Question: Hi; I do not understand why the tutor indicates that the beta of lodging is the minimum when I see that it has the highest

Hi;

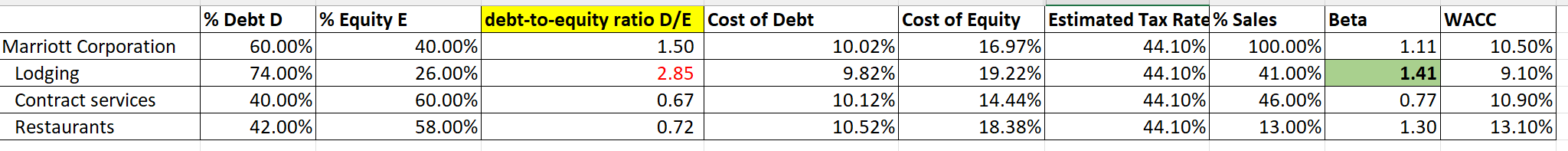

I do not understand why the tutor indicates that the beta of lodging is the minimum when I see that it has the highest value in the following table, in green:

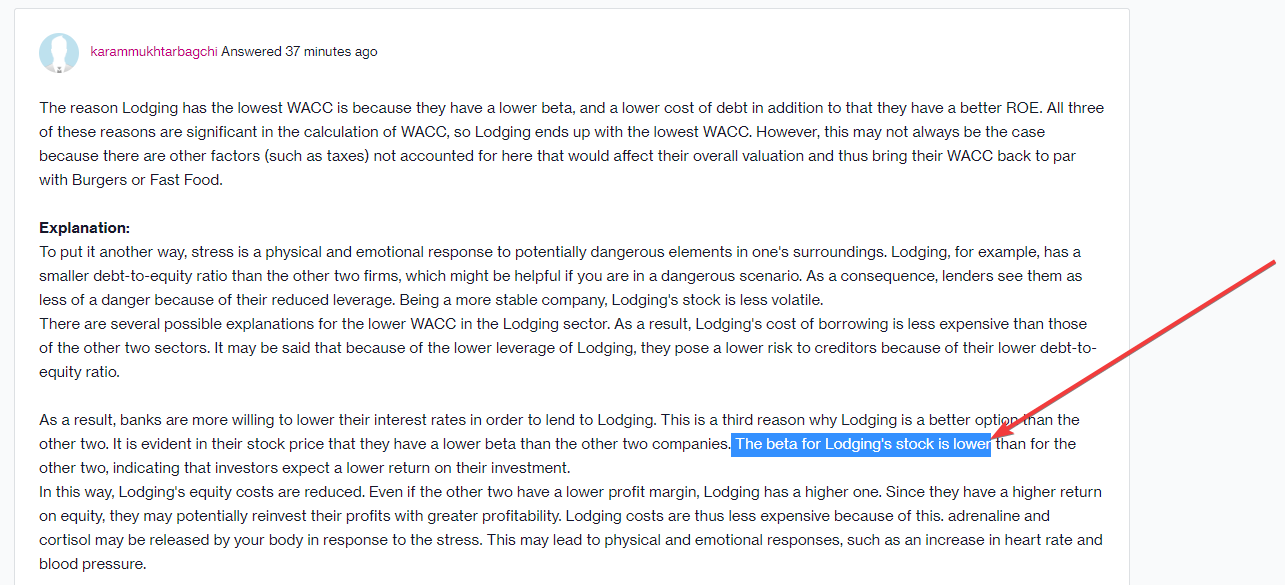

% Debt D % Equity E debt-to-equity ratio D/E Cost of Debt Cost of Equity Estimated Tax Rate% Sales Beta WACC Marriott Corporation 60.00% 40.00% 1.50 10.02% 16.97% 44.10% 100.00% 1.11 10.50% Lodging 74.00% 26.00% 2.85 9.82% 19.22% 44.10% 41.00% 1.41 9.10% 40.00% 60.00% 0.67 10.12% 14.44% 44.10% 46.00% 0.77 10.90% Contract services 42.00% 58.00% 10.52% 18.38% 44.10% 13.00% 1.30 13.10% Restaurants 0.72karammukhtarbagchi Answered 37 minutes ago The reason Lodging has the lowest WACC is because they have a lower beta, and a lower cost of debt in addition to that they have a better ROE. All three of these reasons are significant in the calculation of WACC, so Lodging ends up with the lowest WACC. However, this may not always be the case because there are other factors (such as taxes) not accounted for here that would affect their overall valuation and thus bring their WACC back to par with Burgers or Fast Food. Explanation: To put it another way, stress is a physical and emotional response to potentially dangerous elements in one's surroundings. Lodging, for example, has a smaller debt-to-equity ratio than the other two firms, which might be helpful if you are in a dangerous scenario. As a consequence, lenders see them as less of a danger because of their reduced leverage. Being a more stable company, Lodging's stock is less volatile. There are several possible explanations for the lower WACC in the Lodging sector. As a result, Lodging's cost of borrowing is less expensive than those of the other two sectors. It may be said that because of the lower leverage of Lodging, they pose a lower risk to creditors because of their lower debt-to- equity ratio. As a result, banks are more willing to lower their interest rates in order to lend to Lodging. This is a third reason why Lodging is a better option than the other two. It is evident in their stock price that they have a lower beta than the other two companies. The beta for Lodging's stock is lower than for the other two, indicating that investors expect a lower return on their investment. In this way, Lodging's equity costs are reduced. Even if the other two have a lower profit margin, Lodging has a higher one. Since they have a higher return on equity, they may potentially reinvest their profits with greater profitability. Lodging costs are thus less expensive because of this. adrenaline and cortisol may be released by your body in response to the stress. This may lead to physical and emotional responses, such as an increase in heart rate and blood pressure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts