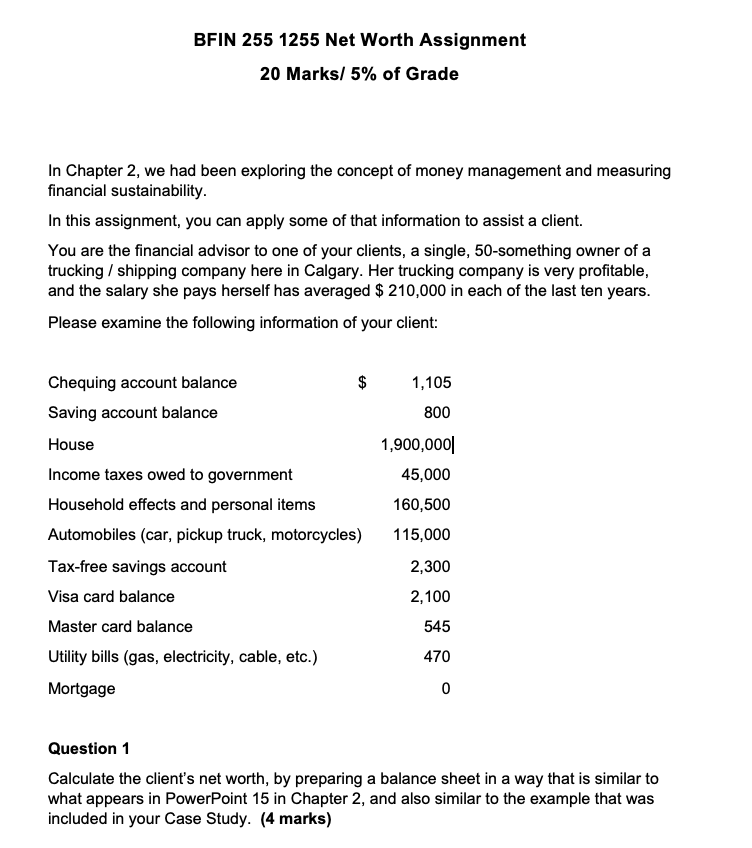

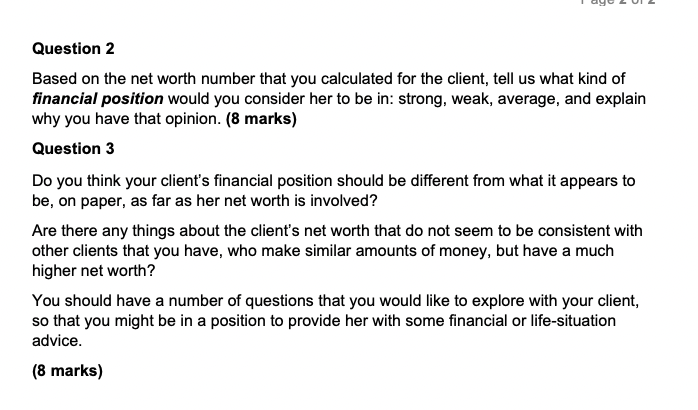

Question: Hi, i need help to answer the attached. BFIN 255 1255 Net Worth Assignment 20 Marksi 5% of Grade In Chapter 2, we had been

Hi, i need help to answer the attached.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock