Question: Hi, I need a complete well-structured answer for the question below: Question 1 Project Cape is a research and development project. Summarised data relating to

Hi, I need a complete well-structured answer for the question below:

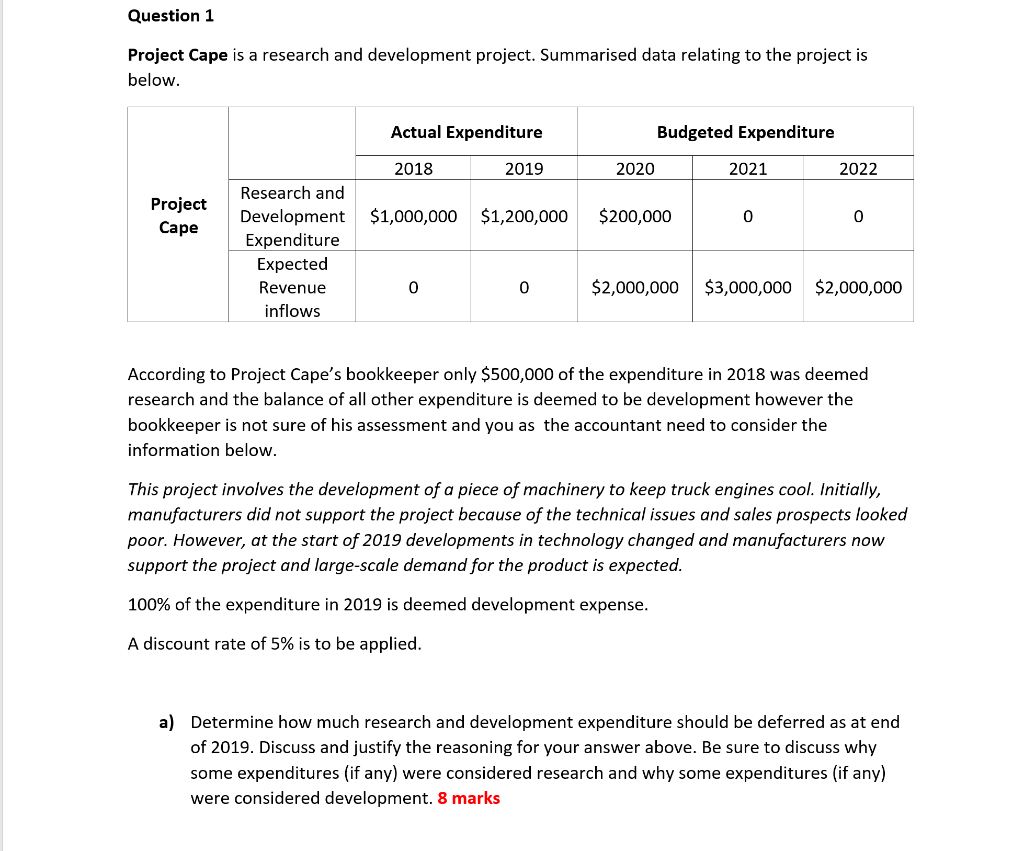

Question 1 Project Cape is a research and development project. Summarised data relating to the project is below. Actual Expenditure Budgeted Expenditure 2018 2019 2020 2021 2022 Project Cape $1,000,000 $1,200,000 $200,000 0 0 Research and Development Expenditure Expected Revenue inflows 0 0 $2,000,000 $3,000,000 $2,000,000 According to Project Cape's bookkeeper only $500,000 of the expenditure in 2018 was deemed research and the balance of all other expenditure is deemed to be development however the bookkeeper is not sure of his assessment and you as the accountant need to consider the information below. This project involves the development of a piece of machinery to keep truck engines cool. Initially, manufacturers did not support the project because of the technical issues and sales prospects looked poor. However, at the start of 2019 developments in technology changed and manufacturers now support the project and large-scale demand for the product is expected. 100% of the expenditure in 2019 is deemed development expense. A discount rate of 5% is to be applied. a) Determine how much research and development expenditure should be deferred as at end of 2019. Discuss and justify the reasoning for your answer above. Be sure to discuss why some expenditures (if any) were considered research and why some expenditures (if any) were considered development. 8 marks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts