Question: Hi! I need help solving requirements 1, 2, and 3. I provided the information necessary. Willa Manufacturing makes fashion products and competes on the basis

Hi!

I need help solving requirements 1, 2, and 3. I provided the information necessary.

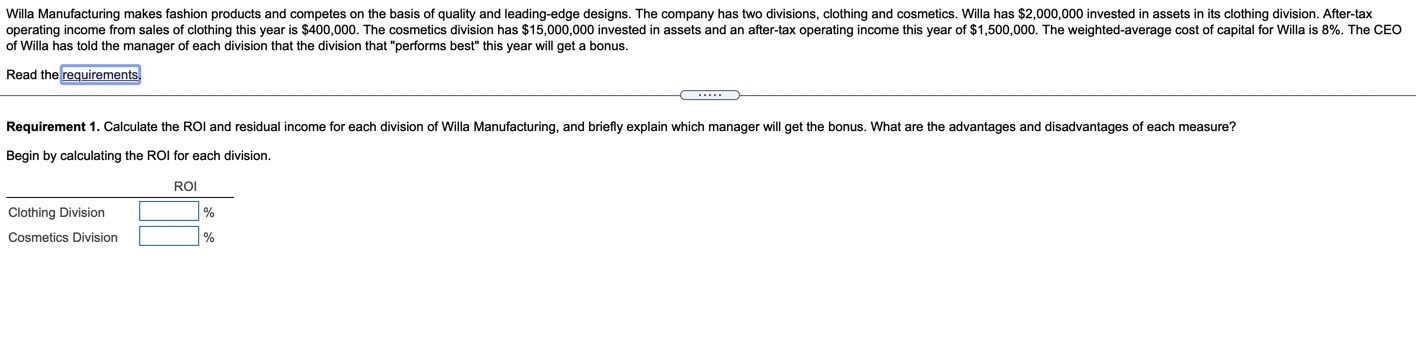

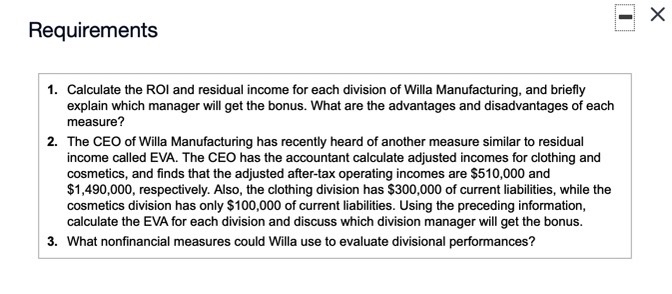

Willa Manufacturing makes fashion products and competes on the basis of quality and leading-edge designs. The company has two divisions, clothing and cosmetics. Willa has $2,000,000 invested in assets in its clothing division. After-tax operating income from sales of clothing this year is $400,000. The cosmetics division has $15,000,000 invested in assets and an after-tax operating income this year of $1,500,000. The weighted-average cost of capital for Willa is 8%. The CEO of Willa has told the manager of each division that the division that "performs best" this year will get a bonus. Read the requirements. Requirement 1. Calculate the ROI and residual income for each division of Willa Manufacturing, and briefly explain which manager will get the bonus. What are the advantages and disadvantages of each measure? Begin by calculating the ROI for each division. ROI Clothing Division % Cosmetics Division %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts