Question: Hi, I need a complete answer with proper explanation for the question down below: Question 2 John Ltd enters into a non-cancellable 5 year lease

Hi, I need a complete answer with proper explanation for the question down below:

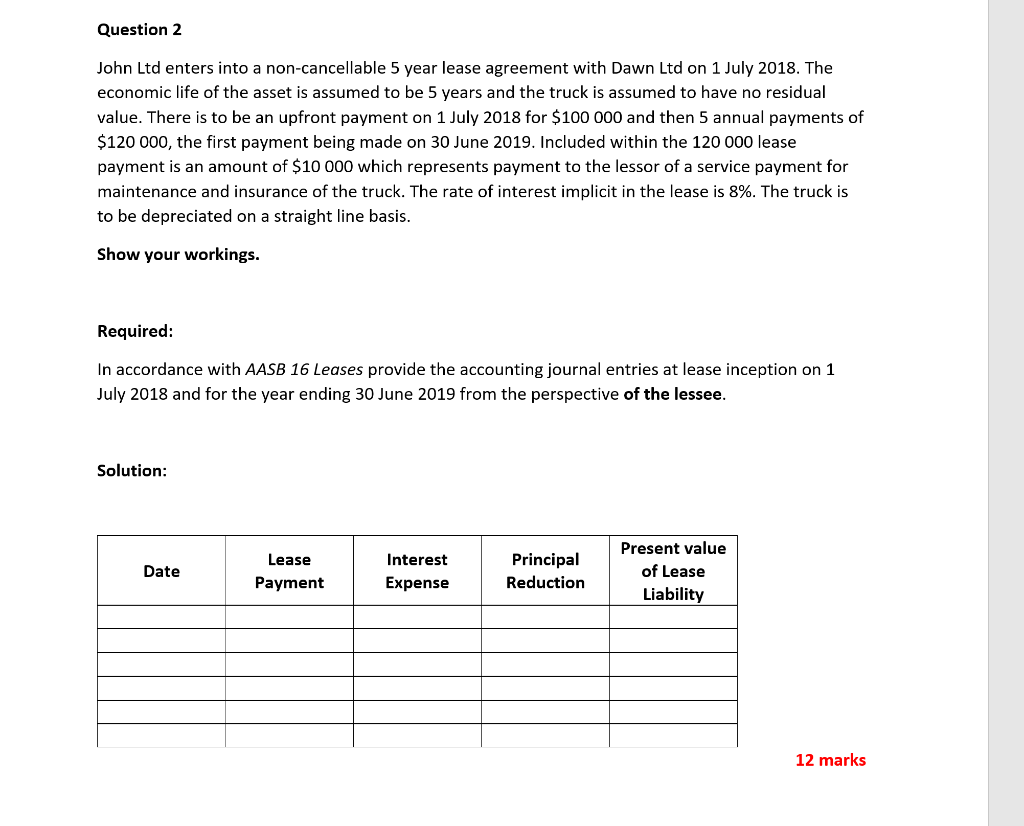

Question 2 John Ltd enters into a non-cancellable 5 year lease agreement with Dawn Ltd on 1 July 2018. The economic life of the asset is assumed to be 5 years and the truck is assumed to have no residual value. There is to be an upfront payment on 1 July 2018 for $100 000 and then 5 annual payments of $120 000, the first payment being made on 30 June 2019. Included within the 120 000 lease payment is an amount of $10 000 which represents payment to the lessor of a service payment for maintenance and insurance of the truck. The rate of interest implicit in the lease is 8%. The truck is to be depreciated on a straight line basis. Show your workings. Required: In accordance with AASB 16 Leases provide the accounting journal entries at lease inception on 1 July 2018 and for the year ending 30 June 2019 from the perspective of the lessee. Solution: Date Lease Payment Interest Expense Principal Reduction Present value of Lease Liability 12 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts