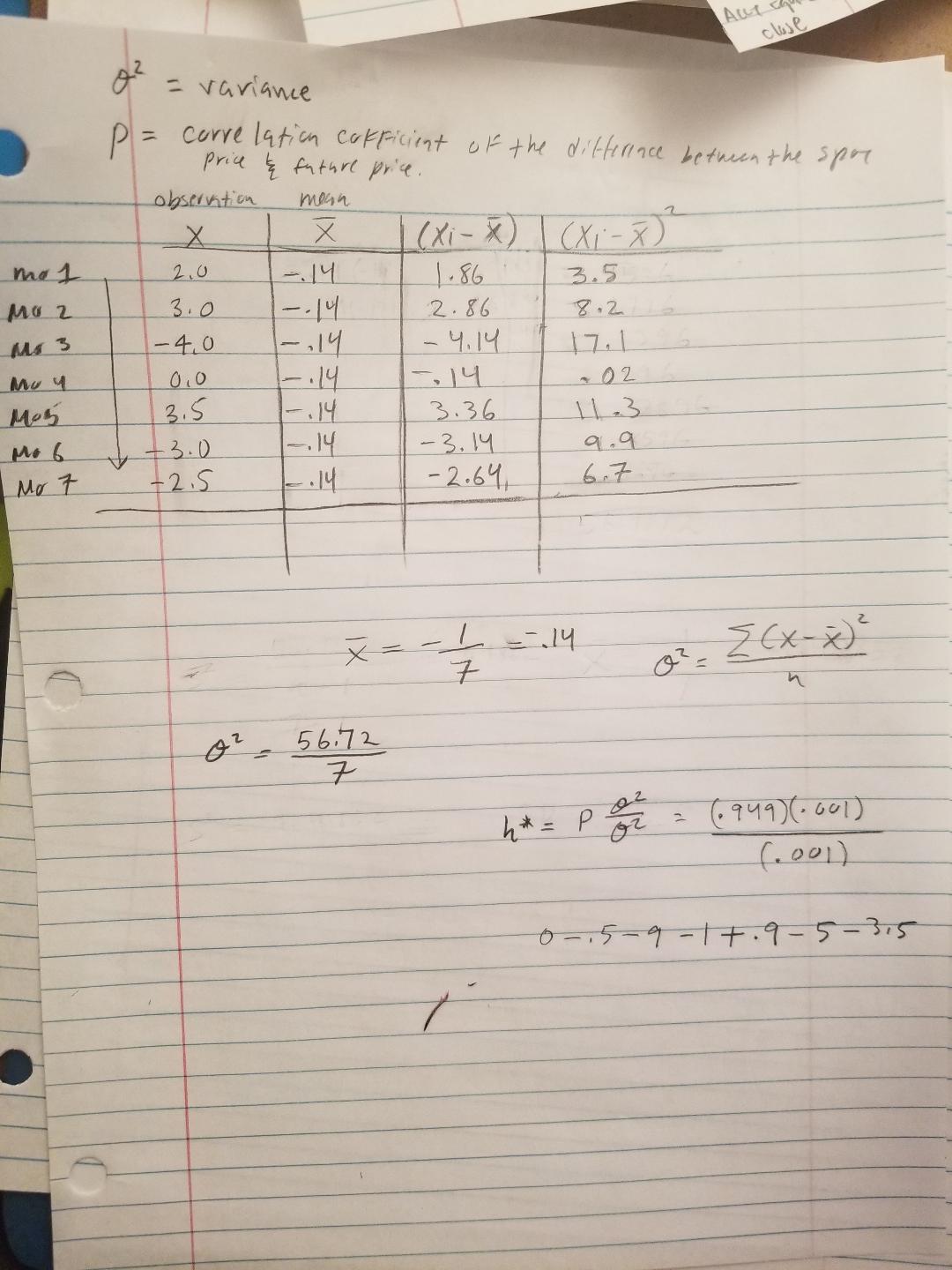

I have the answer in EXCEL it's in RED but I have no idea on how to do it on paper as you see I tried doing so down below.

Can someone please explain to me how you can calculate the variance, and the correlation coefficient which is that "p" symbol also how you can calculate the "h*" and finally how u get the 21 optimum number of contracts.

the answers are given below I just dont understand how Variance = .001 , .001

p = 0.949 and H* = .906

PLEASE DO NOT USE EXCEL I NEED IT ON PAPER STEP BY STEP like how I did it on my own paper.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock