Question: Hi, I need help constructing a balance sheet as at 7 March 2023 for a trust as per current Australian Accounting Standards. The trust doesn't

Hi,

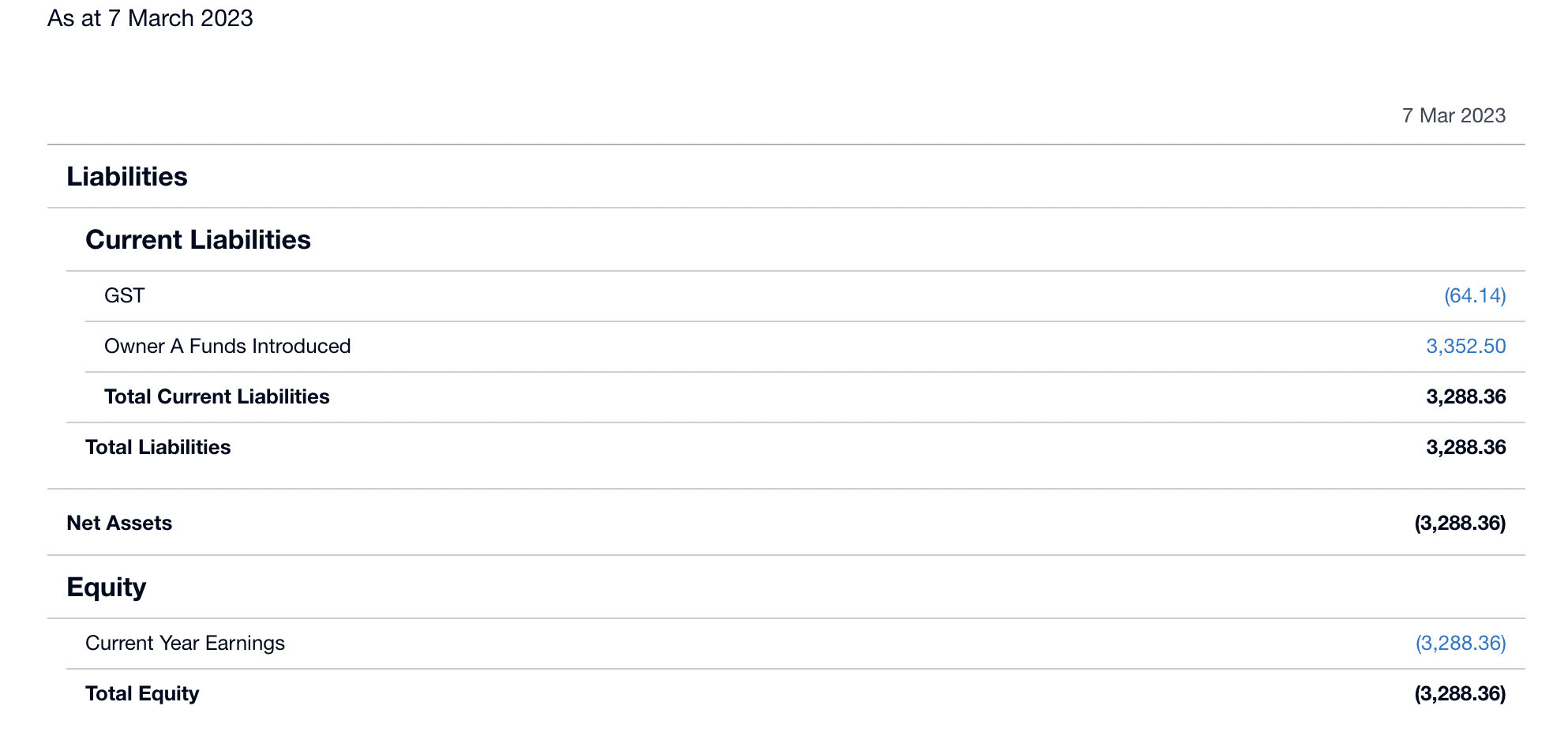

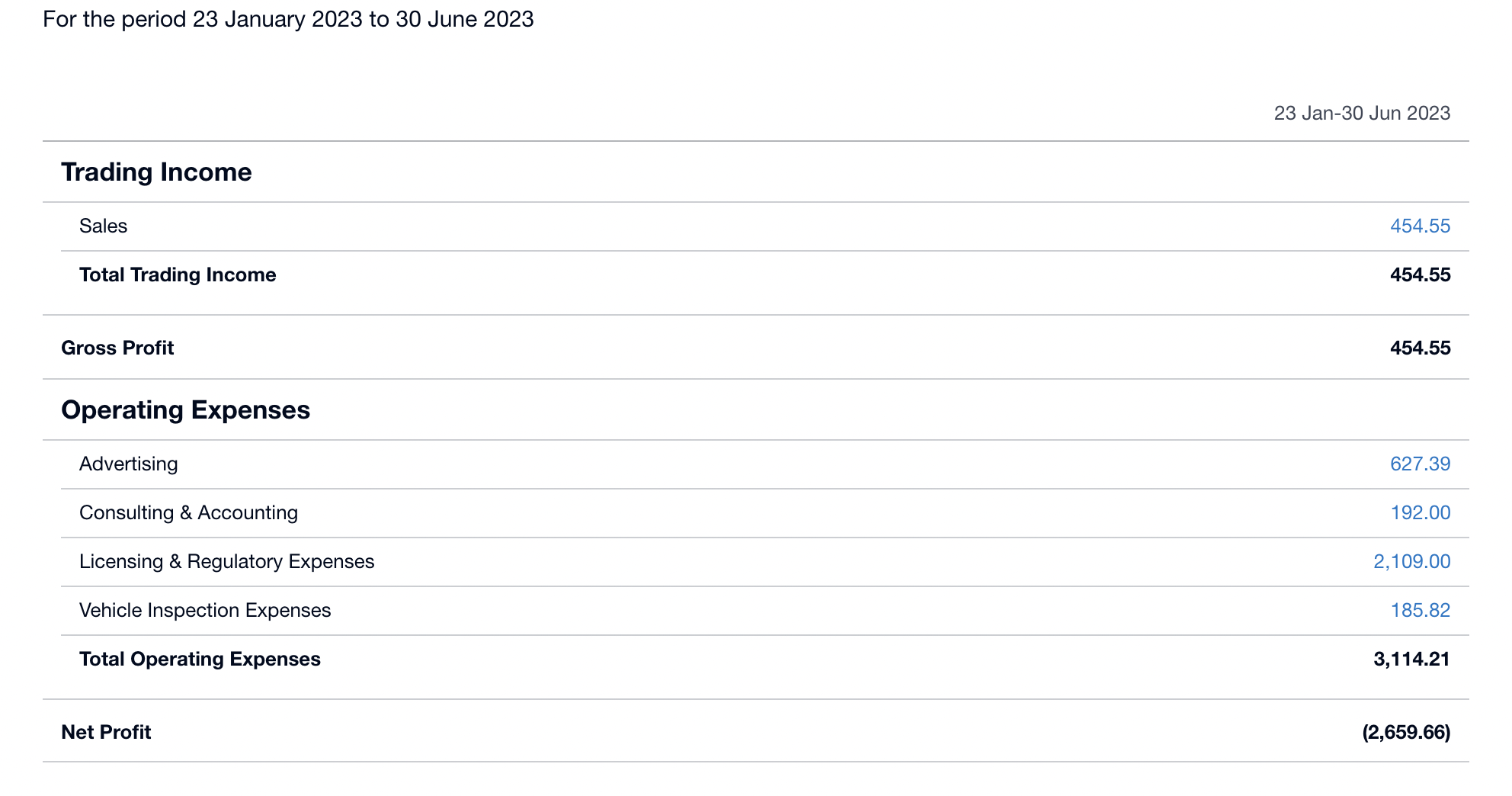

I need help constructing a balance sheet as at 7 March 2023 for a trust as per current Australian Accounting Standards. The trust doesn't trade and is entitled to 50% of a private company that does trade (and a different trust belonging to the second owner of the private company is entitled to the other 50%). The company and trust were both started in December 2022, therefore there is no prior financial history for both entities and the trust is a discretionary trust. The trust owes $556.75 in accountancy setup fees loaned by the trustee to open the trust and the settled sum during the setup of the trust was $10. No wages have been drawn as the trading company made a net loss and has met its obligations through owner contributions. I've attached the Balance Sheet as at 7 March 2023 as well as the Profit and Loss Statement for the period 23 January 2023 to 30 June 2023 for the company below.

I look forward to your response and please let me know whether any further information is required and, if so, the process for completing the balance sheet with the new information.

Thanks

As at 7 March 2023 7 Mar 2023 Liabilities Current Liabilities GST (64.14) Owner A Funds Introduced 3,352.50 Total Current Liabilities 3,288.36 Total Liabilities 3,288.36 Net Assets (3,288.36) Equity Current Year Earnings (3,288.36) Total Equity (3,288.36)For the period 23 January 2023 to 30 June 2023 23 Jan30 Jun 2023 Trading Income Sales 454.55 Total Trading Income 454.55 Gross Profit 454.55 Operating Expenses Advertising 627.39 Consulting & Accounting 192.00 Licensing & Regulatory Expenses 2,109.00 Vehicle Inspection Expenses 185.82 Total Operating Expenses 3,114.21 Net Prot (2,659.66)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts