Question: Hi, I have trouble doing this finance tutorial question. Matlab is needed as it involves matrices. Suppose there are only two periods, period 0 and

Hi, I have trouble doing this finance tutorial question. Matlab is needed as it involves matrices.

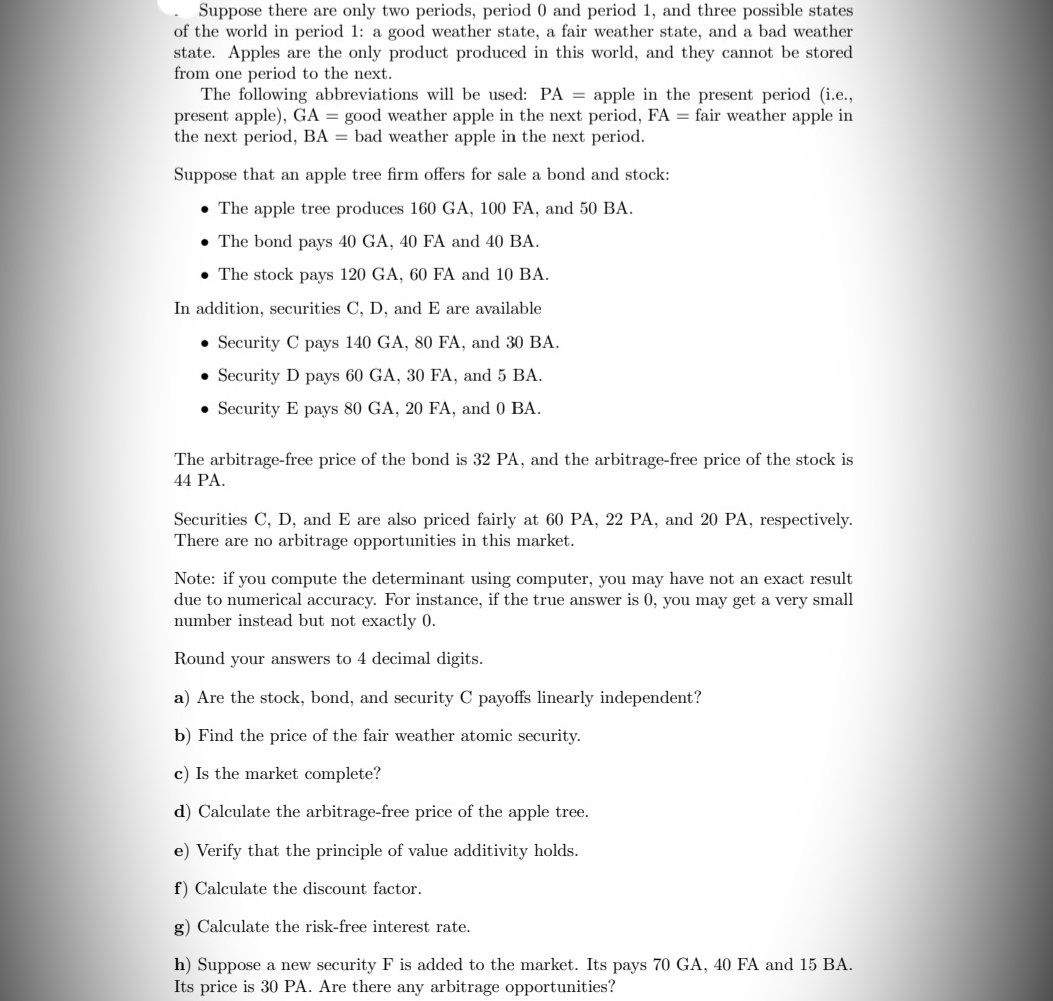

Suppose there are only two periods, period 0 and period 1, and three possible states of the world in period 1: a good weather state, a fair weather state, and a bad weather state. Apples are the only product produced in this world, and they cannot be stored from one period to the next. The following abbreviations will be used: PA = apple in the present period (i.e., present apple), GA = good weather apple in the next period, FA = fair weather apple in the next period, BA = bad weather apple in the next period. Suppose that an apple tree rm offers for sale a bond and stock: 0 The apple tree produces 160 GA, 100 FA, and 50 BA. o The bond pays 40 GA, 40 FA and 40 BA. . The stock pays 120 GA, 60 FA and 10 BA. In addition, securities 0, D, and E are available I Security C pays 140 GA, 80 FA, and 30 BA. . Security 13 pays 60 GA, 30 FA, and 5 BA. a Security E pays 80 GA, 20 FA, and 0 BA. The arbitrage-free price of the bond is 32 PA, and the arbitrage-free price of the stock is 44 PA. Securities C, D, and E are also priced fairly at 60 PA, 22 PA, and 20 PA, respectively. There are no arbitrage opportunities in this market. Note: if you compute the determinant using computer, you may have not an exact result due to numerical accuracy. For instance, if the true answer is 0, you may get a very small number instead but not exactly 0. Round your answers to 4 decimal digits. 3) Are the stock, bond, and security C payoffs linearly independent? b} Find the price of the fair weather atomic security. c} Is the market complete? d} Calculate the arbitrage-free price of the apple tree. 3) Verify that the principle of value additivity holds. f} Calculate the discount factor. 5) Calculate the risk-free interest rate. h} Suppose a newr security F is added to the market. Its pays 70 GA, 40 FA and 15 BA. I ' Its price is 30 PA. Are there any arbitrage opportunities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts