Question: Hi, I need help with C6-2. My textbook does not give me any other information for the problem. For part a, how do I calculate

Hi, I need help with C6-2.

My textbook does not give me any other information for the problem.

For part a, how do I calculate for Judgments and claims? For vacation and sick leave? For pensions and opeb?

Then how do I calculate for the 10% for part b?

Thank you!!

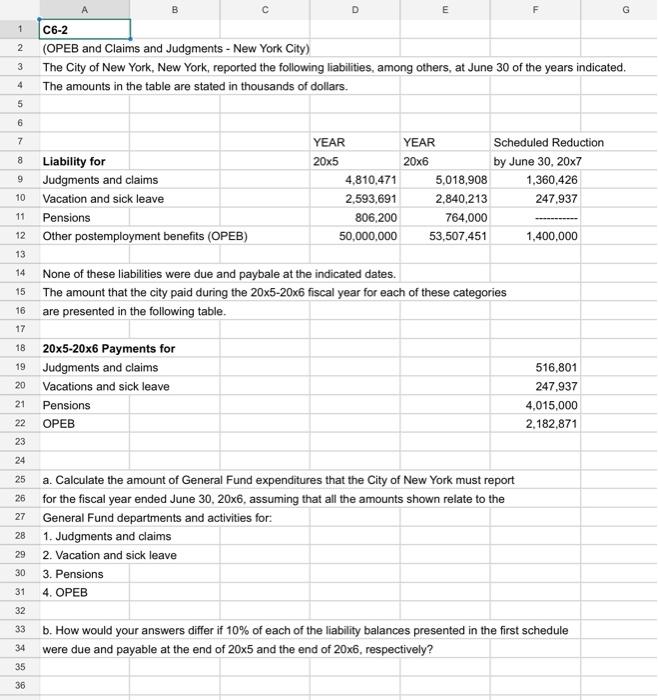

(OPEB and Claims and Judgments - New York City) 3 The City of New York, New York, reported the following liabilities, among others, at June 30 of the years indicated. The amounts in the table are stated in thousands of dollars. \begin{tabular}{|r|l|l|l|r|} \hline 5 & & & & \\ \hline 6 & & & & \\ \hline 7 & & YEAR & YEAR & Scheduled Reduction \\ \hline 8 & Liability for & 205 & 206 & by June 30,207 \\ \hline 9 & Judgments and claims & 4,810,471 & 5,018,908 & 1,360,426 \\ \hline 10 & Vacation and sick leave & 2,593,691 & 2,840,213 & 247,937 \\ \hline 11 & Pensions & 806,200 & 764,000 & \\ \hline 12 & Other postemployment benefits (OPEB) & 50,000,000 & 53,507,451 & 1,400,000 \\ \hline \end{tabular} None of these liabilities were due and paybale at the indicated dates. The amount that the city paid during the 205206 fiscal year for each of these categories are presented in the following table. a. Calculate the amount of General Fund expenditures that the City of New York must report for the fiscal year ended June 30,20x6, assuming that all the amounts shown relate to the General Fund departments and activities for: 1. Judgments and claims 2. Vacation and sick leave 3. Pensions 4. OPEB b. How would your answers differ if 10% of each of the liability balances presented in the first schedule were due and payable at the end of 205 and the end of 206, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts