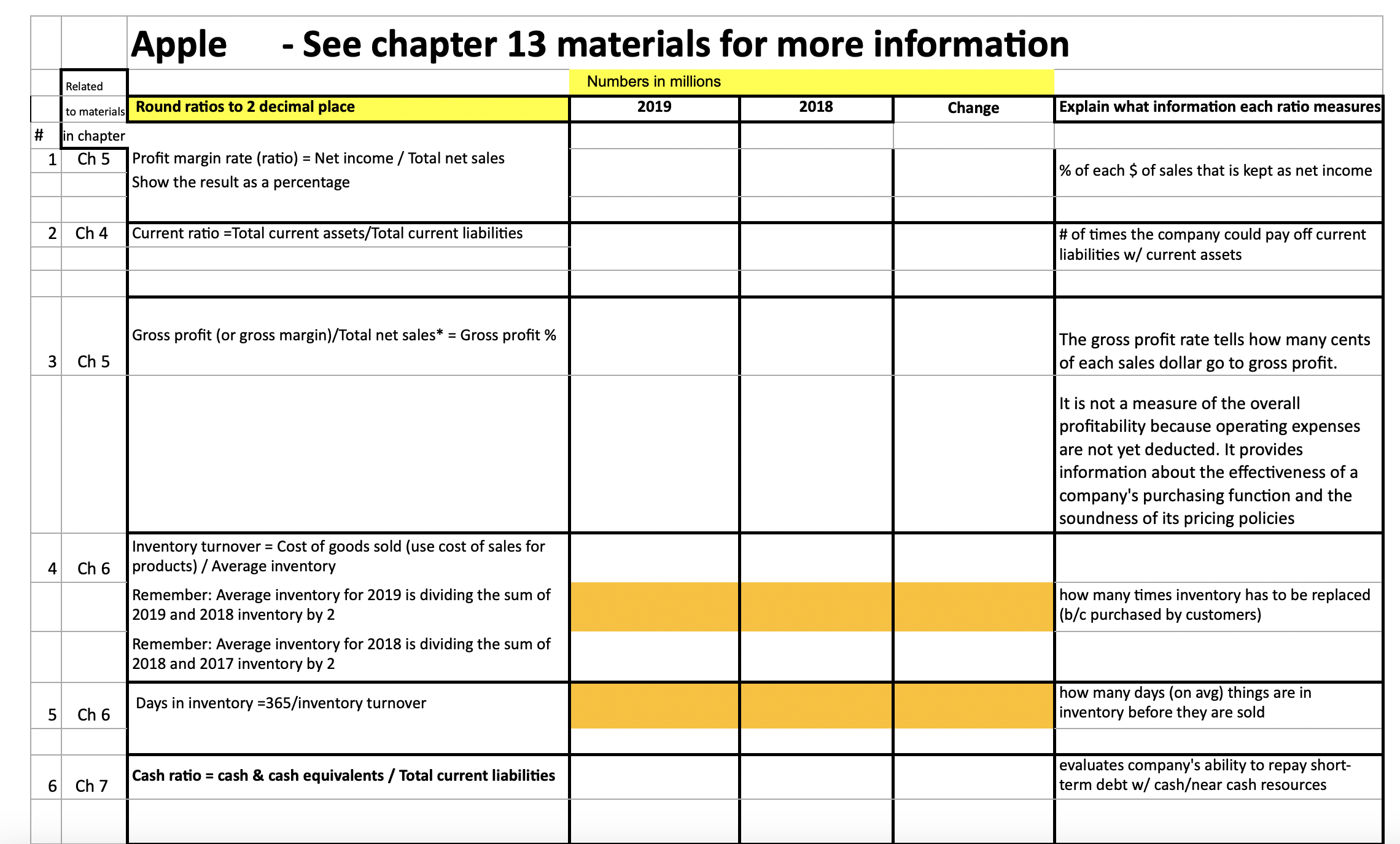

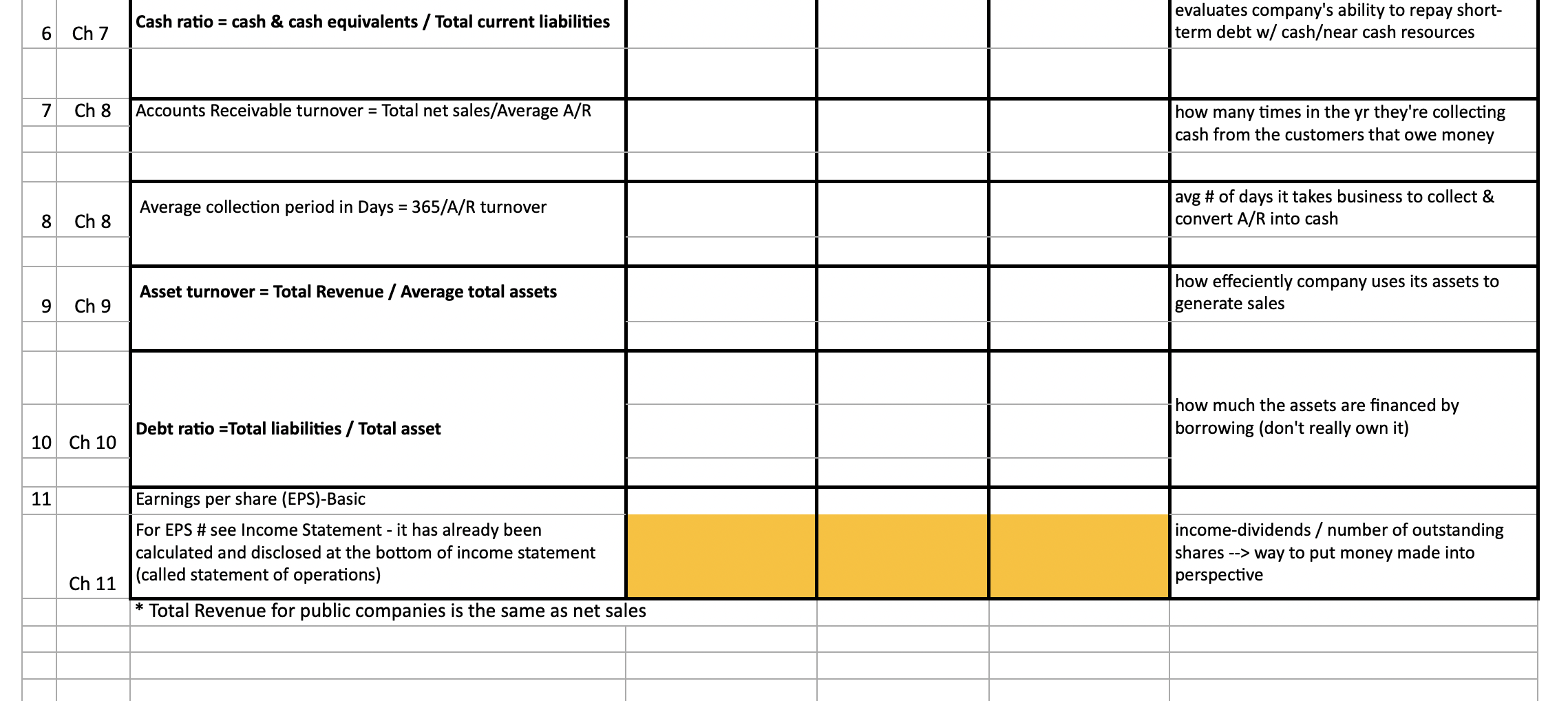

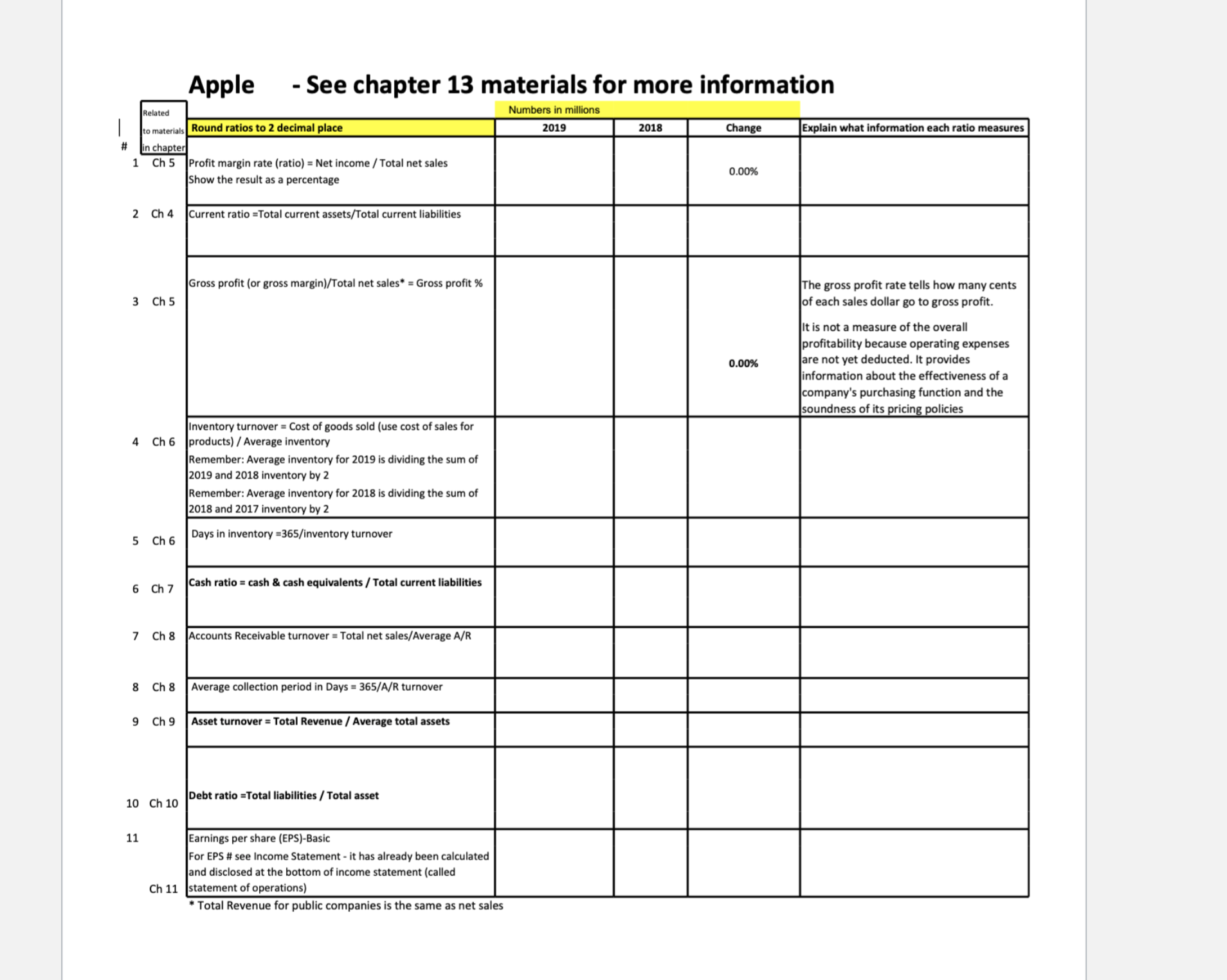

Question: Hi, I need help calculating the ratios on this Excel sheet, please also explain all the details of the calculations. For example, for each ratio

Hi, I need help calculating the ratios on this Excel sheet, please also explain all the details of the calculations. For example, for each ratio expain what numbers were used in the numerator and what numbers were used in the denominator.

here's the link to the excel sheet and a photo

https://drive.google.com/file/d/10Nn7KqLJ_Hzp7oy6AdvioaiUunA9HSmt/view?usp=sharing

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock