Question: Hi! I need help with part C figuring out the balance of non-controlling interest at the end of year six. Thanks! Johannes Inc. acquired 80

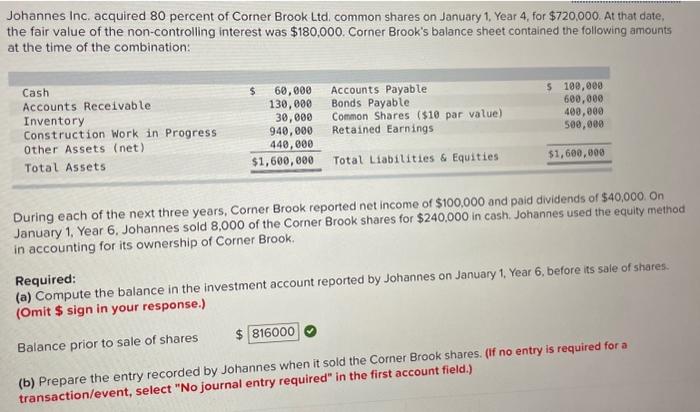

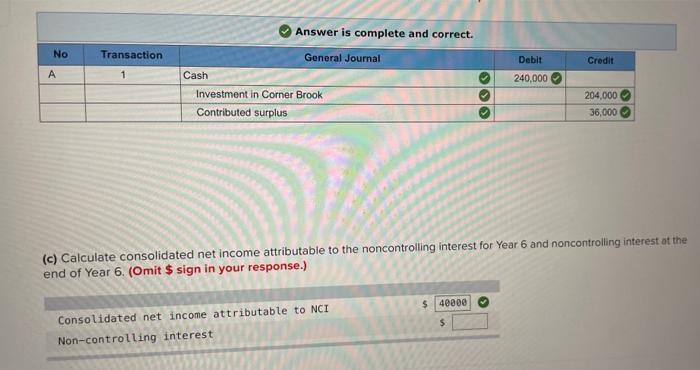

Johannes Inc. acquired 80 percent of Corner Brook Ltd, common shares on January 1, Year 4 , for $720,000. At that date, the fair value of the non-controlling interest was $180,000. Corner Brook's balance sheet contained the following amounts at the time of the combination: During each of the next three years, Corner Brook reported net income of $100,000 and paid dividends of $40,000. On January 1, Year 6. Johannes sold 8,000 of the Corner Brook shares for $240,000 in cash. Johannes used the equity method in accounting for its ownership of Corner Brook. (a) Compute the balance in the investment account reported by Johannes on January 1, Year 6 , before its sale of shares. Required: (Omit $ sign in your response.) Balance prior to sale of shares (b) Prepare the entry recorded by Johannes when it sold the Corner Brook shares. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Answer is complete and correct. (c) Calculate consolidated net income attributable to the noncontrolling interest for Year 6 and noncontrolling interest at the end of Year 6. (Omit $ sign in your response.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts