Question: Hi I need help on what is the answer to this problems? Below is the question and other concerns will be in the comment section

Hi I need help on what is the answer to this problems? Below is the question and other concerns will be in the comment section. I hope you can help me and surely I will give you full positive feedback

1.

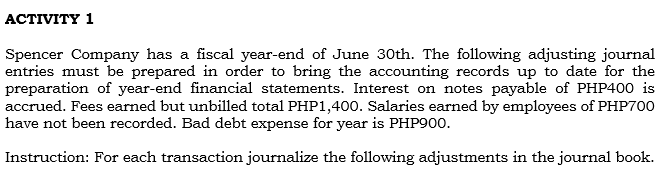

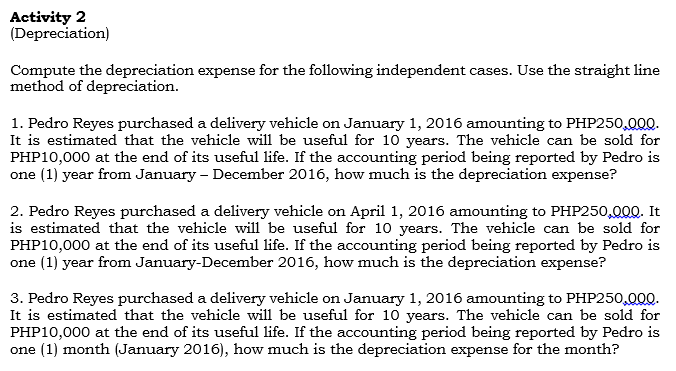

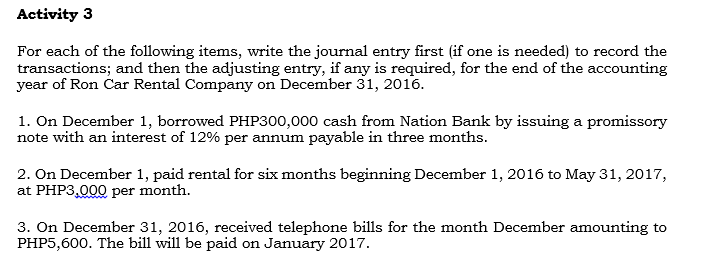

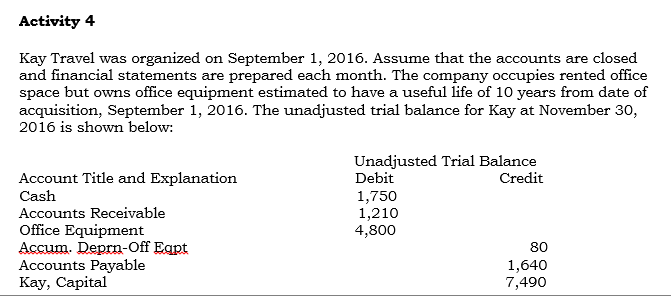

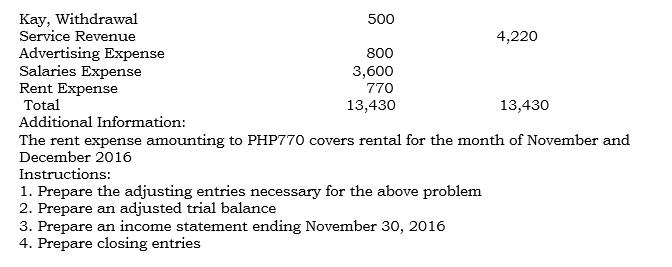

ACTIVITY 1 Spencer Company has a fiscal year-end of June 30th. The following adjusting journal entries must be prepared in order to bring the accounting records up to date for the preparation of year-end financial statements. Interest on notes payable of PHP400 is accrued. Fees earned but unbilled total PHP1,400. Salaries earned by employees of PHP700 have not been recorded. Bad debt expense for year is PHP900. Instruction: For each transaction journalize the following adjustments in the journal book.Activity 2 (Depreciation) Compute the depreciation expense for the following independent cases. Use the straight line method of depreciation. 1. Pedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,090. It is estimated that the vehicle will be useful for 10 years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) year from January - December 2016, how much is the depreciation expense? 2. Pedro Reyes purchased a delivery vehicle on April 1, 2016 amounting to PHP250,000. It is estimated that the vehicle will be useful for 10 years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) year from January-December 2016, how much is the depreciation expense? 3. Pedro Reyes purchased a delivery vehicle on January 1, 2016 amounting to PHP250,000. It is estimated that the vehicle will be useful for 10 years. The vehicle can be sold for PHP10,000 at the end of its useful life. If the accounting period being reported by Pedro is one (1) month (January 2016), how much is the depreciation expense for the month?Activity 3 For each of the following items, write the journal entry first (if one is needed) to record the transactions; and then the adjusting entry, if any is required, for the end of the accounting year of Ron Car Rental Company on December 31, 2016. 1. On December 1, borrowed PHP300,000 cash from Nation Bank by issuing a promissory note with an interest of 12% per annum payable in three months. 2. On December 1, paid rental for six months beginning December 1, 2016 to May 31, 2017, at PHP3,000 per month. 3. On December 31, 2016, received telephone bills for the month December amounting to PHP5,600. The bill will be paid on January 2017.Activity 4 Kay Travel was organized on September 1, 2016. Assume that the accounts are closed and financial statements are prepared each month. The company occupies rented office space but owns office equipment estimated to have a useful life of 10 years from date of acquisition, September 1, 2016. The unadjusted trial balance for Kay at November 30, 2016 is shown below: Unadjusted Trial Balance Account Title and Explanation Debit Credit Cash 1.750 Accounts Receivable 1,210 Office Equipment 4.800 Accum. Deprn-Off Eqpt 80 Accounts Payable 1,640 Kay, Capital 7,490Kay, Withdrawal 500 Service Revenue 4,220 Advertising Expense 800 Salaries Expense 3,600 Rent Expense 770 Total 13,430 13,430 Additional Information: The rent expense amounting to PHP770 covers rental for the month of November and December 2016 Instructions: 1. Prepare the adjusting entries necessary for the above problem 2. Prepare an adjusted trial balance 3. Prepare an income statement ending November 30, 2016 4. Prepare closing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts