Question: Hi, I know this question has been asked already . Although with an answer , there isn't any explanation. I used the method of converting

Hi, I know this question has been asked already . Although with an answer , there isn't any explanation. I used the method of converting the 48 month to 4 years, and used 500 per month to 6,000 per annum . Which I found should be much easier to used a monthly based solution , and also because this question appears to be using the methods of calculating the annuity methods , so its natural for me to consider to use the annual based method.

Hi, I know this question has been asked already . Although with an answer , there isn't any explanation. I used the method of converting the 48 month to 4 years, and used 500 per month to 6,000 per annum . Which I found should be much easier to used a monthly based solution , and also because this question appears to be using the methods of calculating the annuity methods , so its natural for me to consider to use the annual based method.

The question I have is that , with the same figured, just different time base . The two methods should give the same result should they? But using the monthly method gives a larger result , and I don't understand why . Please tell me why .

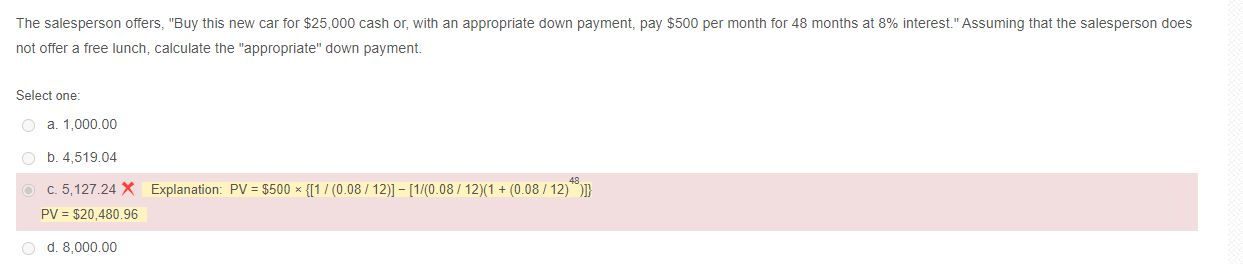

The salesperson offers, "Buy this new car for $25,000 cash or with an appropriate down payment, pay $500 per month for 48 months at 8% interest." Assuming that the salesperson does not offer a free lunch, calculate the "appropriate" down payment. Select one: O a. 1,000.00 b. 4,519.04 C. 5,127.24 X Explanation: PV = $500 * {[1/(0.08 / 12)] - [1/(0.08 / 12X(1 + (0.08 / 12))]} PV = $20,480.96 d. 8,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts