Question: Hi I need help with ratio analysis for pepsico case. the case will be in this link https://www.chegg.com/reader/9780135203736/534--%7B%22dataIndex%22%3A1%2C%22childIndex%22%3A0%7D/, and this is the provided worksheet that

Hi I need help with ratio analysis for pepsico case. the case will be in this link https://www.chegg.com/reader/9780135203736/534--%7B%22dataIndex%22%3A1%2C%22childIndex%22%3A0%7D/, and this is the provided worksheet that has to be done its a strategic management course

thank you

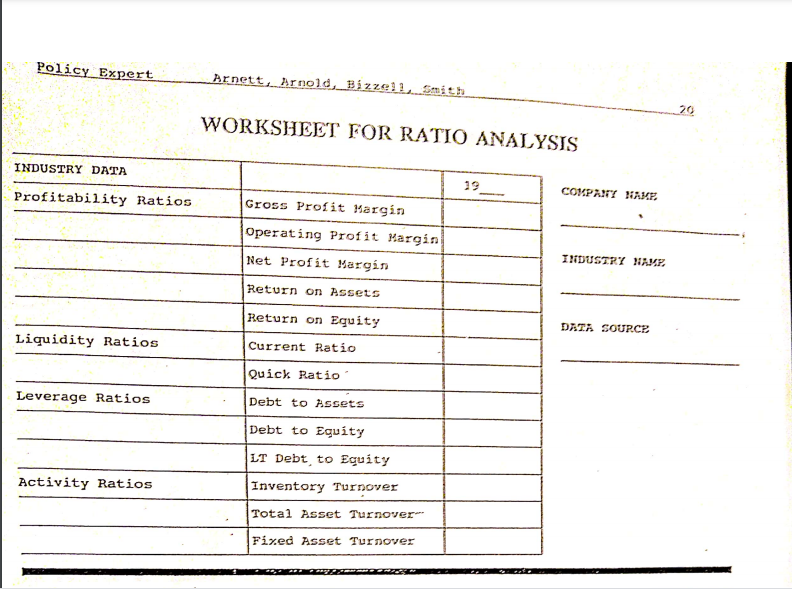

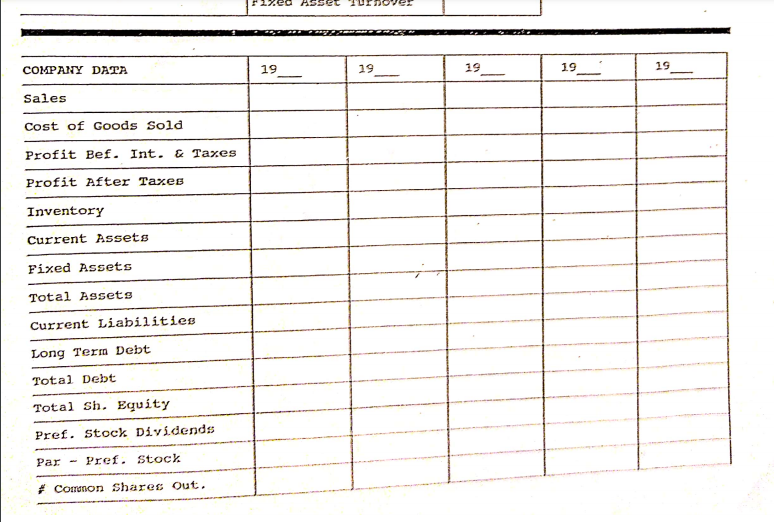

Policy Expert Arnett, Arnold, Bizzell Smith 20 WORKSHEET FOR RATIO ANALYSIS INDUSTRY DATA 39 Profitability Ratios COMPANY NAME . Cross Profit Margin Operating Profit Margin Net Profit Margin INDUSTRY HAMP. Return on Assets Return on Equity DATA SOURCE Liquidity Ratios Current Ratio Quick Ratio Leverage Ratios Debt to Assets Debt to Equity LT Debt to Equity Inventory Turnover Activity Ratios Total Asset Turnover Fixed Asset Turnover ce ASSET COMPANY DATA 19 19 19 19 19 Sales Cost of Goods Sold Profit Bef. Int. & Taxes Profit After Taxes Inventory Current Assets Fixed Assets Total Assets Current Liabilities Long Term Debt Total Debt Total Sh. Equity Pref. Stock Dividends Par Pref. Stock # Comon shares Out. Policy Expert Arnett, Arnold, Bizzell Smith 20 WORKSHEET FOR RATIO ANALYSIS INDUSTRY DATA 39 Profitability Ratios COMPANY NAME . Cross Profit Margin Operating Profit Margin Net Profit Margin INDUSTRY HAMP. Return on Assets Return on Equity DATA SOURCE Liquidity Ratios Current Ratio Quick Ratio Leverage Ratios Debt to Assets Debt to Equity LT Debt to Equity Inventory Turnover Activity Ratios Total Asset Turnover Fixed Asset Turnover ce ASSET COMPANY DATA 19 19 19 19 19 Sales Cost of Goods Sold Profit Bef. Int. & Taxes Profit After Taxes Inventory Current Assets Fixed Assets Total Assets Current Liabilities Long Term Debt Total Debt Total Sh. Equity Pref. Stock Dividends Par Pref. Stock # Comon shares Out

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts