Question: hi i need help on c to e Consider risk measures on the following 3 large cap stocks: Stock Beta (B) Berkshire Hathaway (BRK) Apple

hi i need help on c to e

hi i need help on c to e

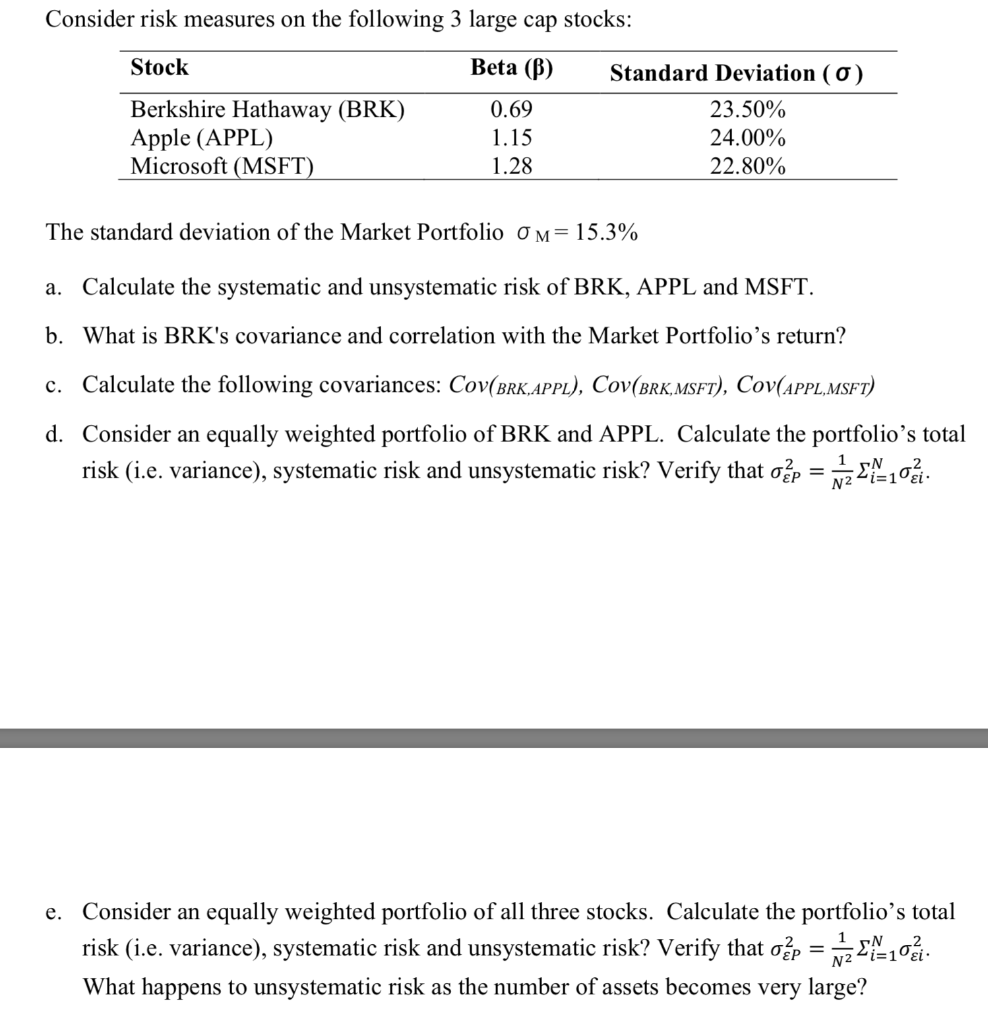

Consider risk measures on the following 3 large cap stocks: Stock Beta (B) Berkshire Hathaway (BRK) Apple (APPL) Microsoft (MSFT) 0.69 1.15 1.28 Standard Deviation (0) 23.50% 24.00% 22.80% The standard deviation of the Market Portfolio Om= 15.3% a. Calculate the systematic and unsystematic risk of BRK, APPL and MSFT. b. What is BRK's covariance and correlation with the Market Portfolio's return? c. Calculate the following covariances: Cov(BRK,APPL), Cov(BRK,MSFT), Cov(APPL,MSFT) d. Consider an equally weighted portfolio of BRK and APPL. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that op = w2E10. e. Consider an equally weighted portfolio of all three stocks. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that op = x2 Enc. What happens to unsystematic risk as the number of assets becomes very large? Consider risk measures on the following 3 large cap stocks: Stock Beta (B) Berkshire Hathaway (BRK) Apple (APPL) Microsoft (MSFT) 0.69 1.15 1.28 Standard Deviation (0) 23.50% 24.00% 22.80% The standard deviation of the Market Portfolio Om= 15.3% a. Calculate the systematic and unsystematic risk of BRK, APPL and MSFT. b. What is BRK's covariance and correlation with the Market Portfolio's return? c. Calculate the following covariances: Cov(BRK,APPL), Cov(BRK,MSFT), Cov(APPL,MSFT) d. Consider an equally weighted portfolio of BRK and APPL. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that op = w2E10. e. Consider an equally weighted portfolio of all three stocks. Calculate the portfolio's total risk (i.e. variance), systematic risk and unsystematic risk? Verify that op = x2 Enc. What happens to unsystematic risk as the number of assets becomes very large

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts