Question: Hi, i need help with quickbooks chapter 9 case problem 9-1 It would help me if you could please show me step by step with

Hi, i need help with quickbooks chapter 9 case problem 9-1

It would help me if you could please show me step by step with picture how to answer the entire question i only need the Journal.

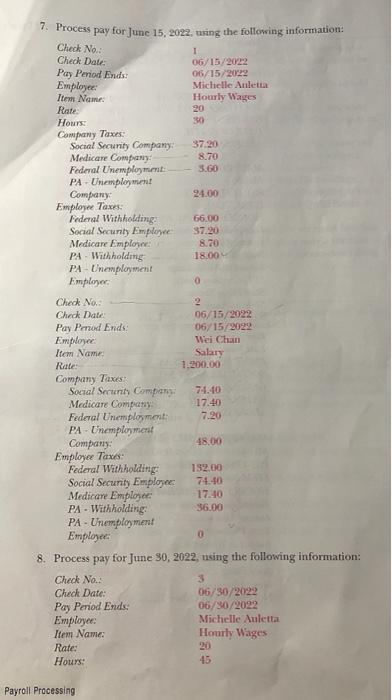

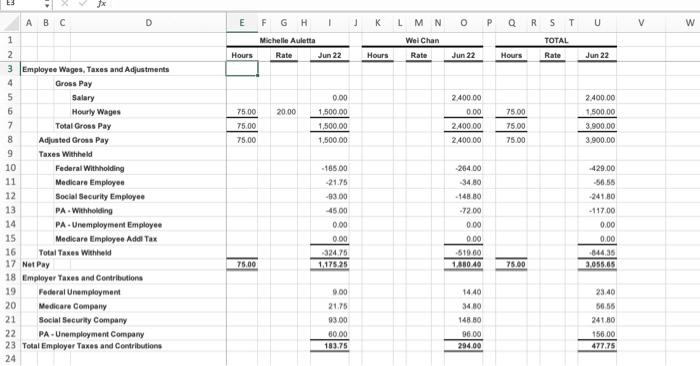

This is the Payroll Summary

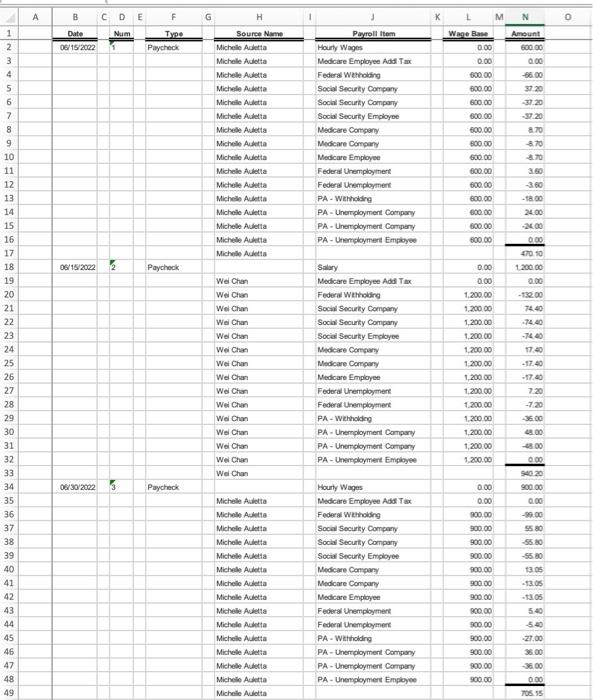

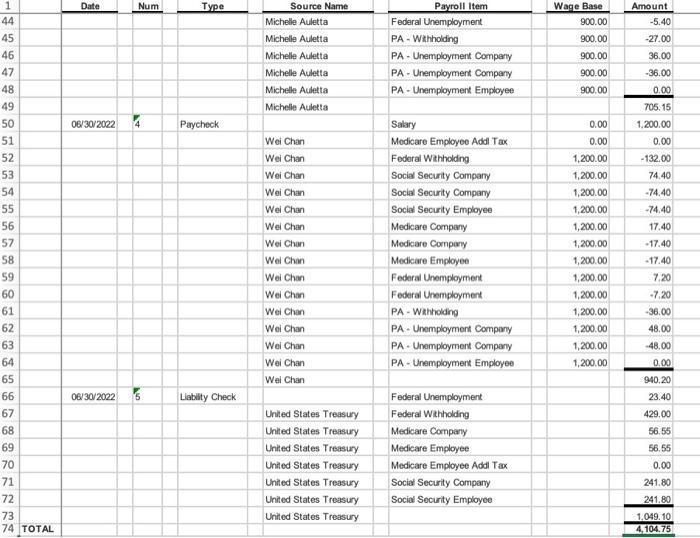

This is Payroll Transaction Detail

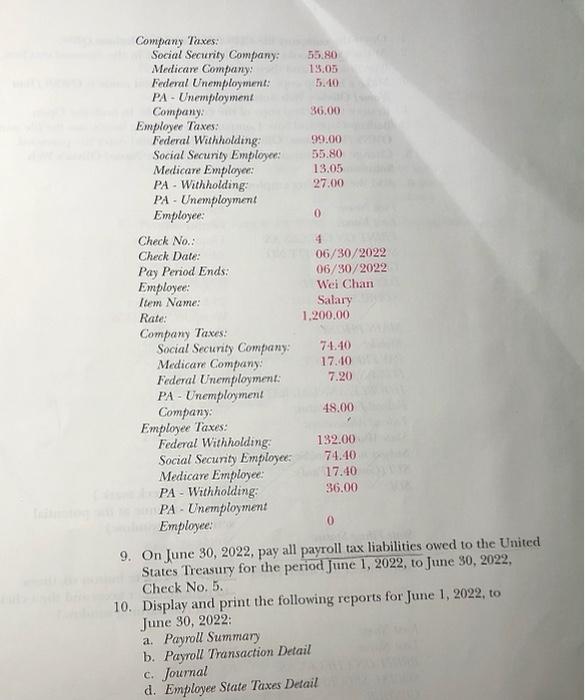

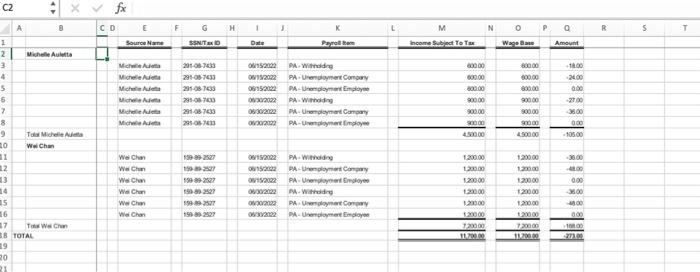

This is Employee State Taxes Detail

I just need the Journal those Transactions might help you to answer Journal

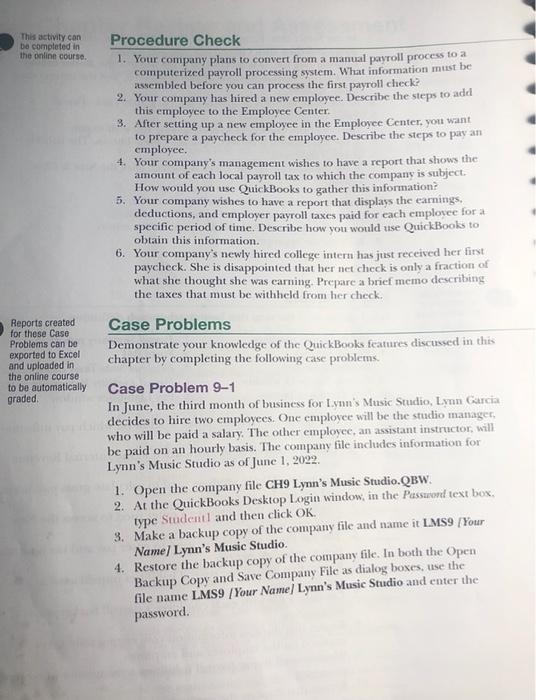

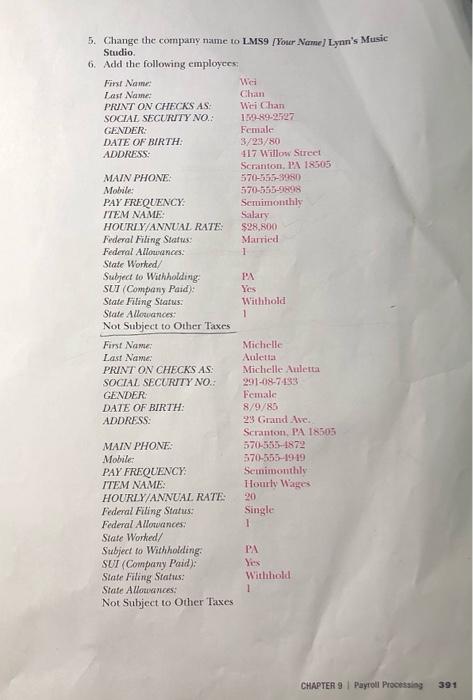

This activity con be completed in the online course Reports created for these caso Problems can be exported to Excel and uploaded in the online course to be automatically graded Procedure Check 1. Your company plans to convert from a manual payroll process to a computerized payroll processing system. What information must be assembled before you can process the first payroll check? 2. Your company has hired a new employee. Describe the steps to add this employee to the Employee Center 3. After setting up a new employee in the Employee Center, you want to prepare a paycheck for the employee. Describe the steps to pay an employee. 4. Your company's management wishes to have a report that shows the amount of cach local payroll tax to which the company is subject. How would you use QuickBooks to gather this information 5. Your company wishes to have a report that displays the earnings, deductions, and employer payroll taxes paid for each emplovee for at specific period of time. Describe how you would use QuickBooks to obtain this information 6. Your company's newly hired college inter has just received her first paycheck. She is disappointed that her net check is only a fraction of what she thought she was carning. Prepare a brief memo describing the taxes that must be withheld from her check Case Problems Demonstrate your knowledge of the QuickBooks features discussed in this chapter by completing the following case problems Case Problem 9-1 In June, the third month of business for Lynn's Music Studio, Lynn Garcia decides to hire two employees. One employee will be the studio manager, who will be paid a salary. The other employee, an assistant instructor, will be paid on an hourly basis. The company file includes information for Lynn's Music Studio as of June 1, 2022. 1. Open the company file CH9 Lynn's Music Studio.QBW. 2. At the QuickBooks Desktop Login window, in the Password text box, type Student and then click OK 3. Make a backup copy of the company file and name it LMS9 [Your Name) Lynn's Music Studio. 4. Restore the backup copy of the company file. In both the Open Backup Copy and Save Company File as dialog boxes, use the file name LMS9 /Your Name) Lynn's Music Studio and enter the password. 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio 6. Add the following employees First Name: We Last Name Chan PRINT ON CHECKS AS: Wei Chan SOCIAL SECURITY NO.: 109-89-9127 GENDER: Female DATE OF BIRTH: 3/23/80 ADDRESS: 417 Willow Street Scranton, PA 18505 MAIN PHONE: 570-555-98 Mobile: 570-5999 PAY FREQUENCY: Seruimonthly ITEM NAME: Salary HOURI Y/ANNUAL RATE: $28.800 Federal Filing Status. Married Federal Allows: 1 State Worked Subject to Withholding PA SUT (Company Pard): Yes State Filling Status Withhold Stale Allowances 1 Not Subject to Other Taxes First Name: Michelle Last Name Auleta PRINT ON CHECKS AS: Michelle Auletta SOCIAL SECURITY NO.: 291-08-7433 GENDER Female DATE OF BIRTH: 8/9/85 ADDRESS: 23 Grand Ave Scranton, PA 18505 MAIN PHONE: 570-555-1872 Mobile 570-555-1919 PAY FREQUENCY: Semnimonthly ITEM NAME: Hourly Wages HOURLY/ANNUAL RATE: 20 Federal Filing Status Single Federal Allowances: 1 State Worked/ Subject to Withholding: SUI (Company Paid): Yes State Filing Status: Withhold State Allowances: 1 Not Subject to Other Taxes CHAPTER 9 Payroll Processing 391 7. Process pay for June 15, 2022, turing the following information: Check No: 1 Check Date: 06/15/2022 Pay Period Ends: 06/15/20/22 Employer: Michelle Auletta Item Name: Hourly Wages Rate. 20 Hours: 30 Company Taxes: Social Security Company 3720 Medicare Company 8.70 Federal Unemployment 3.60 PA - Unemployment Company 24.00 Employee Taxes: Federal Withholding 66.00 Social Secundy Employee $7.20 Medicare Employee 8.70 PA Withholding 18.00 PA - Unemployment Employer 0 Check No. 2 Check Date: 06/15/2022 Pay Prod Ends 06/15 22029 Employee Wei Chan Item Name Salary Rate: 1.200,00 Company Taxes Social Security Compan 74.10 Medicare Company 17.40 Federal Unemployment 7.20 PA - Unemployment Company 48.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee 74.-10 Medicare Employee 17.10 PA - Withholding 36.00 PA - Unemployment Employer 0 8. Process pay for June 30, 2022, using the following information: Check No: Check Date: 06/30/2029 Pay Period Ends: 06/30/2022 Employee Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 Payroll Processing Company Taxes: Social Security Company: 55.80 Medicare Company: 13.05 Federal Unemployment 5.10 PA - Unemployment Company: 36.00 Employee Taxes: Federal Withholding 99.00 Social Security Employees 55.80 Medicare Employee: 13.05 PA - Withholding: 27.00 PA - Unemployment Employee: 0 Check No.: 4 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Wei Chan Item Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company 74.10 Medicare Company: 17.10 Federal Unemployment 7.20 PA - Unemployment Company: 48.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee: 74.10 Medicare Employee 17.40 PA - Withholding 36.00 PA - Unemployment Employee: 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022 a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail E K L M N O P Q R S T U V w F G H 1 Michelle Auletta Rate Jun 22 Wel Chan TOTAL Rate Hours Hours Rate Jun 22 Hours Jun 22 NMN 0.00 20.00 75 00 75.00 1,500.00 1,500.00 1,500.00 2.400.00 0.00 2.400.00 2.400.00 75 00 75.00 2.400.00 1,500.00 3.900.00 3,900.00 75.00 75.00 ABC D 1 2 3 Employee Wages, Taxes and Adjustments 4 Gross Pay 5 Salary 6 Hourly Wages 7 Total Gross Pay 8 Adjusted Gross Pay 9 Taxes Withheld 10 Federal Withholding 11 Medicare Employee 12 Social Security Employee 13 PA. Withholding 14 PA.Unemployment Employee 15 Medicare Employee Adidl Tox 16 Total Taxes Withheld 17 Net Pay 18 Employer Taxes and Contributions 19 Federal Unemployment 20 Medicare Company 21 Social Security Company 22 PA.Unemployment Company 23 Total Employer Taxes and Contributions 24 -185.00 21.75 -9300 45.00 0.00 0.00 324.75 1.17525 264.00 -3480 -448.80 -72.00 0.00 000 -429.00 -56.55 241 30 -117.00 0.00 0.00 044 35 3.055.65 -519.00 1.880.40 75.00 75.00 9.00 21.75 93.00 60.00 183.75 14.40 34.80 148.80 96.00 294.00 23.40 5656 241.80 156.00 477.75 A B C D E F G H Date Num 1 2 Type Paycheck 06/15/2002 1 Source Name Michelle Aletta Michelle Auletta Michele Auletta Michele Auletta Michele Auletta Michele Auletta Michelle Auletta Michelle Aletta Michelle Auletta Michele Auletta Michelle Aletta Michelle Auletta Michelle Auletta Michele Auletta Michele Auletta Michelle de Amount 600.00 0.00 86.00 3720 37.20 M Ware Base 0.00 0.00 600.00 600.00 600.00 800.00 500.00 800.00 600.00 Payroll Item Hounty Wages Medicare Employee Add Tax Federal Wahholding Social Security Company Social Security Company Social Security Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA - Wholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 8.70 8.70 2.70 3.60 800.00 600.00 3.60 600.00 800.00 600.00 500.00 200 000 470.90 06/15/2002 Paycheck 0.00 1.200.00 0.00 -132.00 74.40 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Wel Chan Wel Chan Wel Chan Wel Chan Wel Chan Wel Chan Wei Chan Wel Chan Wal Chan Wei Chen Wal Chan Wei Chan Wel Chan We Chan Wal Chan Salary Medicare Employee Add Tax Federw Wholding Social Security Company Social Security Company Social Securty Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 0.00 1.200,00 1.200,00 1.200.00 1.200.00 1.200.00 1.200,00 1.200.00 1.200,00 1.200.00 1.200,00 1.200,00 1,200.00 1,200.00 -7440 17.40 -17.40 - 17.40 720 -720 36.00 48.00 8.00 0.00 540.20 900.00 08/30/2002 3 Paycheck 0.00 0.00 0.00 900.00 900.00 900.00 900.00 900.00 5580 55.80 Hounty Wages Medicare Employee Add Tax Federal Whing Social Security Company Social Security Company Social Securty Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 13.06 13.05 Michelle Auletta Michelle Auletta Michele Auletta Michelle Auletta Michelle Atta Michele Auletta Michelle Aletta Michelle Auletta Michele Auletta Michele Auletta Michelle Auletta Michelle Auletta Michelle Auletta Michelle Aletta Michelle Aulietta 900.00 900.00 13.05 5.40 800.00 900.00 900.00 900.00 900.00 27.00 38.00 36.00 000 900.00 TOS. 15 Date Num Type Amount -5.40 Source Name Michelle Auletta Michelle Auletta Michelle Auletta Michelle Auletta Michelle Auletta Payroll Item Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee Wage Base 900.00 900.00 900.00 900.00 900.00 Michelle Auletta 06/30/2022 4 Paycheck 0.00 0.00 Wei Chan Wel Chan Wei Chan 1 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 TOTAL Wei Chan -27.00 36.00 -36.00 0.00 705.15 1,200.00 0.00 -132.00 74.40 -74.40 - 74.40 17.40 -17.40 -17.40 7.20 -7.20 -36.00 48.00 Salary Medicare Employee Add Tax Federal Withholding Social Security Company Social Security Company Social Security Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Wahholding PA - Unemployment Company PA. Unemployment Company PA - Unemployment Employee Wei Chan Wel Chan Wei Chan Wel Chan Wel Chan Wel Chan Wel Chan 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 Wei Chan Wel Chan Wel Chan Wel Chan 48.00 0.00 - 940.20 23.40 06/30/2022 5 Liability Check United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury Federal Unemployment Federal Withholding Medicare Company Medicare Employee Medicare Employee Add Tax Social Security Company Social Security Employee 429.00 56.55 56.55 0.00 241.80 241.80 1.049.10 4, 104.75 C2 CD H M N 0 0 R S T E Source Name SSNITED Date Income Subject TOT Wagene 11.00 10000 300.00 2400 0:00 Michele Michele A Michelle Michael MA Miche 2010 295-07233 205-08 7630 29-0100 231-087033 29-013 52022 PAW W12022 PA-Urody Combay 06952022 PA-reglement 2002 PA Wing 03/30/2002 Prelomart Company 20 PA-Ursynet til 00000 90000 100.00 900.00 900.00 20000 900.00 900.00 000 -2700 3800 000 10500 450000 1 2 Mich Aula 3 4 5 6 7 8 To Michelle Alle 20 Ww Chan 21 22 23 14 15 36 17 To Watch 38 TOTAL 39 20 21 1599227 Wa Cha Wa Cha Wa Cha 1200.00 120.00 120000 000 192022 PA Wading PA-Urepertowy 152022 PA Uinnert Solye 2002 Witry PAUCowy Per Employee 1999 2027 2527 199297527 1992127 Wachu 1 200.00 12.00 120000 2000 120000 000 720000 100 Ww Che Wa Chan 120000 2000 720000 000 EEN 2710 This activity con be completed in the online course Reports created for these caso Problems can be exported to Excel and uploaded in the online course to be automatically graded Procedure Check 1. Your company plans to convert from a manual payroll process to a computerized payroll processing system. What information must be assembled before you can process the first payroll check? 2. Your company has hired a new employee. Describe the steps to add this employee to the Employee Center 3. After setting up a new employee in the Employee Center, you want to prepare a paycheck for the employee. Describe the steps to pay an employee. 4. Your company's management wishes to have a report that shows the amount of cach local payroll tax to which the company is subject. How would you use QuickBooks to gather this information 5. Your company wishes to have a report that displays the earnings, deductions, and employer payroll taxes paid for each emplovee for at specific period of time. Describe how you would use QuickBooks to obtain this information 6. Your company's newly hired college inter has just received her first paycheck. She is disappointed that her net check is only a fraction of what she thought she was carning. Prepare a brief memo describing the taxes that must be withheld from her check Case Problems Demonstrate your knowledge of the QuickBooks features discussed in this chapter by completing the following case problems Case Problem 9-1 In June, the third month of business for Lynn's Music Studio, Lynn Garcia decides to hire two employees. One employee will be the studio manager, who will be paid a salary. The other employee, an assistant instructor, will be paid on an hourly basis. The company file includes information for Lynn's Music Studio as of June 1, 2022. 1. Open the company file CH9 Lynn's Music Studio.QBW. 2. At the QuickBooks Desktop Login window, in the Password text box, type Student and then click OK 3. Make a backup copy of the company file and name it LMS9 [Your Name) Lynn's Music Studio. 4. Restore the backup copy of the company file. In both the Open Backup Copy and Save Company File as dialog boxes, use the file name LMS9 /Your Name) Lynn's Music Studio and enter the password. 5. Change the company name to LMS9 [Your Name] Lynn's Music Studio 6. Add the following employees First Name: We Last Name Chan PRINT ON CHECKS AS: Wei Chan SOCIAL SECURITY NO.: 109-89-9127 GENDER: Female DATE OF BIRTH: 3/23/80 ADDRESS: 417 Willow Street Scranton, PA 18505 MAIN PHONE: 570-555-98 Mobile: 570-5999 PAY FREQUENCY: Seruimonthly ITEM NAME: Salary HOURI Y/ANNUAL RATE: $28.800 Federal Filing Status. Married Federal Allows: 1 State Worked Subject to Withholding PA SUT (Company Pard): Yes State Filling Status Withhold Stale Allowances 1 Not Subject to Other Taxes First Name: Michelle Last Name Auleta PRINT ON CHECKS AS: Michelle Auletta SOCIAL SECURITY NO.: 291-08-7433 GENDER Female DATE OF BIRTH: 8/9/85 ADDRESS: 23 Grand Ave Scranton, PA 18505 MAIN PHONE: 570-555-1872 Mobile 570-555-1919 PAY FREQUENCY: Semnimonthly ITEM NAME: Hourly Wages HOURLY/ANNUAL RATE: 20 Federal Filing Status Single Federal Allowances: 1 State Worked/ Subject to Withholding: SUI (Company Paid): Yes State Filing Status: Withhold State Allowances: 1 Not Subject to Other Taxes CHAPTER 9 Payroll Processing 391 7. Process pay for June 15, 2022, turing the following information: Check No: 1 Check Date: 06/15/2022 Pay Period Ends: 06/15/20/22 Employer: Michelle Auletta Item Name: Hourly Wages Rate. 20 Hours: 30 Company Taxes: Social Security Company 3720 Medicare Company 8.70 Federal Unemployment 3.60 PA - Unemployment Company 24.00 Employee Taxes: Federal Withholding 66.00 Social Secundy Employee $7.20 Medicare Employee 8.70 PA Withholding 18.00 PA - Unemployment Employer 0 Check No. 2 Check Date: 06/15/2022 Pay Prod Ends 06/15 22029 Employee Wei Chan Item Name Salary Rate: 1.200,00 Company Taxes Social Security Compan 74.10 Medicare Company 17.40 Federal Unemployment 7.20 PA - Unemployment Company 48.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee 74.-10 Medicare Employee 17.10 PA - Withholding 36.00 PA - Unemployment Employer 0 8. Process pay for June 30, 2022, using the following information: Check No: Check Date: 06/30/2029 Pay Period Ends: 06/30/2022 Employee Michelle Auletta Item Name: Hourly Wages Rate: 20 Hours: 45 Payroll Processing Company Taxes: Social Security Company: 55.80 Medicare Company: 13.05 Federal Unemployment 5.10 PA - Unemployment Company: 36.00 Employee Taxes: Federal Withholding 99.00 Social Security Employees 55.80 Medicare Employee: 13.05 PA - Withholding: 27.00 PA - Unemployment Employee: 0 Check No.: 4 Check Date: 06/30/2022 Pay Period Ends: 06/30/2022 Employee: Wei Chan Item Name: Salary Rate: 1.200,00 Company Taxes: Social Security Company 74.10 Medicare Company: 17.10 Federal Unemployment 7.20 PA - Unemployment Company: 48.00 Employee Taxes: Federal Withholding 132.00 Social Security Employee: 74.10 Medicare Employee 17.40 PA - Withholding 36.00 PA - Unemployment Employee: 0 9. On June 30, 2022, pay all payroll tax liabilities owed to the United States Treasury for the period June 1, 2022, to June 30, 2022, Check No. 5. 10. Display and print the following reports for June 1, 2022, to June 30, 2022 a. Payroll Summary b. Payroll Transaction Detail c. Journal d. Employee State Taxes Detail E K L M N O P Q R S T U V w F G H 1 Michelle Auletta Rate Jun 22 Wel Chan TOTAL Rate Hours Hours Rate Jun 22 Hours Jun 22 NMN 0.00 20.00 75 00 75.00 1,500.00 1,500.00 1,500.00 2.400.00 0.00 2.400.00 2.400.00 75 00 75.00 2.400.00 1,500.00 3.900.00 3,900.00 75.00 75.00 ABC D 1 2 3 Employee Wages, Taxes and Adjustments 4 Gross Pay 5 Salary 6 Hourly Wages 7 Total Gross Pay 8 Adjusted Gross Pay 9 Taxes Withheld 10 Federal Withholding 11 Medicare Employee 12 Social Security Employee 13 PA. Withholding 14 PA.Unemployment Employee 15 Medicare Employee Adidl Tox 16 Total Taxes Withheld 17 Net Pay 18 Employer Taxes and Contributions 19 Federal Unemployment 20 Medicare Company 21 Social Security Company 22 PA.Unemployment Company 23 Total Employer Taxes and Contributions 24 -185.00 21.75 -9300 45.00 0.00 0.00 324.75 1.17525 264.00 -3480 -448.80 -72.00 0.00 000 -429.00 -56.55 241 30 -117.00 0.00 0.00 044 35 3.055.65 -519.00 1.880.40 75.00 75.00 9.00 21.75 93.00 60.00 183.75 14.40 34.80 148.80 96.00 294.00 23.40 5656 241.80 156.00 477.75 A B C D E F G H Date Num 1 2 Type Paycheck 06/15/2002 1 Source Name Michelle Aletta Michelle Auletta Michele Auletta Michele Auletta Michele Auletta Michele Auletta Michelle Auletta Michelle Aletta Michelle Auletta Michele Auletta Michelle Aletta Michelle Auletta Michelle Auletta Michele Auletta Michele Auletta Michelle de Amount 600.00 0.00 86.00 3720 37.20 M Ware Base 0.00 0.00 600.00 600.00 600.00 800.00 500.00 800.00 600.00 Payroll Item Hounty Wages Medicare Employee Add Tax Federal Wahholding Social Security Company Social Security Company Social Security Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA - Wholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 8.70 8.70 2.70 3.60 800.00 600.00 3.60 600.00 800.00 600.00 500.00 200 000 470.90 06/15/2002 Paycheck 0.00 1.200.00 0.00 -132.00 74.40 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 Wel Chan Wel Chan Wel Chan Wel Chan Wel Chan Wel Chan Wei Chan Wel Chan Wal Chan Wei Chen Wal Chan Wei Chan Wel Chan We Chan Wal Chan Salary Medicare Employee Add Tax Federw Wholding Social Security Company Social Security Company Social Securty Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 0.00 1.200,00 1.200,00 1.200.00 1.200.00 1.200.00 1.200,00 1.200.00 1.200,00 1.200.00 1.200,00 1.200,00 1,200.00 1,200.00 -7440 17.40 -17.40 - 17.40 720 -720 36.00 48.00 8.00 0.00 540.20 900.00 08/30/2002 3 Paycheck 0.00 0.00 0.00 900.00 900.00 900.00 900.00 900.00 5580 55.80 Hounty Wages Medicare Employee Add Tax Federal Whing Social Security Company Social Security Company Social Securty Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee 13.06 13.05 Michelle Auletta Michelle Auletta Michele Auletta Michelle Auletta Michelle Atta Michele Auletta Michelle Aletta Michelle Auletta Michele Auletta Michele Auletta Michelle Auletta Michelle Auletta Michelle Auletta Michelle Aletta Michelle Aulietta 900.00 900.00 13.05 5.40 800.00 900.00 900.00 900.00 900.00 27.00 38.00 36.00 000 900.00 TOS. 15 Date Num Type Amount -5.40 Source Name Michelle Auletta Michelle Auletta Michelle Auletta Michelle Auletta Michelle Auletta Payroll Item Federal Unemployment PA-Withholding PA - Unemployment Company PA - Unemployment Company PA - Unemployment Employee Wage Base 900.00 900.00 900.00 900.00 900.00 Michelle Auletta 06/30/2022 4 Paycheck 0.00 0.00 Wei Chan Wel Chan Wei Chan 1 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 TOTAL Wei Chan -27.00 36.00 -36.00 0.00 705.15 1,200.00 0.00 -132.00 74.40 -74.40 - 74.40 17.40 -17.40 -17.40 7.20 -7.20 -36.00 48.00 Salary Medicare Employee Add Tax Federal Withholding Social Security Company Social Security Company Social Security Employee Medicare Company Medicare Company Medicare Employee Federal Unemployment Federal Unemployment PA-Wahholding PA - Unemployment Company PA. Unemployment Company PA - Unemployment Employee Wei Chan Wel Chan Wei Chan Wel Chan Wel Chan Wel Chan Wel Chan 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 1,200.00 Wei Chan Wel Chan Wel Chan Wel Chan 48.00 0.00 - 940.20 23.40 06/30/2022 5 Liability Check United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury United States Treasury Federal Unemployment Federal Withholding Medicare Company Medicare Employee Medicare Employee Add Tax Social Security Company Social Security Employee 429.00 56.55 56.55 0.00 241.80 241.80 1.049.10 4, 104.75 C2 CD H M N 0 0 R S T E Source Name SSNITED Date Income Subject TOT Wagene 11.00 10000 300.00 2400 0:00 Michele Michele A Michelle Michael MA Miche 2010 295-07233 205-08 7630 29-0100 231-087033 29-013 52022 PAW W12022 PA-Urody Combay 06952022 PA-reglement 2002 PA Wing 03/30/2002 Prelomart Company 20 PA-Ursynet til 00000 90000 100.00 900.00 900.00 20000 900.00 900.00 000 -2700 3800 000 10500 450000 1 2 Mich Aula 3 4 5 6 7 8 To Michelle Alle 20 Ww Chan 21 22 23 14 15 36 17 To Watch 38 TOTAL 39 20 21 1599227 Wa Cha Wa Cha Wa Cha 1200.00 120.00 120000 000 192022 PA Wading PA-Urepertowy 152022 PA Uinnert Solye 2002 Witry PAUCowy Per Employee 1999 2027 2527 199297527 1992127 Wachu 1 200.00 12.00 120000 2000 120000 000 720000 100 Ww Che Wa Chan 120000 2000 720000 000 EEN 2710

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts