Question: Hi, i need a detailed answer for this exercise. Return to question Problem 25-10 Valuing financial leases Acme has branched out to rentals of office

Hi, i need a detailed answer for this exercise.

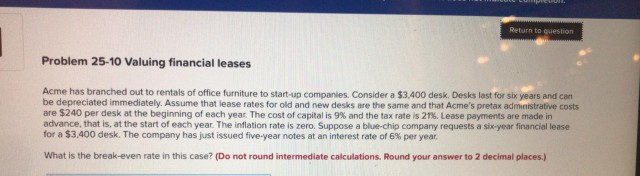

Return to question Problem 25-10 Valuing financial leases Acme has branched out to rentals of office furniture to start-up companies. Consider a $3.400 desk. Desks last for six years and can be depreciated immediately. Assume that lease rates for old and new desks are the same and that Acme's pretax administrative costs are $240 per desk at the beginning of each year. The cost of capital is 9% and the tax rate is 21%. Lease payments are made in advance, that is, at the start of each year. The inflation rate is zero. Suppose a blue-chip company requests a six-year financial lease for a $3.400 desk. The company has just issued five year notes at an interest rate of 6% per year. What is the break-even rate in this case? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Return to question Problem 25-10 Valuing financial leases Acme has branched out to rentals of office furniture to start-up companies. Consider a $3.400 desk. Desks last for six years and can be depreciated immediately. Assume that lease rates for old and new desks are the same and that Acme's pretax administrative costs are $240 per desk at the beginning of each year. The cost of capital is 9% and the tax rate is 21%. Lease payments are made in advance, that is, at the start of each year. The inflation rate is zero. Suppose a blue-chip company requests a six-year financial lease for a $3.400 desk. The company has just issued five year notes at an interest rate of 6% per year. What is the break-even rate in this case? (Do not round intermediate calculations. Round your answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts