Question: Hi! I just need help with how they got the calculations in each section of the table for net property income. If someone could explain

Hi! I just need help with how they got the calculations in each section of the table for net property income. If someone could explain how they got this answer with the provided additional information, it would be greatly appreciated! thanks in advance

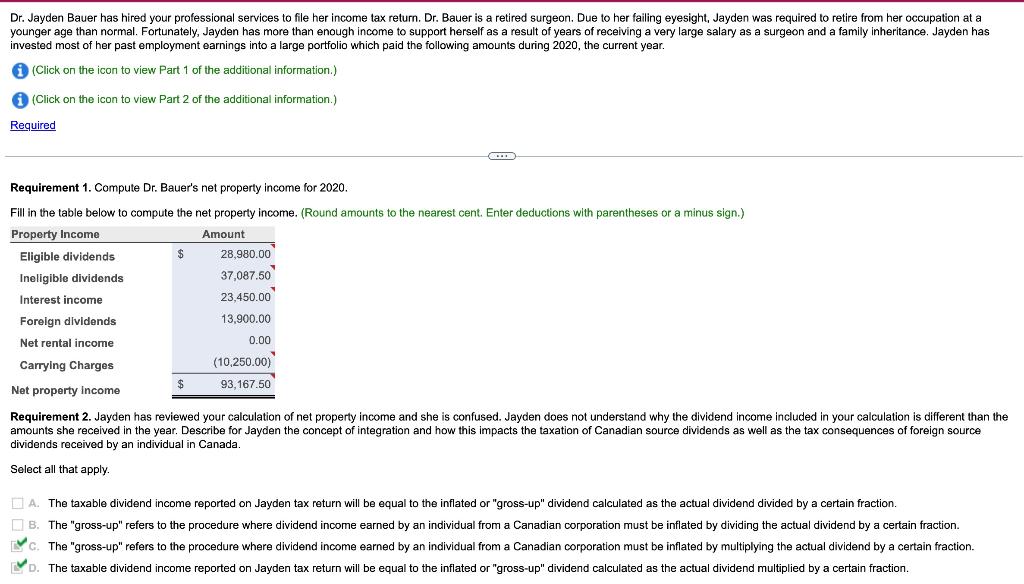

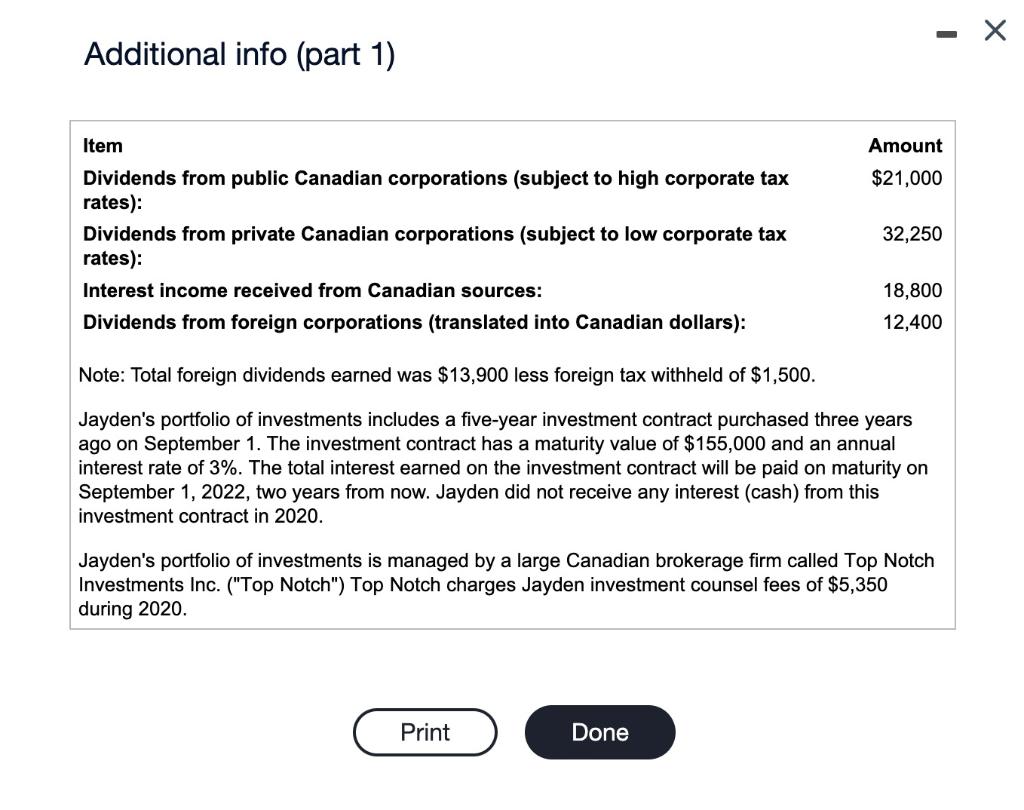

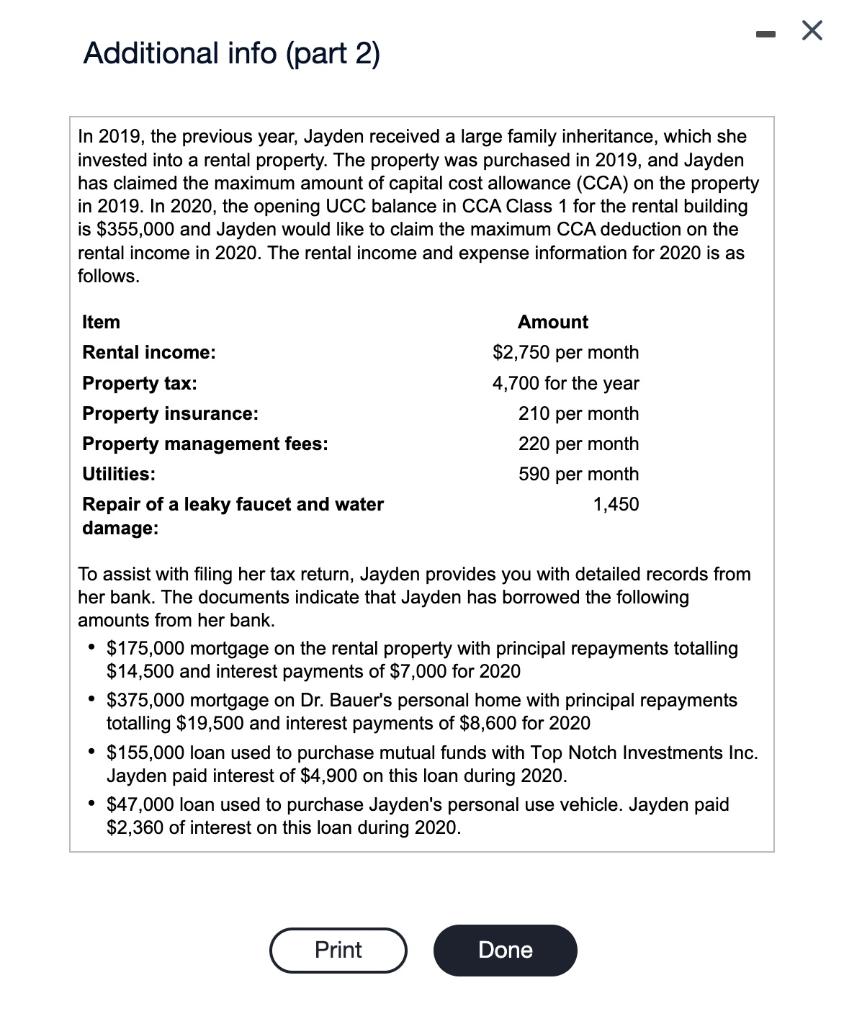

invested most of her past employment earnings into a large portfolio which paid the following amounts during 2020 , the current year. (Click on the icon to view Part 1 of the additional information.) (Click on the icon to view Part 2 of the additional information.) Requirement 1. Compute Dr. Bauer's net property income for 2020. Fill in the table below to compute the net property income. (Round amounts to the nearest cent. Enter deductions with parentheses or a minus sign.) dividends received by an individual in Canada. Select all that apply. Additional info (part 1) Additional info (part 2) In 2019, the previous year, Jayden received a large family inheritance, which she invested into a rental property. The property was purchased in 2019 , and Jayden has claimed the maximum amount of capital cost allowance (CCA) on the property in 2019. In 2020, the opening UCC balance in CCA Class 1 for the rental building is $355,000 and Jayden would like to claim the maximum CCA deduction on the rental income in 2020 . The rental income and expense information for 2020 is as follows. To assist with filing her tax return, Jayden provides you with detailed records from her bank. The documents indicate that Jayden has borrowed the following amounts from her bank. - $175,000 mortgage on the rental property with principal repayments totalling $14,500 and interest payments of $7,000 for 2020 - $375,000 mortgage on Dr. Bauer's personal home with principal repayments totalling $19,500 and interest payments of $8,600 for 2020 - $155,000 loan used to purchase mutual funds with Top Notch Investments Inc. Jayden paid interest of $4,900 on this loan during 2020. - $47,000 loan used to purchase Jayden's personal use vehicle. Jayden paid $2,360 of interest on this loan during 2020. invested most of her past employment earnings into a large portfolio which paid the following amounts during 2020 , the current year. (Click on the icon to view Part 1 of the additional information.) (Click on the icon to view Part 2 of the additional information.) Requirement 1. Compute Dr. Bauer's net property income for 2020. Fill in the table below to compute the net property income. (Round amounts to the nearest cent. Enter deductions with parentheses or a minus sign.) dividends received by an individual in Canada. Select all that apply. Additional info (part 1) Additional info (part 2) In 2019, the previous year, Jayden received a large family inheritance, which she invested into a rental property. The property was purchased in 2019 , and Jayden has claimed the maximum amount of capital cost allowance (CCA) on the property in 2019. In 2020, the opening UCC balance in CCA Class 1 for the rental building is $355,000 and Jayden would like to claim the maximum CCA deduction on the rental income in 2020 . The rental income and expense information for 2020 is as follows. To assist with filing her tax return, Jayden provides you with detailed records from her bank. The documents indicate that Jayden has borrowed the following amounts from her bank. - $175,000 mortgage on the rental property with principal repayments totalling $14,500 and interest payments of $7,000 for 2020 - $375,000 mortgage on Dr. Bauer's personal home with principal repayments totalling $19,500 and interest payments of $8,600 for 2020 - $155,000 loan used to purchase mutual funds with Top Notch Investments Inc. Jayden paid interest of $4,900 on this loan during 2020. - $47,000 loan used to purchase Jayden's personal use vehicle. Jayden paid $2,360 of interest on this loan during 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts